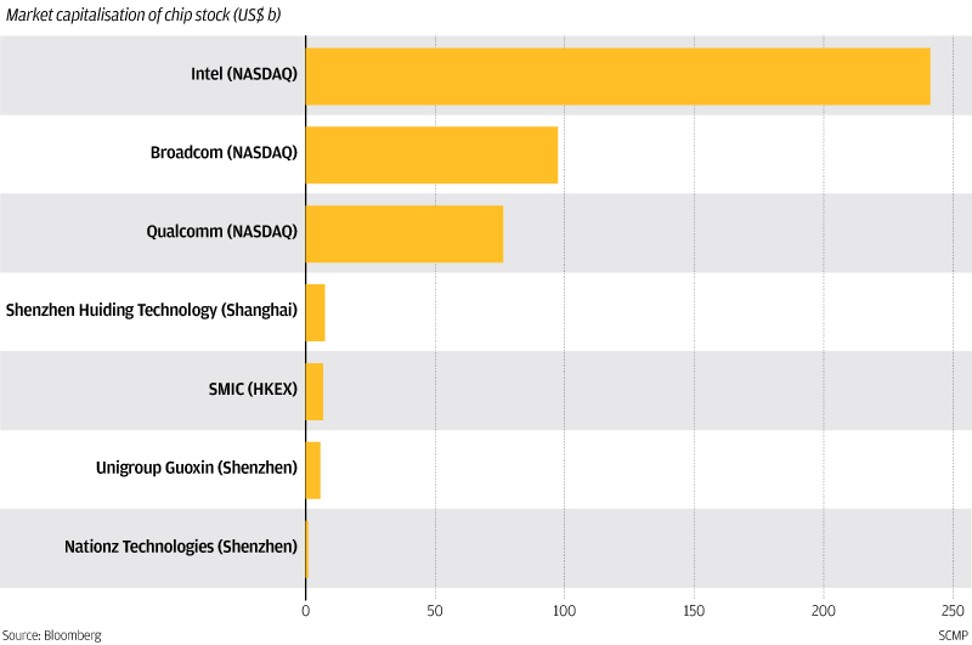

US semiconductor makers dwarf Chinese peers in market valuation as China’s chip dream remains distant

China’s biggest chip maker is valued at a fraction of US giants like Intel and Qualcomm; the mainland imports US$200b of US chips annually

Chinese chip makers are no match for their US counterparts at least in the stock market, even as the nation’s state media are fully charged to hype up the needs to develop its home-grown semiconductor industry amid the escalating trade row between the world’s two largest economies.

Intel, Broadcom and Qualcomm, the US suppliers of chips for smartphones and computers, are at least 10 times the market value of China’s biggest chip maker Shenzhen Huiding Technology, according to Bloomberg data. While the processors made by the US companies are mostly used in the upscale electronic products, the China-made ones can only fill the low-end market for products such as bank cards and USB-keys.

While the state-run Xinhua News Agency and the Communist Party’s mouthpiece People’s Daily both ran articles last week urgently calling for the speedy development of the country’s semiconductor industry, the gap with the US is unlikely to narrow any time soon, according to investors including Hengsheng Asset Management.

“The gap is still huge and the semiconductor industry is capital- and labour-intensive,” said Dai Ming, a money manager at the Shanghai-based fund management firm. “It requires massive investment and technology accumulation. It’s difficult for China to catch up with the US in the short term.”

These dwarf the Chinese rivals. Shenzhen Huiding, the Shenzhen-listed designer of maker of chips for finger-verifying devices, has a market capitalisation of US$7.7 billion. Hong Kong-listed Semiconductor Manufacturing International Corp is valued at US$6.5 billion, and Shenzhen-traded Unigroup Guoxin, whose chips are mainly used in USB-keys, is valued at US$5.6 billion.

It’s difficult for China to catch up with the US in the short term

Chinese policymakers have already elevated its support of its own chip industry to state strategy level. Even before the US ban on ZTE, the nation has created a 140 billion yuan (US$22 billion) China Integrated Circuit Industry Investment Fund to aid semiconductor companies. The fund has already invested in about 20 listed companies including SMIC, Sanan Optoelectronics and Jiangsu Changjiang Electronics Technology.

In the blueprint for the high-end manufacturing industry promulgated by the State Council in 2015, Chinese semiconductor companies will need to supply 40 per cent of the nation’s chips by 2020 and the proportion will rise to 50 per cent in 2025.

Local traders were riding on the nation’s chip dream, as a gauge of 70 chip stocks on the mainland’s exchanges has risen 24 per cent from a February low, based on data from Great Wisdom. Still, the run-up seemed unwarranted to Ken Chen, a strategist at KGI Securities in Shanghai

“There’s no fundamental change in China’s semiconductor industry,” he said. “Domestic chip makers aren’t good performers in earnings. It’s a long way ahead before they can serve the state strategy.”