Hong Kong’s second-half growth will slow further as consumption slumps: Citibank

Citibank estimates that second-half GDP will rise 2.4 per cent, down from the 3.7-per cent rise in the first six months

Consumption in Hong Kong will be sluggish in the second-half on the back of slower economic growth, compared with the first half, according to Citibank’s forecast.

Even as mainland tourist arrivals increased, it would not boost tourist-related goods sales, said Adrienne Lui, Hong Kong economist at the bank.

“Take May 2017 for example, despite a 3.8 per cent year-on-year rise in mainland tourist arrivals, retail sales value and volume only rose 0.6 per cent and 0.7 per cent year-on-year, respectively,” she said. “Tourists no longer buy big ticket items and there are many alternate shopping destinations.”

Tourists no longer buy big ticket items and there are many alternate shopping destinations

The bank predicted a low single-digit growth in retail sales value, which would still be an improvement from last year’s 8.1-per cent decline, year-on-year.

It forecast that the city’s gross domestic product in the second-half of the year would pare back to 2.4 per cent, from the robust 3.7 per cent year-on-year growth in the first-half of the year.

“Effects of China’s financial and credit tightening will be reflected in the second-half of the year,” Lui said.

The bank projected China’s second-half GDP to rise 6.7 per cent on year.

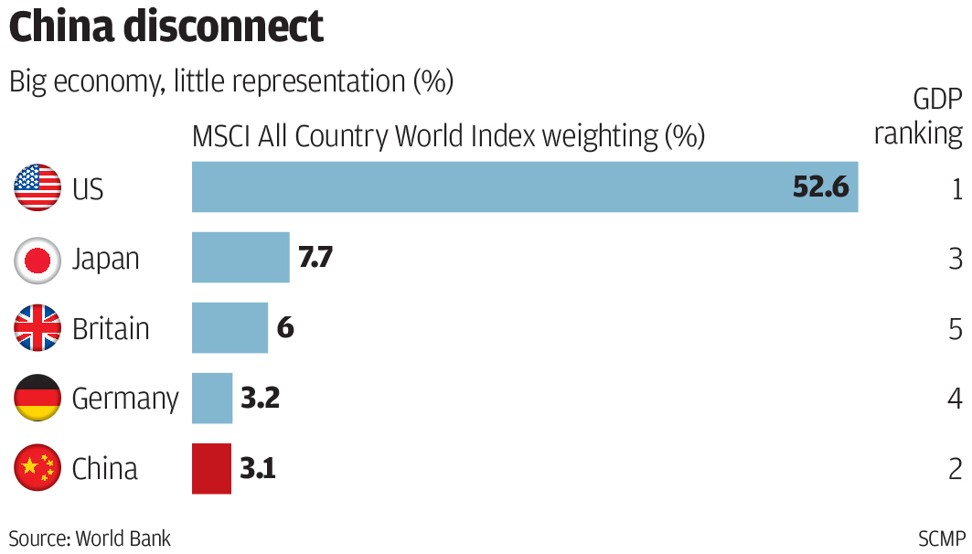

Citibank’s optimism is shared by Capital Group, which urges for greater inclusion of China’s A-shares in international benchmark indexes.

The report said A-Share inclusion to MSCI index might spur further market liberalisation and heighten the scrutiny of China’s financial market.

MSCI estimated that the first wave of inclusion of mainland Chinese stocks would draw US$17 billion of inflows. In 10 years, China A-shares could draw inflows of US$400 billion to US$500 billion, some

brokerages have estimated.

“Increased involvement by global investors should strengthen the level of corporate governance in China over time. With A-shares entering the MSCI indexes, trading volumes should increase and the market should become more transparent,” says Capital Group portfolio manager Steve Watson.

MSCI announced last month that it will include 222 mainland Chinese companies in its widely followed MSCI Emerging Markets Index.

These large cap companies will comprise just 0.73% of the overall MSCI Emerging Markets Index by September 2018.