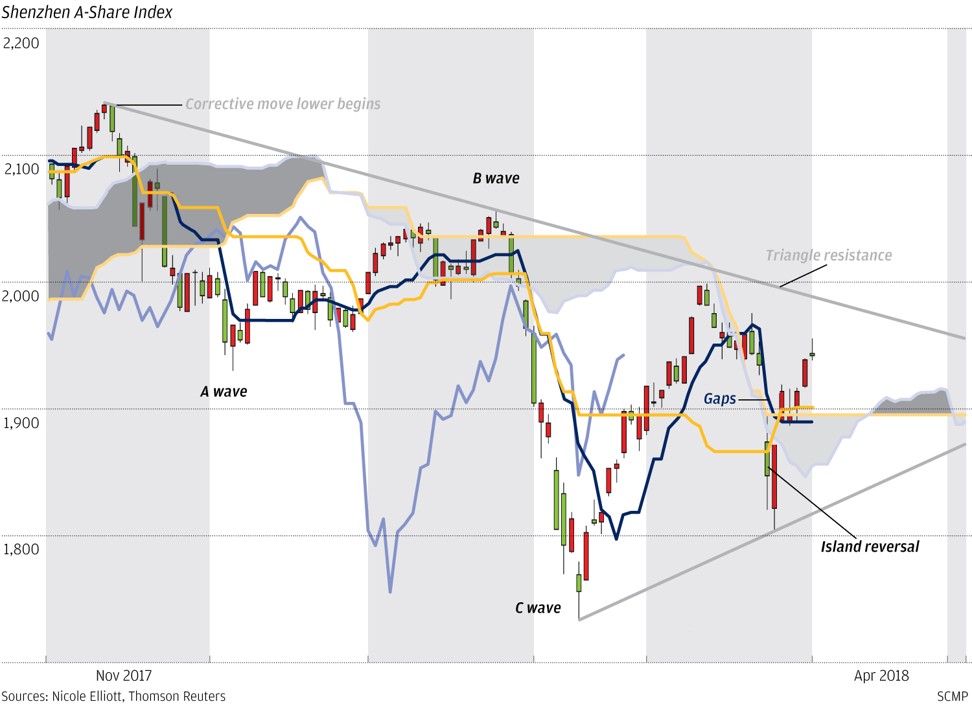

Chart of the day: Shenzhen A shares impress

Global stock markets have had a troubling couple of months as the threat of potential trade wars between the United States and China escalates. Like others, the Shenzhen A-Share Index saw an A, B, C-type correction but then found its feet as we wrote at the end of February. The rally in the last week of March was also impressive, filling the gap created on the way down and gapping again on the way up, thus forming an island reversal. It has broken above the thin Ichimoku cloud, and though moving averages have yet to turn bullish, good volume and increased volatility on the way up suggest a test of triangle resistance. Breaking above the top of the B wave could set the scene for a surge to November’s high.

Nicole Elliott is a technical analyst