Apple’s iPhone X will squeeze global supplies of OLED screens, giving it edge over competitors

Home-grown mainland smartphone brands are likely to face stiffer competition buying high-end handset panels in the near future, as global supplies are expected to shrink after Apple announced its new OLED (organic light-emitting diode) screen to the world this week.

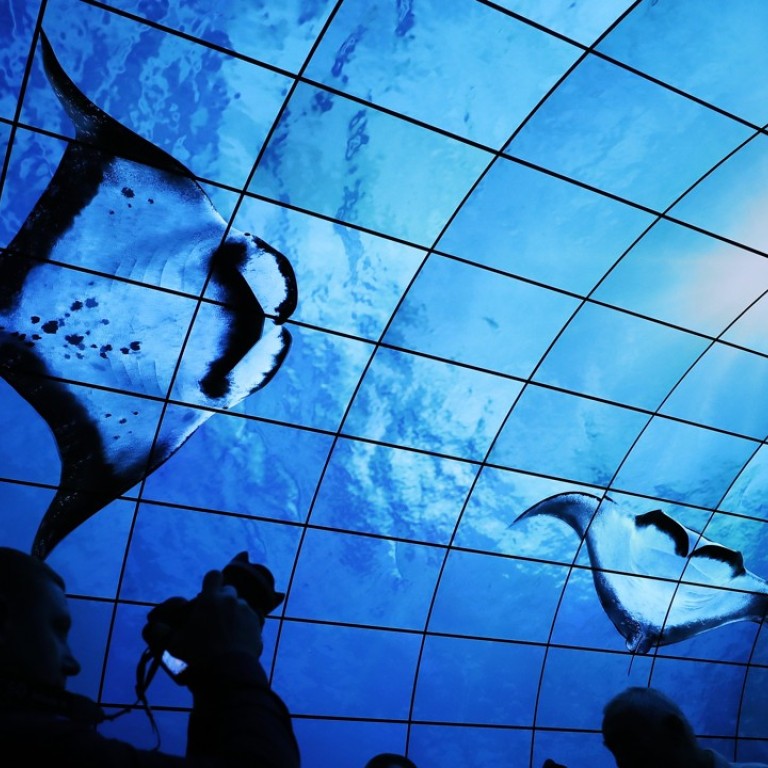

Apple said the switch to a type of OLED display, called an AMOLED, would help the phone produce “true blacks” and more accurate colours than before. LG and Samsung already use similar technology on their handsets.

Global OLED supplies are already stretched, as are AMOLED screens – higher-end OLED panels being used on the more-expensive handsets – which are nearly exclusively made by Samsung.

Zhao Ziming, a senior analyst at Pintu Tank in Beijing which focuses on internet research, said Apple’s iPhone X launch will make it difficult for local Chinese smartphone companies to obtain orders from the South Korean panel titan.

Data from Display Supply Chain Consultants, which monitors global OLED market trends, has indicated that Samsung currently ships almost 97 per cent of global AMOLED panels.

On Tuesday, Apple launched the iPhone X with a 5.8-inch OLED screen, which fills the entire front of the device. Apple reportedly spent US$9 billion for a two-year deal with Samsung for production and supply of OLED display panels.

“Samsung’s dominance in smartphone OLED panel technology is impregnable currently as it has long been focused on research and development of the panels equipped on small devices,” said Zhao, who added that even LG Display, another South Korean technology giant known for its big-size OLED television screens, is lagging Samsung in mobile panel technology.

Overall demand and supply for smartphone OLED panels in the global smartphones market is also unbalanced as Samsung always retains the latest high-end AMOLED supplies for its own flagship smartphone models.

According to another DSCC research note, Samsung consumed most of the OLED smartphone panels – 264 million units or 72 per cent of the entire supply in the market in 2016 – compared with Oppo and Vivo’s 11 per cent each, and Huawei’s 2 per cent. The remaining brands consumed 15 per cent and Apple had yet to utilise any OLED panels.

Demand for AMOLED displays is also on the rise in the smartphone market, especially since the flexible display technology enables smartphones to be produced in various designs, like the narrow bezel or bezel-less designs increasingly popular in the markets nowadays.

“The AMOLED display market is expected to get a huge boost from Apple’s decision to use the screen in its new iPhone series, and from Chinese smartphone makers’ moving to newer applications of the panels,” said Ricky Park, director of display research at IHS Markit, in a research note in July.

“To meet the burgeoning demand, South Korean and Chinese display makers have been heavily investing in Generation 6 AMOLED fabrications,” said Park.

A growing number of Chinese smartphone makers have already raised their investments in OLED panels to challenge the dominate position of their South Korean peers.

In February, a Bloomberg report said Apple was already in discussions with China’s BOE Technology Group – one of the country’s largest screen makers – to supply next-generation OLED displays for future iPhones. BOE has spent close to 100 billion yuan to build two AMOLED plants in China, which anticipated that its cooperation with Apple will start from 2018 or later.

Royole Group, a Chinese start-up known for its flexible, thin and ultra-high-definition display technology that could be utilised from communication devices and smart vehicles to home appliances, has announced the world’s first 1.1-million-square-foot mass production campus in Shenzhen with a total investment of US$1.7 billion to be fully operational by the end of this year.

Global demands for OLED related products are huge and will continue to rise in the future, which has convinced Royole to boost research and development on its key flexible display products, as the innovative technology could be utilised in a variety of products other than the handset, a spokesman from Royole said.