Tax changes needed to help boost ‘Greater Bay Area’ plan, says PwC

Different economic structures among bay area region cities means Hong Kong should look to reduce the tax burden to encourage business ties

The Hong Kong government should improve tax policies to attract further talent and capital and help companies benefit from the “Greater Bay Area” plan, according to PricewaterhouseCoopers.

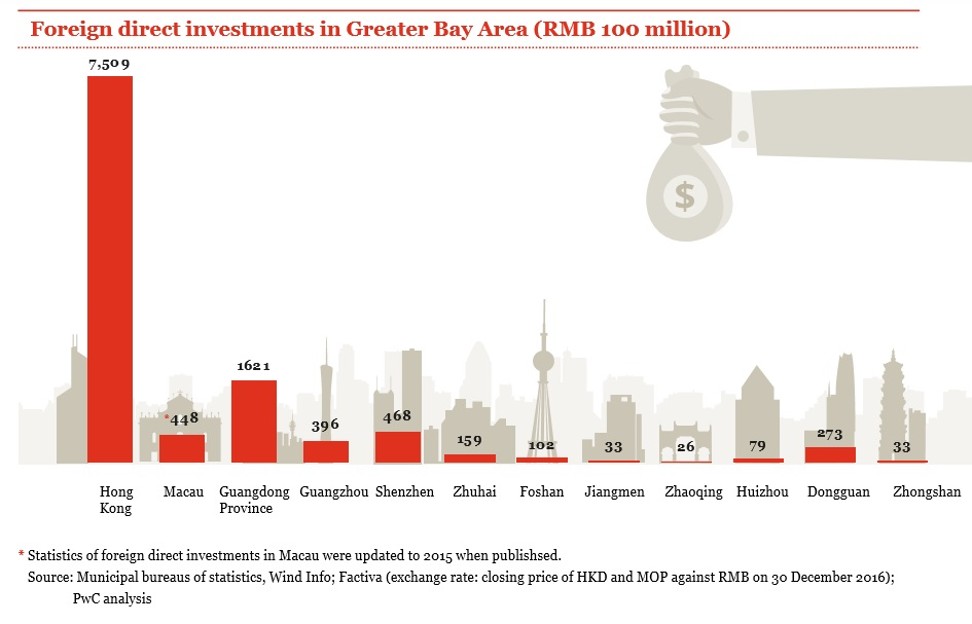

“Cooperation among the 11 cities in the Bay Area means we separate each other among different roles,” Agnes Wong, a partner in tax services at PricewaterhouseCoopers in Hong Kong said on Wednesday. “Because the major industries in Hong Kong are in the service and finance sectors, we need to supplement the other cities [in order] to remain an attractive destination for foreign direct investment.”

“Singapore is a big competitor as a headquarters for MNCs [multinational corporations],” Wong added. “We need to attract more funding, capital and people to make use of the other cities in the bay area.”

First proposed in 2011, Beijing hopes the bay area, or Guangdong-Hong Kong-Macau Greater Bay Area as it is officially known, will provide an engine of growth for China’s economy. The area is similar to the deltas in Tokyo and New York.

