Update | Volatility returns to China’s stocks as more shares seen gaining in 2018

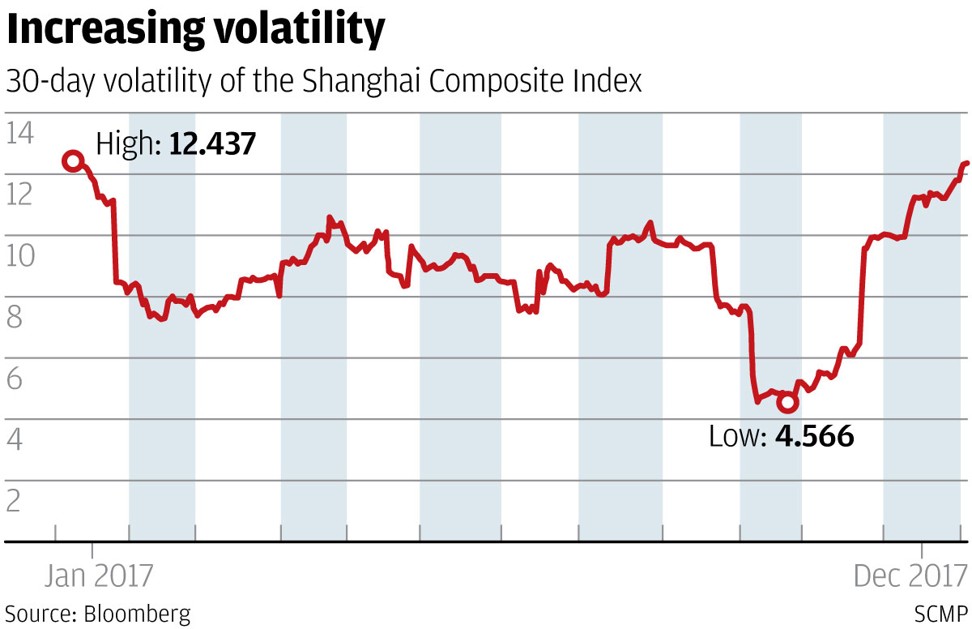

The 30-day volatility in the Shanghai Composite Index hit a one-year high this week as investors forecast gains will expand to more stocks

Volatility has returned to China’s stocks, prompting forecasts of a more active market in 2018, after price swings fell to a nadir last year amid increased regulatory surveillance.

The 30-day volatility in the benchmark Shanghai Composite Index rose to a one-year high this week, rebounding from its lowest level on record in October, according to data compiled by Bloomberg.

The pattern at the start of 2018 can be explained by a move by the central bank to temporarily lower the reserve requirement ratios for commercial lenders in the coming Chinese Lunar New Year. But investors including Shanshan Finance say the trend may continue throughout the year as the market turns more liquid in 2018, with more stocks poised to rise after valuations fall to levels justifiable for a comeback.

The number of gainers on the stock market this year will very likely exceed that of last year

“The market will be more liquid and active this year as lots of stocks, particularly the mid-caps, have dropped to a point where valuations are attractive and intrinsic values stand out,” said Wu Kan, a fund manager at Shanshan Finance in Shanghai. “The number of gainers on the stock market this year will very likely exceed that of last year.”

The CSI 500 Index, a gauge of mainly mid-cap shares on the Shanghai and Shenzhen bourses, remains subdued so far this year, with the gain almost matching that on the Shanghai Composite, with a 2.7 per cent advance. The top winners on the CSI 500 are property developer Tahoe Group and Hengyi Petrochemical, which have climbed at least 21 per cent in the first few days of 2018.

The measure is valued at 19.5 times estimated earnings for the following 12 months, near the lowest level in three years, according to Bloomberg data.

The 30-day price swing on the Shanghai Composite dropped to a record low in October as deleveraging aimed at curbing arbitrage in financial markets and shadow banking weighed on stocks, and regulators strengthened oversight of manipulation and speculative trading.

Even as the Shanghai Composite managed a 6.6 per cent advance last year, the gains were limited to a narrow group of big-cap stocks, with mid- and small-cap shares being dumped because of strained liquidity and stretched valuations. For the whole year, more stocks fell on the index than rose, with 1.8 decliners for every gainer.