Update | Hong Kong stocks end little changed following Fed policy rate meeting

Hang Seng Index eases 17.47 points, or 0.1 per cent, to 28,110.33

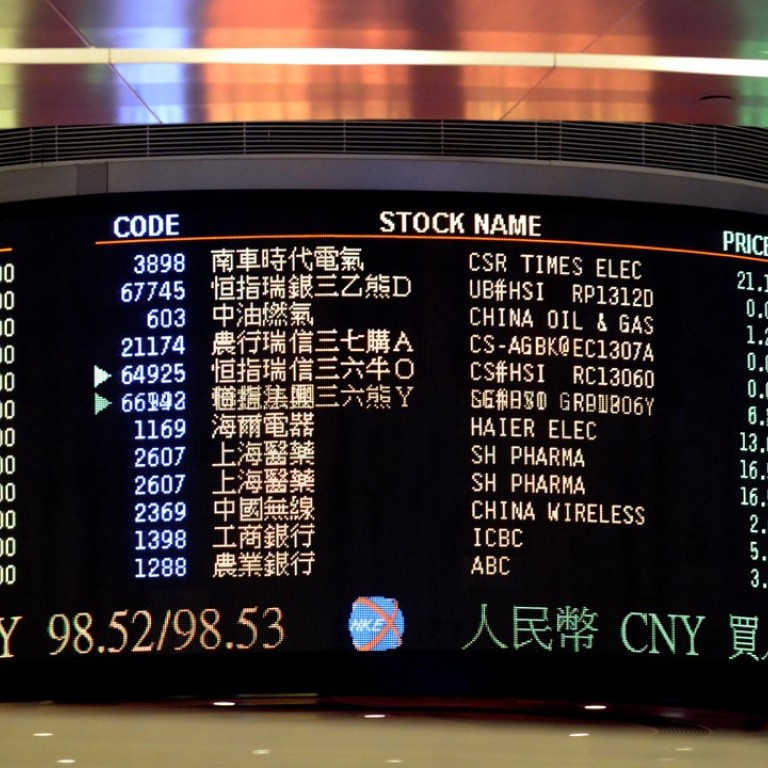

Hong Kong stocks ended little changed on Thursday, as gains in casinos and carmakers countered concerns after the Federal Reserve said it would press ahead with dismantling its ultra-loose monetary policy.

Mainland Chinese stocks closed lower, dragged by materials firms.

The Hang Seng Index edged down 0.1 per cent, or 17.47 points, to 28,110.33, while the Hang Seng China Enterprises Index rose 0.2 per cent, or 24.81 points, to 11,198.32.

Daily turnover stood at HK$109 billion, up 11 per cent from HK$98 billion on Wednesday.

“The major driver of the Hong Kong stock market has been overseas funds since the 2008 global financial crisis, so the liquidity may tighten [as the Fed shrinks its balance sheet],” said Castor Pang Wai-sun, Core Pacific-Yamaichi’s head of research.

But outflows will be mitigated by capital from the mainland through the stock connect schemes, Pang said.

Major stock markets in Asia shrugged off the Fed’s decision on Wednesday to start to shrink its US$4.5 trillion balance sheet, with Japanese and Taiwanese benchmarks rising at least 0.2 per cent and 0.6 per cent in Thursday’s session. The US central bank said it was sticking with its forecast that there would be a further increase in interest rates this year, but left the benchmark rate unchanged in a range of 1 per cent to 1.25 per cent after a two-day meeting.

“The Fed’s tightening of monetary policies has been long expected and well digested so that won’t dampen the sentiment too much,” said Wei Wei, a trader at Huaxi Securities in Shanghai.

“The good momentum on Hong Kong stocks will remain intact, though the share-price gains are likely to moderate a bit going forward.”

Macau’s casino operators led the advance, after Deutsche Bank AG said the former Portuguese colony may see the busiest Golden Week holiday in four years starting on October 1. The eight-day holiday is one day longer than usual because the Mid-Autumn Festival falls in October this year, it said.

Galaxy Entertainment Group rose 2.5 per cent, and Sands China was up 1.3 per cent.

Chinese carmakers also advanced amid media reports that China will require all cars to be electric by 2030.

BYD, China’s largest electric-car maker, added 4 per cent, while Brilliance China increased 1.3 per cent. Geely Auto rose 0.8 per cent.

China International Capital Corp surged 18 per cent, after technology giant Tencent Holdings agreed to invest HK$2.9 billion in the investment bank.

Property stocks retreated broadly, with the subindex down 1.1 per cent. CK Asset Holdings dropped 2 per cent, and New World Development slid 3.5 per cent.

In mainland trading, the Shanghai Composite Index dropped 0.2 per cent, or 8.18 points, to 3,357.81. The CSI 300 Index lost 0.1 per cent, or 4.62 points, to 3,837.82.

The Shenzhen Composite Index was down 0.8 per cent at 1,995.42, and the ChiNext gauge of smaller firms retreated 1 per cent to 1872.77.

Elsewhere in Asia, South Korea’s Kospi was down 0.2 per cent, and Sydney All Ordinaries declined 1 per cent.