3D hologram concerts and anime: how China’s rich kids will reshape the entertainment market

As Chinese millennials are natives of the internet, the magnitude of their spending in the digital form could surpass their parents’ generation

Teenagers in China’s expanding middle class households are pouring their pocket money into Japan’s animation and virtual entertainment industry, bolstering it in much the same way that their parents’ spending had driven demand for consumer goods from Japanese toilet seats to French handbags.

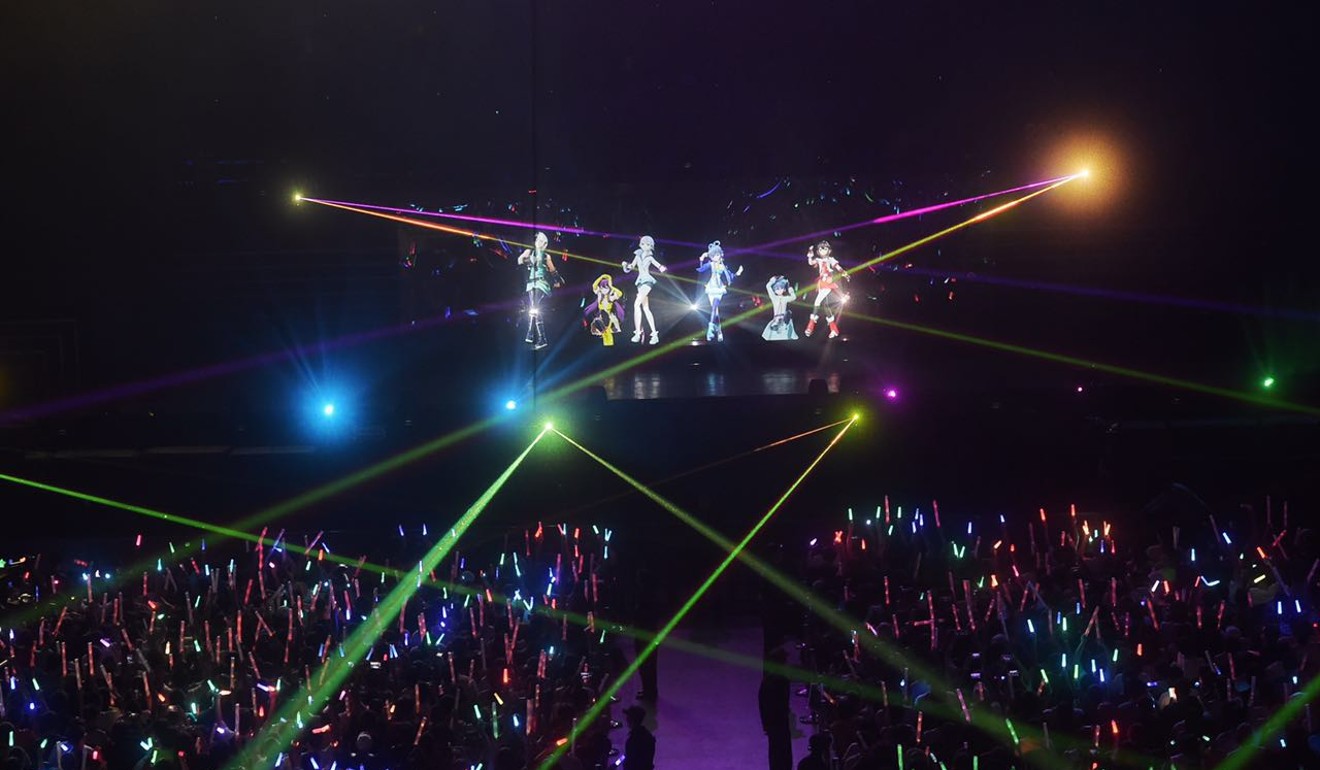

For proof of how the anime -- Japanese for hand-drawn or computer animation -- industry has captured Chinese teenagers, look no further than the Bilibili World event that ended last Sunday in Shanghai. More than 100,000 teenagers thronged the three-day affair, paying between 180 yuan and 1,480 yuan (US$219) on tickets to watch performances by anime holograms, and to meet the voice artists behind the characters. Five years ago, a mere 800 people showed up.

That’s giving anime a much-needed second life, as its home market is shrinking from the world’s fastest greying population, and a low birth rate that’s not replenishing the industry’s shrinking viewership and readership.

Compared with their parents, those born in the post-90s and post-2000 era in China are financially more secured and interested to indulge themselves in a colourful cultural life, which brings changes in the demand for entertainment

“They want diversified content that suits their individual tastes. The internet has made it possible for them to consume a huge amount of content from anime, games, and original video created by fellow internet users,” said Chen, whose company Bilibili is known to have a hold of China’s largest fan community for ACG – animation, comics and games.

The company has also expanded to encompass broader business concepts of the virtual world based on the ACG culture.

About half of Bilibili’s online content falls under the ACG category, which has helped the site secure more than 150 million monthly active users, while the average age of the site’s users is 17.

Young people under the age of 25 represent a major demographic shift that would reshape China’s, and the world’s media and entertainment landscape, as they will become the main consumers for digital entertainment by 2020, said PricewaterhouseCoopers’ China-Hong Kong technology, media and telecommunications leader Wilson Chow.

“Chinese millennials are the natives of the internet and social media,” he said. “They enjoy the freedom and flexibility of consuming entertainment at any time and any place at a very young age.”

“So their willingness to consume entertainment, and the magnitude of their spending, especially in the digital mode and form, are expected to be higher than their parents’ generation when they get older,” he said, adding that various industries from gaming, movies to live streaming would be boosted by young people’s growing interests.

So their willingness to consume entertainment, and the magnitude of their spending, especially in the digital mode and form, are expected to be higher than their parents’ generation when they get older

Their passion for ACG alone has created a market worth “hundreds of billions of yuan” in 2017, with an estimated 300-million fan base in China, according to a report from market research firm Ent Group.

The Japanese animation industry has as much as seen the benefits from the Chinese consumption.

According to the latest available figures from the Association of Japanese Animation, anime exports surged 79 per cent in 2015 to a record 34.9 billion yen (US$314.9 million), mostly because of the “shopping spree of China”.

“China market has been important, and will be even more so from now on, considering the ageing population of Japan,” said Naoki Ishikawa, the association’s vice secretary general.

While sales of Japanese anime in the North American and other Asian markets had also risen, the association estimated that China alone has contributed more than half of the increase in overseas sales in 2015.