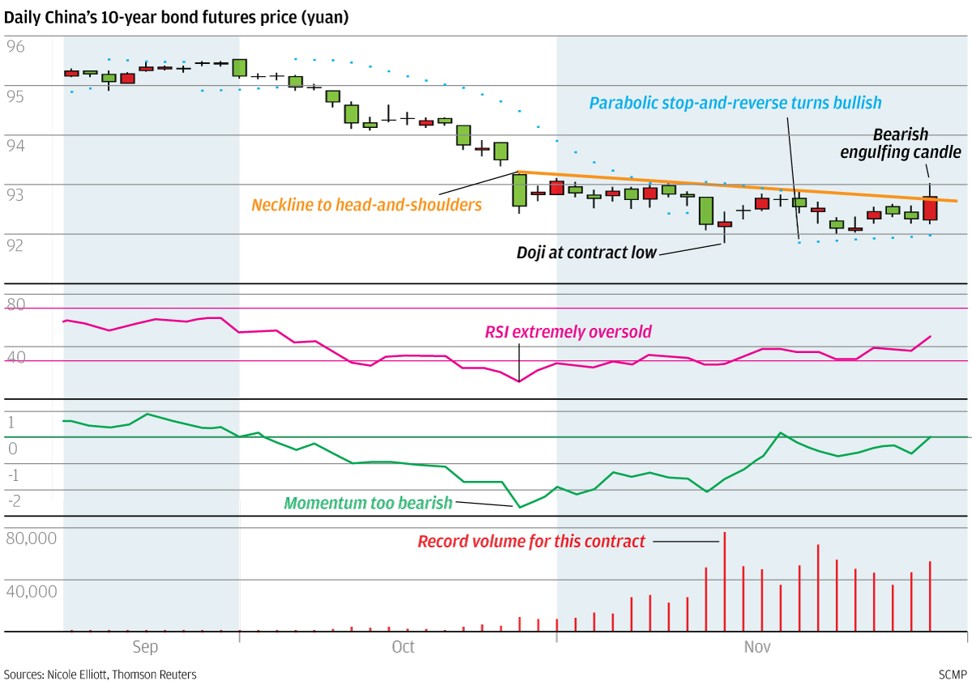

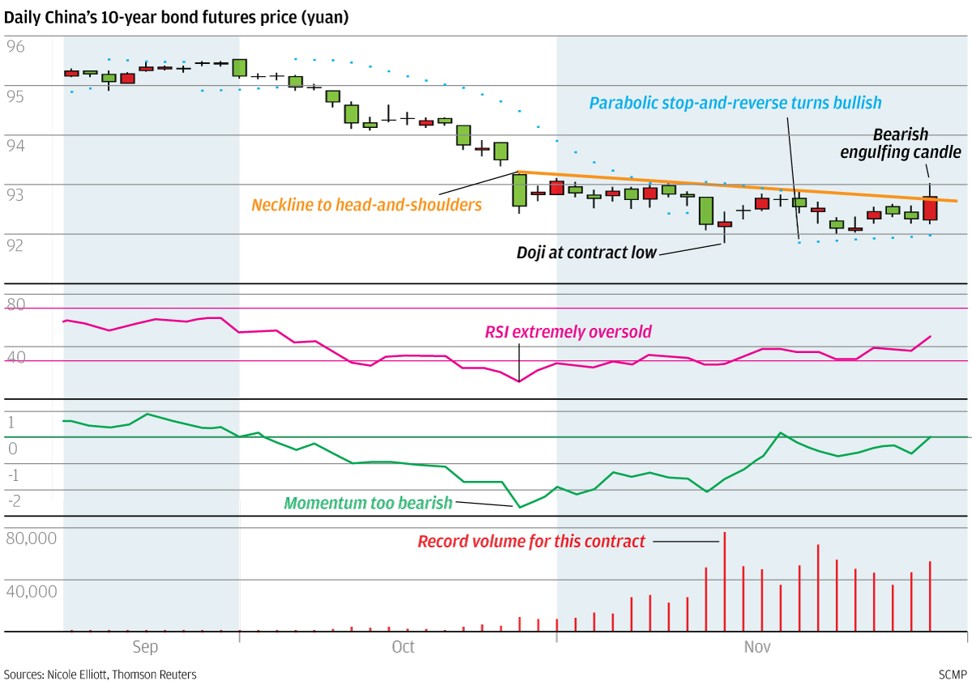

Prices for the 10-year bond futures on the China Financial Futures Exchange have been falling for a year, with a concomitant rebound in benchmark yields from 2.6 per cent to 4.03 per cent. The 4 per cent level is a Fibonacci 61 per cent retracement of the previous sharp fall in yields between November 2013 and November 2016. Now that November 2017 is over, there is a chance that yields will drop again. The active March 2018 futures contract shows Wednesday’s bearish engulfing candle is another element of a basing process that started at the end of October. A ridiculously oversold situation, extremely bearish momentum and excellent volume at the contract’s record-low doji add weight to the potential inverted head-and-shoulders bottom, confirmed by the parabolic stop-and-reverse indicator.