Mao Zedong’s favourite tipple is now a 1 trillion yuan company

Maker of China’s famous fiery liquor Kweichow Moutai set to become only the country’s seventh to enjoy such a such a towering market cap

The value of Kweichow Moutai, the maker of China’s famous fiery liquor, briefly topped 1 trillion yuan (US$155 billion) on Monday, making it the first ever mainland-listed consumer firm to reach the milestone.

The distiller rose as much as 1.4 per cent to 799.06 yuan in intraday trading in Shanghai, capitalising the company at 1 trillion yuan. The value had slipped back to 986.6 billion yuan by the close, with the stock ending the day 0.4 per cent lower at 785.37 yuan.

Moutai’s meteoric rise as a drinks juggernaut on China’s US$8 trillion stock market highlights the nation’s transition to a more consumption and service-based economy, from a one reliant on credit-fuelled investment.

Consumption now contributes almost two thirds of China’s economic growth and the service industries have consistently been making up more than half of the economy since 2015.

“Kweichow Moutai has been transformed into a global brand, and its luxury white liquor baijiu typifies how China is increasing its economic power and influence in high-end consumption,” said Xing Tingzhi, an analyst China International Capital Corp.

China’s group of biggest publicly traded companies had previously been dominated by finance firms and energy producers.

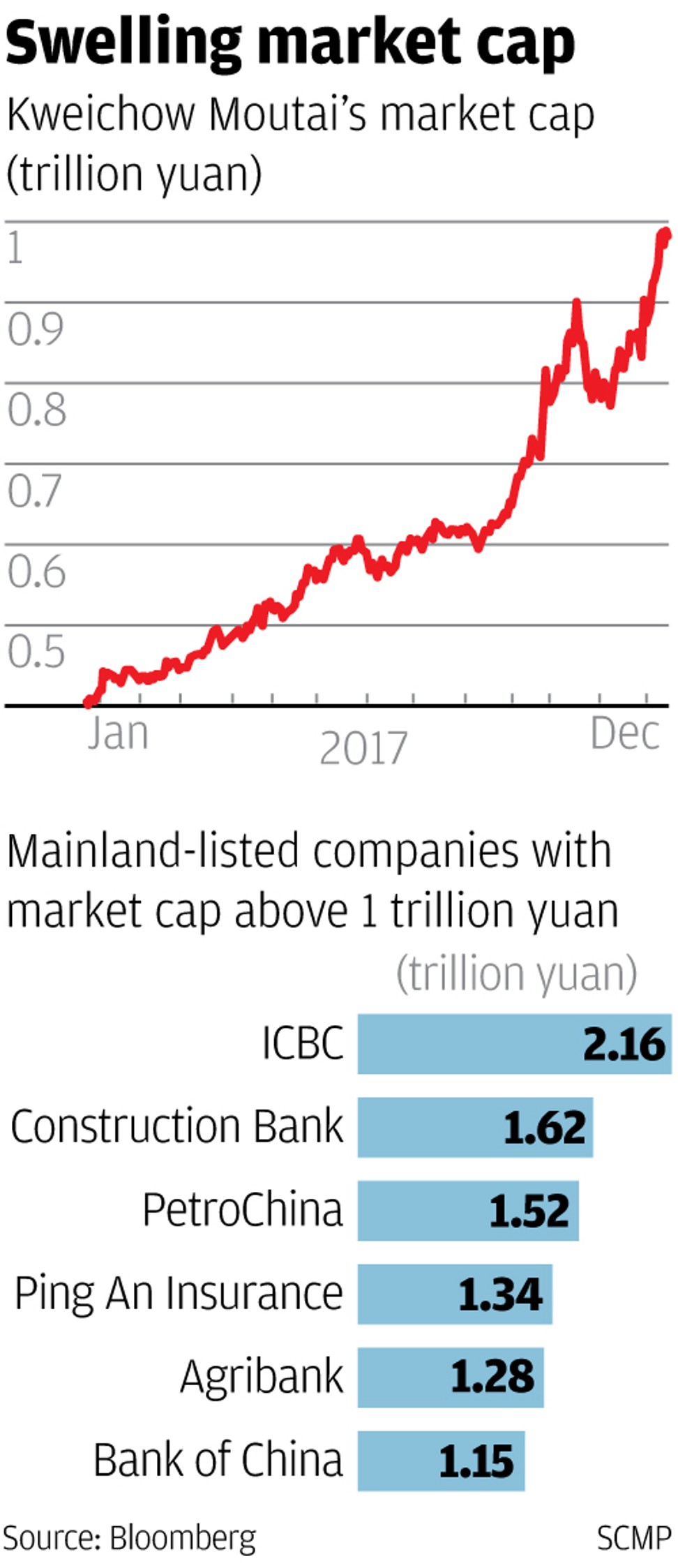

There are just six companies whose market caps are currently above 1 trillion yuan on the Shanghai and Shenzhen exchanges, and Kweichow’s continued elevation past that mark would make seven.

Industrial and Commercial Bank of China is the most valuable with a market cap of 2.16 trillion yuan, followed by 1.62 trillion yuan for China Construction Bank and 1.52 trillion yuan for PetroChina.

Kweichow Moutai’s market cap has jumped more than a hundred fold since its listing in 2001, with profits increasing annually since going public.

It toasted a whopping 109 per cent gain in its stock price last year, as rising disposable incomes stoked booming demand for the high-end spirit, which was traditionally used by China’s state leaders to toast foreign guests at banquets. It was reputed to be Chairman Mao Zedong’s favourite tipple.

Its rising popularity has prompted Moutai to raise its product prices for the first time in five years.

The Guizhou province-based firm announced an average 18 per cent rise on its price tags last month as it announced an expecting a 58 per cent surge in annual profits for 2017 – the third-fastest rise since 2001.

Kweichow Moutai now has a 12-month price target of 795.98 yuan per cent, representing a mere 1 per cent gain from Monday’s close, according to Bloomberg data.