Global investors buy China stocks at fastest pace ever as MSCI inclusion draws closer

Average daily buys reach US$374m in April, the highest since the stock connect programmes were launched in 2014

Foreign fund managers are fully geared up for ploughing their money into China’s equities in the run-up to the integration of the nation’s US$7.5 trillion market into the global benchmarks next month.

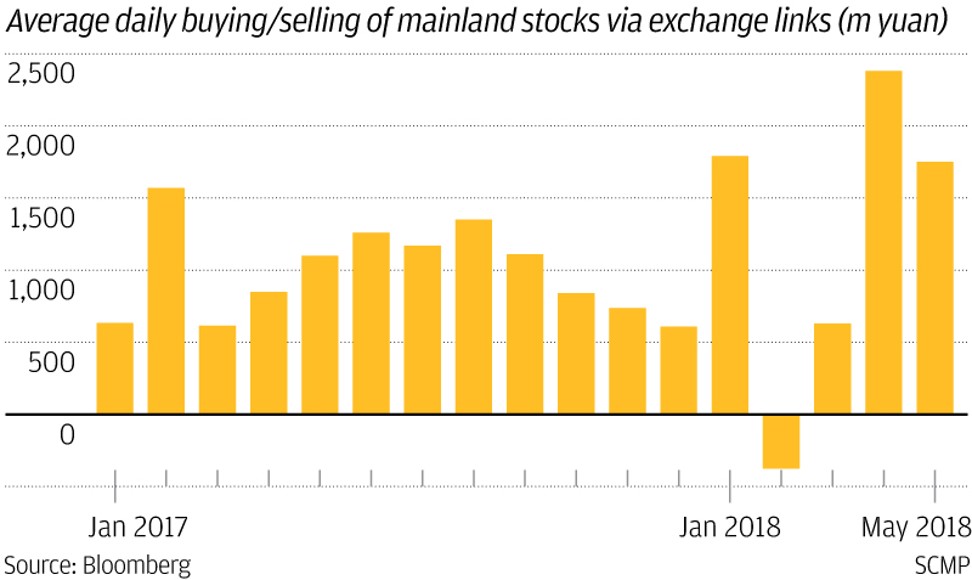

They bought an average 2.38 billion yuan (US$373.9 million) of mainland-traded shares on a daily basis in April through the Shenzhen and Shanghai stock connect programmes with the Hong Kong exchange, according to data compiled by Bloomberg. That was the highest since the stock links that gave overseas investors wider access to China’s stocks started in 2014. The daily inflow was 1.82 billion yuan so far in May, the data showed.

An estimated 120 billion yuan of funds will be ploughed into China’s markets as global money managers increase their allocations of yuan-traded stocks to their index-based portfolios to reflect Chinese equities’ addition to the MSCI’s global indexes in June, according to Sinolink Securities and GF Securities.

JPMorgan Chase predicts the inflow will probably reach as much as US$40 billion, when taking into consideration the investments by actively managed funds.

Signs of foreign buying seem to be increasingly conspicuous.

Foreign investors are probably accelerating their paces of buying Chinese stocks before the upcoming MSCI inclusion

The CSI 300 Index of the 300 most valuable companies on the Shanghai and Shenzhen bourses rallied 1.2 per cent on Tuesday. The gauge covers almost all the 232 large-cap stocks picked by MSCI to be added to its emerging-market and all-world indexes.

“Foreign investors are probably accelerating their paces of buying Chinese stocks before the upcoming MSCI inclusion,” said Wei Wei, a trader at Huaxi Securities in Shanghai. “What they are mainly interested in is those blue chip companies with quite solid fundamentals.”

Fiery liquor giant Kweichow Moutai, Ping An Insurance Group, Jiangsu Hengrui Medicine and Gree Electric Appliances were among the most actively traded mainland stocks through the link in April, according to the monthly data from the Hong Kong exchange.

MSCI’s inclusion of Chines stocks will be implemented in two steps – June and September respectively, as announced by the index compiler a year ago. That will gain the mainland equities an initial 0.8 per cent weighting in the MSCI Emerging Markets Index.

Still, it is likely that the MSCI will give more weighting to Chinese stocks represented in its indexes after the People’s Bank of China quadrupled the limit on the value of stocks foreign traders can buy to 52 billion yuan last month.

China’s stock markets will remain as a beneficiary of institutional inflows in the next five years, with an entry of as much as 5 trillion yuan from the nation’s pension fund, household investible funds and foreign capital, Morgan Stanley said in a report on Monday.