A whole lot of ganbei drives Moutai’s market value to half the GDP of its home province

China’s palate for baijiu, a fiery liquor that was Mao Zedong’s favourite tipple, has pushed the share price of its most famous distiller Kweichow Moutai to become China’s most expensive stock, in the process valuing the company at more than half of the economy of its home province of Guizhou.

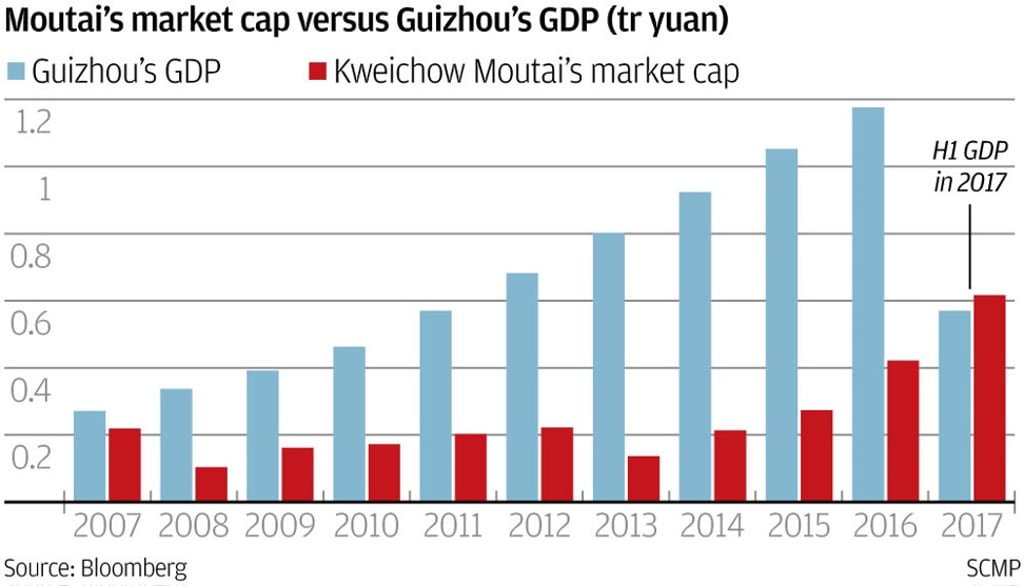

Moutai’s shares touched a record intraday high of 500.10 yuan each on August 14, and recently changed hands at 491.27 yuan in Shanghai, giving the company based in the township of Maotai 617 billion yuan (US$93.7 billion) in market capitalisation. In the first six months of 2017, Moutai’s market value surpassed Guizhou’s gross domestic product.

Distilled from fermented sorghum, a bottle of maotai -- the baijiu must be distilled in the town to use that name -- from the distillery starts from 1,799 yuan, and could go up to 8 million yuan at auctions. First produced during the Qing Dynasty, maotai’s fortunes had been closely tied to the Communist Party, owing its success to the party’s founding elders. Mao used to drink it, and Zhou Enlai toasted Richard Nixon with maotai during the American president’s historic visit to China in 1972.

It continues to be served during state banquets at the Great Hall of the People in the Chinese capital, and had been the staple for official gift giving for decades. In recent years, the price of baijiu in general, and maotai in particular, has taken a hit from President Xi Jinping’s austerity drive among party cadres.

Moutai’s market value fell by half in 2013, a year after Xi’s rise to China’s presidency heralded in a crackdown on graft, and a campaign for austerity among party cadres and senior government staff. Tens of thousands of senior public servants and military officers fell from grace, often with public pictures of their symbols of ill-gotten wealth -- including cases of Maotai -- shown on state media.