Chinese investors back drug stocks to weather trade war

Mainland-traded pharma stock prices rise 10pc as a sector in 2018 so far, the best-performing industry on the CSI 300 Index

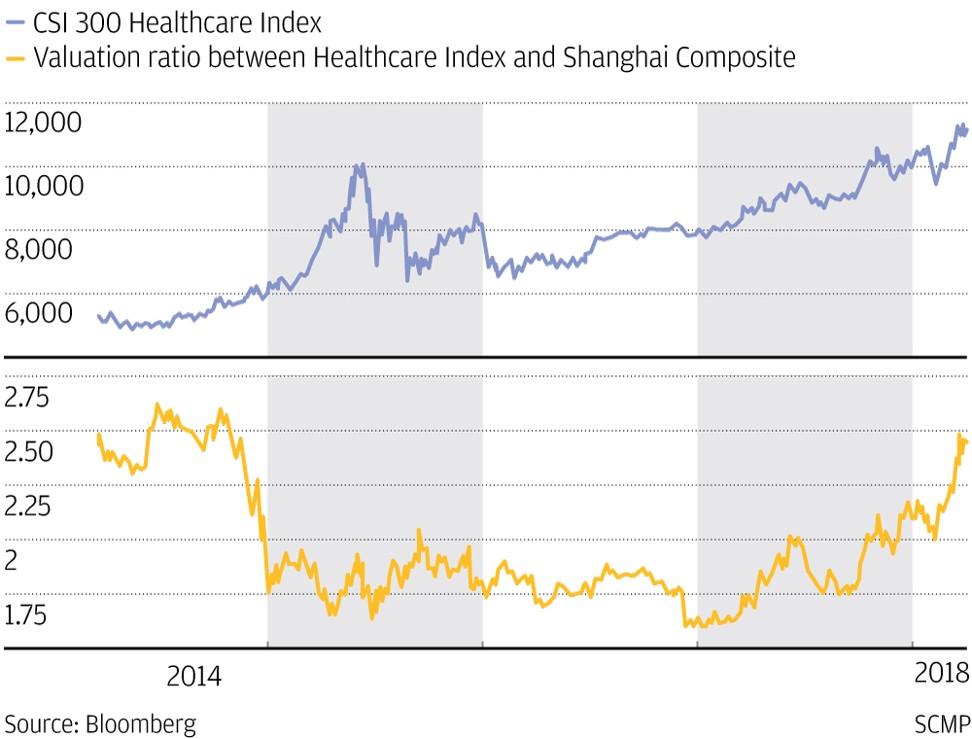

Mainland-traded pharma shares have risen 11 per cent in value so far this year as a group, and are not only the best-performing industry on the CSI 300 Index, but also the only sector to deliver gains.

The sub-index of health care companies is also at its highest level relative to the benchmark Shanghai Composite Index in three years.

A rebound in the industry’s earnings growth has added impetus to the rally, as the government rolls out policies to bolster the development of proprietary and generic drugs, and drug prices stabilise after officials launched a campaign to reduce the influence of smaller sales distributors.

“Companies with new drugs pipelines and strong development capability are doing well,” said Hong Hao, managing director at Bocom International Holdings, the Bank of Communications subsidiary.

“The government has changed the policy to allow faster proprietary drug development and the production of overseas generic drugs.”

China’s food and drug administration has cut the time it needs to approve proprietary drugs to 17 months from 57 months, according to Southwest Securities, while the State Council announced early this month it would slash the corporate tax rate for generic drug makers from the universal 25 per cent to 15 per cent.

The securities regulator is also aiding the industry’s major players, with faster equity financing procedures.

Wuxi AppTec, China’s biggest contract medical researcher, took just 50 days to gain approval to float its shares domestically. The regulatory approval process previously took an average 519 days for ordinary companies, according to Shenwan Hongyuan Group.

The biggest health care sector gainer of the year has been Lepu Medical Technology, a Shenzhen-listed maker of cardiovascular medicines and medical devices, which has soared 38 per cent so far.

The Beijing-based firm posted a 32 per cent gain in full-year earnings last year, the fastest pace in seven years, on increased sales. First-quarter profit looks like rising by as much as 40 per cent.

Aier Eye Hospital Group, and Zhangzhou Pientzehuang Pharmaceutical – which makes traditional Chinese medicine to treat liver disease – follow close on Lepu’s heels with annual 38 per cent, and 35 per cent stock price gains, respectively.

Sector-wide income is also recovering. The collective profits of China’s pharmaceutical industry increased 17.8 per cent in 2017, compared with 13.9 per cent a year earlier.

The improved result is most likely to be due to larger industry players already digesting the negative cost impact of government moves to eliminate smaller distributors, which were being blamed for higher medicine prices, according to Wang Chen, a partner with Xufunds Investment Management.

Jin Ming, an analyst at Soochow Securities, added that listed pharmaceutical companies have already recovered from their earnings low ebb, “and their acceleration in earnings growth will become more conspicuous”.

Pharmaceutical stocks are now trading at 39.2 times reported earnings, a 144 per cent premium over the Shanghai Composite, according to Bloomberg data. The sector’s biggest premium over the benchmark stock gauge was 185 per cent.

“That valuation is far from being stretched, and it [the pharmaceutical sector] remains one of the very few with good fundamentals and growth,” said Wang from Xufunds. “The run-up [or sudden increase in stock prices] will continue.”