What’s China’s speed limit on growth of US imports? Try US$100 billion by 2020, says JP Morgan

China could “realistically” ramp up its purchases of US goods by US$100 billion in the next two years as part of efforts to close the widening trade gap, according to research by JP Morgan.

The chances of a US$200 billion rise in goods and services purchases by 2020, as advocated by some US trade representatives, looks “challenging, if not impossible” because of constraints on both sides, according to the report authored by six analysts from the investment bank’s equities and policy research departments.

“Realistically, China could import US$10 billion more in auto by 2020, US$20-25 billion more in farm products, US$50 billion more in energy products, and US$25 billion more in general by imposing a 2 per cent import duty reduction which has some overlapping part with the auto calculation, ” wrote analysts headed by Zhu Haibin, chief China economist at JP Morgan.

China’s efforts to boost US imports is likely to find the most traction in sectors involving crude oil, liquid natural gas, farm products, tourism and financial services.

However, Zhu cautioned the trade rebalancing would have repercussions “as China may shift demand to the US from other countries”.

Trade tensions between the two nations have eased since a joint statement was issued on May 19 asserting China will “significantly increase” purchases of US goods, following the latest round of negotiations in Washington.

National Economic Council director Larry Kudlow told reporters on May 18 that China had agreed to purchase “at least US$200 billion” in additional goods and services as a way to help balance a trade surplus that reached US$375 billion last year.

However, Chinese authorities quickly denied the target figure, saying through state media that no trade value had been agreed.

A joint statement which was published hours later also lacked specific dollar amounts, suggesting that Beijing had not accepted a specific target.

Under the framework China will increase its purchases of US farm products by 35 to 40 per cent this year and ramp up purchases of energy products to US$50 billion to US$60 billion in the next three to five years, US Treasury Secretary Mnuchin said.

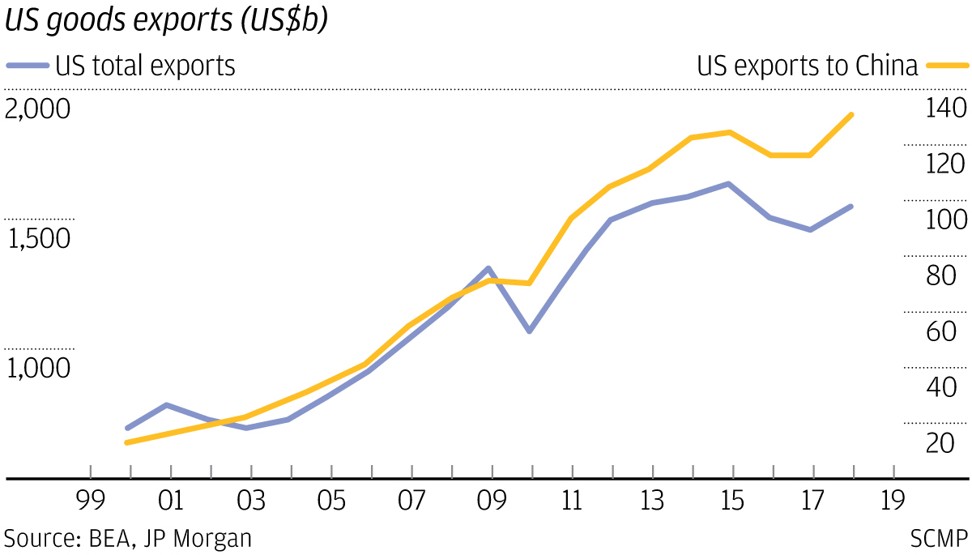

Over the past decade, US goods exports to China have expanded 107 per cent, from US$63 billion to US$130 billion, more than three times faster than the 30.5 per cent export growth to the rest of the world.

At the current pace of growth, the US is on track to export an additional US$17 billion to China in 2018 from a year earlier.

According to JPm Morgan research, the top US exports include aircraft, soybeans and cars. China’s top importing sectors include integrated circuits, petroleum and mobile phones.

In theory, US farm products could undergo significant export growth, given China’s agricultural imports have been increasing at high double-digit growth rates for wheat, soybeans and rice.

“If China buys from the US to meet its newly increased demand while keeping orders from other suppliers unchanged, it could import around US$58 billion more by 2020,” the report said.

Energy products share a similarly upbeat outlook.

“In an optimistic scenario, if China’s net increase in crude oil demand were met entirely by US supply, that could add US$16 billion more in imports in 2018 and US$53 billion more by 2020, if oil prices remain stable,” the report said.

Also, China’s imports of liquefied natural gas (LNG) could increase from US$14.7 billion in 2017 to US$40.4 billion by 2020, under the top-down environmental protection campaign. American exports of LNG to China totalled US$644 million in 2017, suggesting significant room for growth, the report said.

Aside from merchandise trade, the analysts highlighted that “further expansion in service exports to China appears to be a viable way to meaningfully narrow the US-China trade imbalance”.

“Assuming US service exports to China grow at an annual pace of 20 per cent (accelerating modestly from 15.6 per cent annual growth in the past decade), the annual US-China service trade surplus could widen by US$39 billion by 2020,” the report said.

They noted that China could also narrow the trade surplus by reducing its exports to the US or by reducing import tariffs.

Meanwhile, American exports of aircraft and semiconductors to China are unlikely to see a major pick up because of production capacity restraints, the report said.

Xiao Lian, a research fellow at the Institute of World Economics and Politics, Chinese Academy of Social Sciences, said it did not make economic sense for China to agree on specific import targets.

“Even the Chinese government does not have a say in deciding how much more a certain enterprise, or industry will import from the US. It should be decided by the market,” he said.

Xiao said it was unlikely that China would significantly shift imports from other countries to satisfy the US.

“Of course it will be decided by cost, and distance, many factors,” he said.

China’s demand for imports is growing, with the current account slipping into deficit during the first quarter for the first time in 17 years, suggesting a significant shift for the export-driven model economy.

JP Morgan said China’s current account balance could slide into an annual deficit by 2020.

China’s looming shift to a net importer would have consequences for its major trading partners, according to Aidan Yao, senior emerging Asia economist at AXA Investment Managers.

“Those who can provide China with what it needs (services, high-value added products, clean energy) will fare better than those who produce goods that are in direct competition with ‘made in China’ goods,” he said.

Yao cautioned that a bilateral trade surplus with the US could persist even if China’s current account balance slipped to an annual deficit.