Analysis | China likely to pick an outsider to replace dismissed insurance regulator Xiang Junbo

China confirmed the dismissal of insurance regulator Xiang Junbo after a disciplinary investigation. His replacement will most likely be someone from outside China’s insurance industry

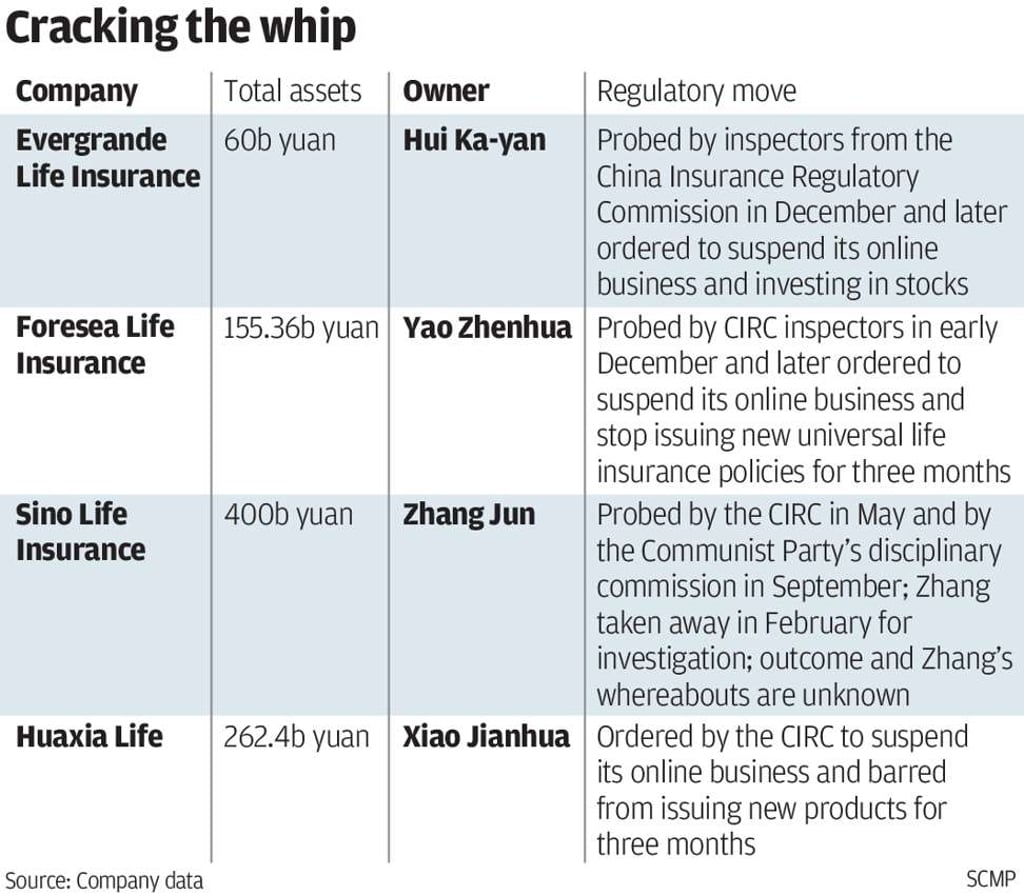

It makes him the highest-ranking cadre in the financial industry to be caught up in Beijing’s clampdown on financial malfeasance.

With the government determined to clean up China’s insurance industry and carve a clean break from Xiang’s regulatory style and strategic vision, Chinese leaders are likely to pick someone outside the industry as his replacement, according to several sources familiar with the situation.

“Whether or not the new CIRC chairman is familiar with the insurance industry now seems less important,” said Dayton Wang, an insurance analyst with Guotai Junan International. “An industry veteran knows the loopholes and is skilled at taking advantage of the position.”