China’s top equity pickers say 2018 will be the year that sees the revenge of the small-cap stocks

Big-cap shares have beat smaller firms by the most since 2014 this year, but top-ranked analysts expect trend to be over in 2018 with a comeback of growth stocks

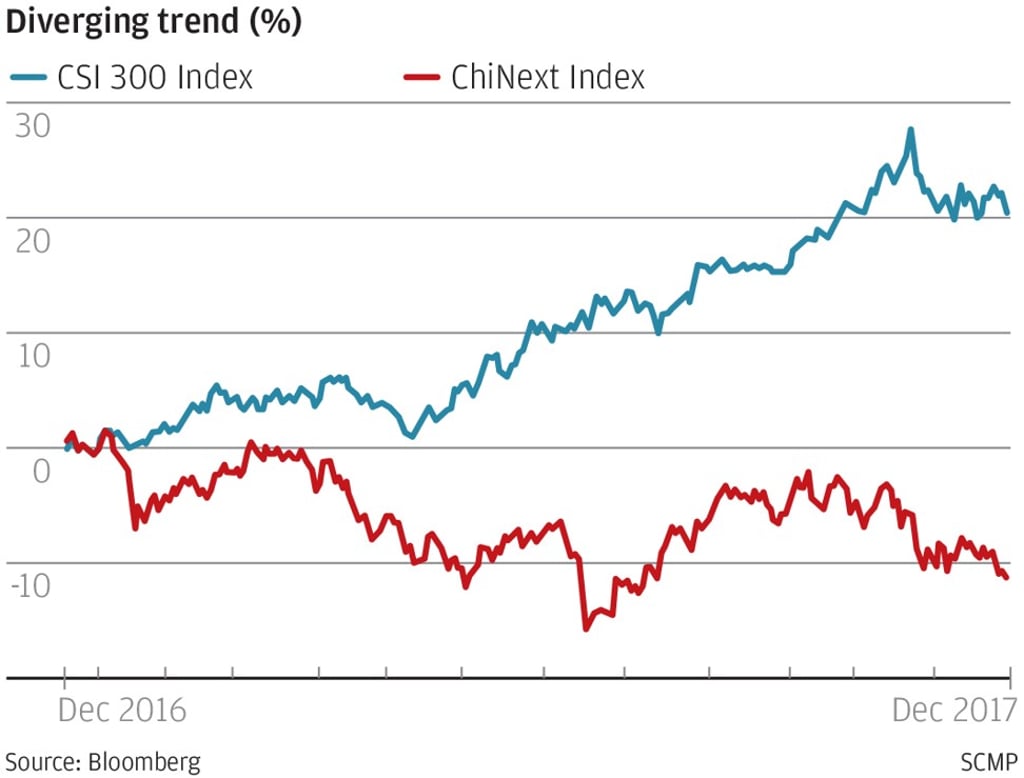

The year 2017 has been one of extreme divergence for China’s stocks, with large-cap companies beating smaller growth firms by a large margin. But such outperformance will probably end next year, as the nation’s most credible analysts and top-performing fund manager are predicting a comeback of small-caps.

Haitong Securities says growth stocks are likely to join blue-chip companies in the rally, while Shenwan Hongyuan Group argues that small-caps may be back in favour as accelerating reforms after the top leadership reshuffle have boosted investors’ risk appetite. Both brokerages took the top two spots on this year’s annual ranking by the New Fortune magazine for Chinese equity strategy research. HSBC Jintrust Fund Management’s Qiu Dongrong, whose fund has beaten 94 per cent of the rivals, is switching into growth firms out of bigger ones.

The performance of the two camps of stocks has not been so divergent since 2014. The CSI 300 Index of the most valuable 300 companies on the Shanghai and Shenzhen exchanges has climbed 21 per cent this year, beating an 11 per cent loss on the ChiNext gauge of start-ups. The gain on the SSE 50 Index, which tracks a smaller group of big-caps on the Shanghai bourse, has been more impressive, notching up an advance of 24 per cent.

Wu said he liked companies in the artificial intelligence, media and culture industries, without specifying any stock.

The ChiNext gauge is twice as expensive as its big-cap counterpart on the valuation basis, but the ratio of the relative value is already close to the lowest level, according to data compiled by Bloomberg. The measure of smaller firms is valued at 31.1 times estimated earnings, the data showed.