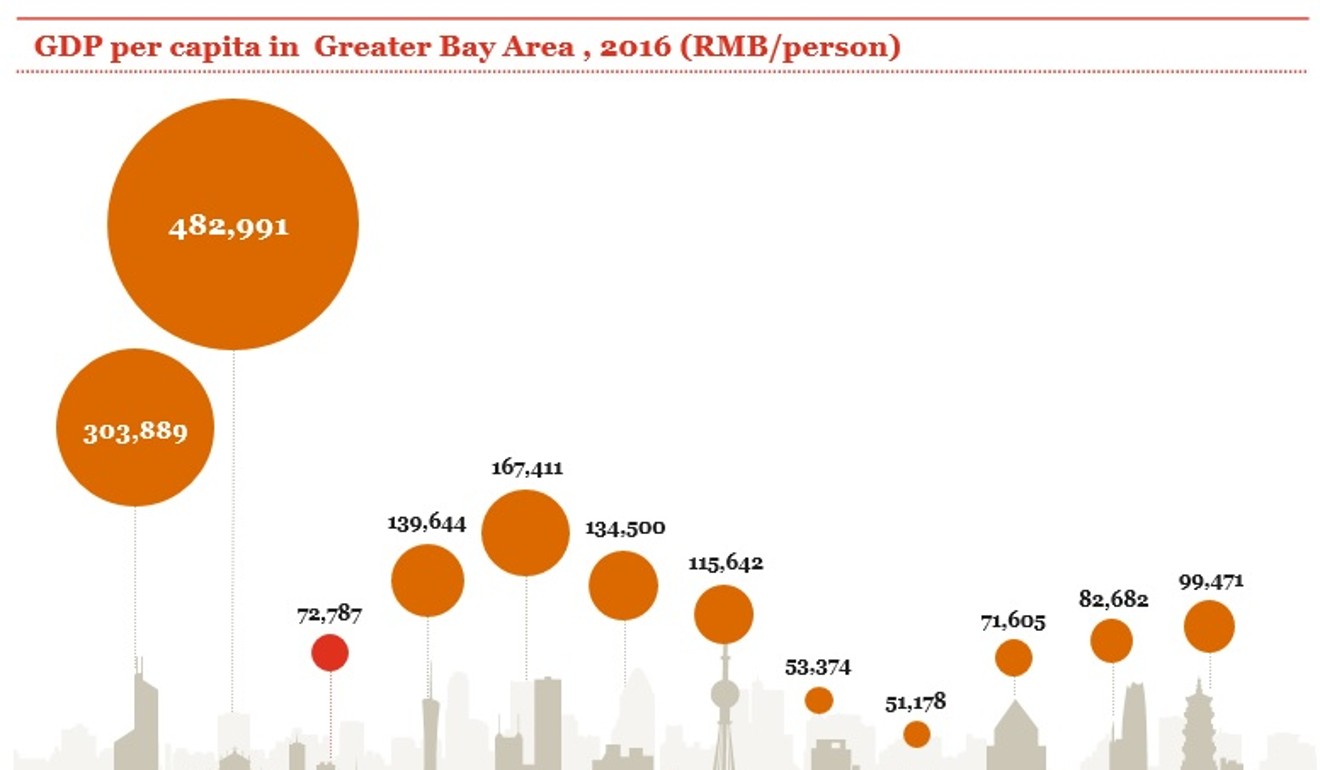

Consisting of 11 cities in southern Guangdong province, plus Hong Kong and Macau, some estimates place the combined economy of the region at US$3.6 trillion by 2030, making it the fifth largest economic zone in the world.

PwC recently submitted an advocacy paper to the Hong Kong government on policies that could benefit companies and individuals who do business in the basin.

The recommendations included improving cross-border tax policies, encouraging Hong Kong companies to establish branches on the mainland to reduce their tax burden, and simplifying the tax code for individuals who need to travel to work in the area.

Jeremy Choi, a partner at PwC in Hong Kong, said the different cities need to play off each other’s strengths if they are to remain an attractive destination for foreign direct investment.

“The different cities should look to compensate each other in a way that benefits the entire region,” he said.

He added it provided an opportunity for Hong Kong business seeking land to expand their businesses to approach other cities in the bay area zone.

Others are also optimistic about the potential benefits from the bay area plan, but say it will require a “national-level approach” to succeed.

Professor Xufei Ma at the Center for Entrepreneurship at the Chinese University of Hong Kong compared the plan to Deng Xiaoping’s economic reforms first implemented in the region in the late 1970s.

“What are the major benefits of the 1979 reform and open door policy?” said Ma. “If you can answer this question, you may also get similar answers to the Greater Bay Area plan.”