Amid market decline, foreign investors chase China stocks and mainland traders sell Hong Kong shares

Overseas investors bought China stocks for 13 consecutive days through Wednesday, while mainland traders sold Hong Kong shares for five days in a row

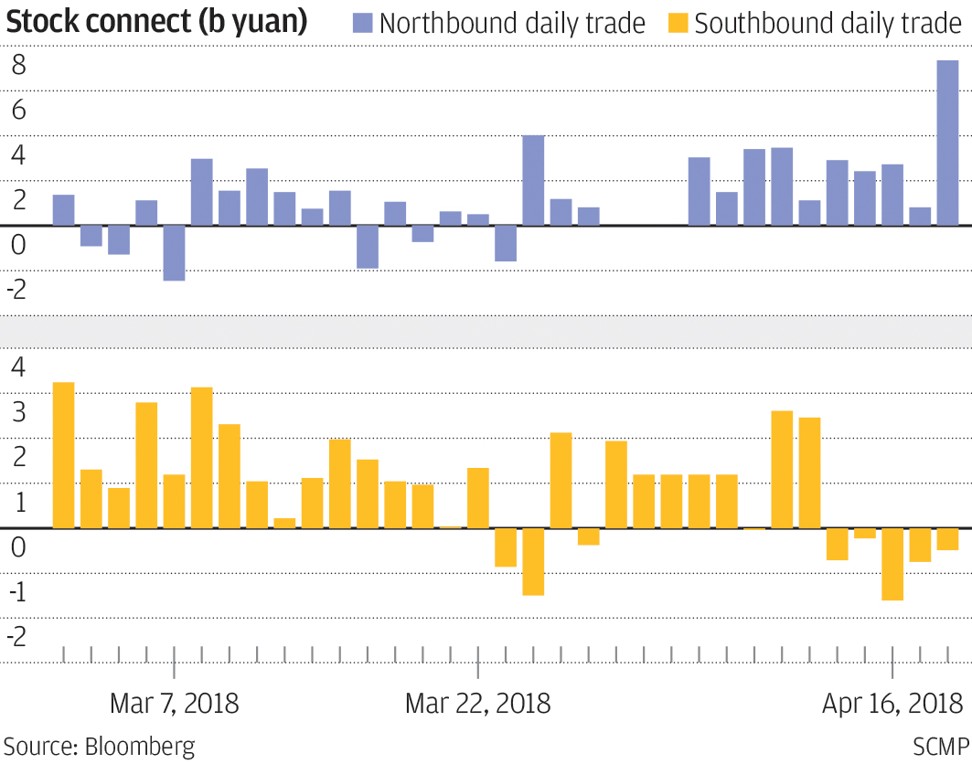

While sell-offs have been rattling markets in China and Hong Kong, foreign and mainland investors have differed in their approach to investments made through the stock connect programmes that link the bourses in Shanghai and Shenzhen with Hong Kong’s.

Unfazed by declines, overseas investors had net purchases of mainland shares for 13 consecutive days through Wednesday, according to data by Bloomberg. Meanwhile, mainland traders seem to have fled their previously favourite asset class and sold Hong Kong stocks for five days in a row.

This is the longest streak of mainland investors selling Hong Kong stocks since the stock connect started in 2016.

And while overseas investors might be forced to buy Chinese stocks to mirror the change in their portfolios ahead of the inclusion of mainland equities to MSCI benchmarks, mainland traders’ flight from Hong Kong shares comes as a surprise, as there had been a total of five days that registered net sales this year before this latest round of selling.

The quick turnaround can possibly be explained by the fact that most mainland investors are trend followers, who cut or even close their positions after sensing that the momentum in Hong Kong stocks has weakened, according to Wei Wei, a trader at Huaxi Securities in Shanghai.

Mainland investors chase the trend and ride the momentum. When things go wrong, they sell to protect their short-term profits

“The differentials in the same market scenario reflect the quite different mentality between foreign and Chinese investors,” she said. “Foreign investors care more about the long-term outlook, so they buy on dips. Mainland investors chase the trend and ride the momentum. When things go wrong, they sell to protect their short-term profits.”

Chinese and Hong Kong stocks have endured more turbulence this year from the prospect of rising interest rates in the United States, the mounting trade tensions between China and the US and a weaker Hong Kong dollar.

The Shanghai Composite Index is down by 12 per cent from a January high and the Hang Seng Index has dropped by 7.5 per cent from an all-time high recorded the same month. Hong Kong’s benchmark index climbed by 36 per cent in 2017 as mainland traders ploughed funds through the stock connect schemes amid the market’s lower valuation.

Most of the selling by mainland investors seems to be concentrated in the financial sector. Ping An Insurance Group, Industrial and Commercial Bank of China and China Construction Bank were among the companies that were sold most by Chinese traders in March, according to data from the Hong Kong stock exchange. They also sold shares in Apple suppliers AAC Technologies Holdings and Sunny Optical Technology, the data showed.

Major buys by foreign investors via the link last month included liquor distiller Kweichow Moutai, dairy maker Inner Mongolia Yili Industrial Group and Jiangsu Hengrui Medicine, according to the Hong Kong stock exchange.