Why China’s plan to launch the highly touted CDR scheme is still on hold

Tech firms’ unwillingness to accept certain terms related to the issuance of CDRs, a stock market rout and weakening yuan in the face of trade war with the US, has forced Beijing to indefinitely the launch plans on hold

It was meant to celebrate four decades of China’s embrace of capitalism.

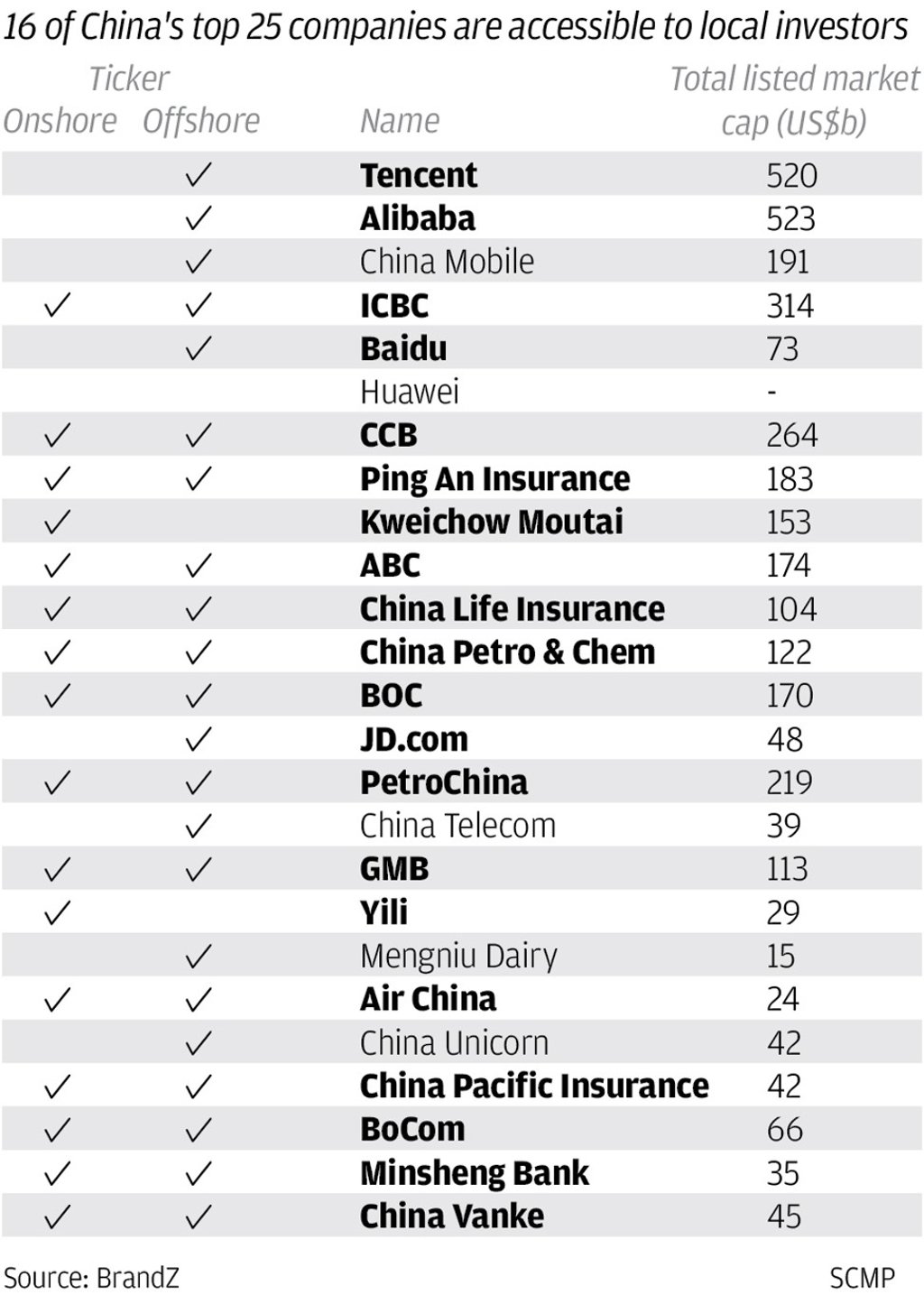

But Beijing’s pet scheme to lure the country’s best tech companies listed in the US as part of capital market reforms has been indefinitely put on hold amid a stock market slump and negotiations with tech firms that remain deadlocked.

Sources at the securities regulator and tech firms involved in the negotiations said they were still working out issues related to the size and pricing of the Chinese depositary receipts (CDRs) – securities underlying the US-listed shares of Chinese companies. Other serious issues that remain to be sorted out include rules governing post-listing information disclosure, dividend payment, employee stock ownership plan and, most importantly, accounting standards.

“Initially it was agreed that they [the US-listed Chinese tech giants] would adjust their financial data from US GAAP to Chinese accounting standards for A-share disclosures,” said a senior official with the China Securities Regulatory Commission (CSRC), who did not want to be named as he was not authorised to reveal the details of the negotiations to the media. “But later there was an argument on how many items the readjustment should apply to, making it very hard to reach a consensus,” adding that there was “no longer a timetable” to kick off the scheme.

“The embarrassing fiasco of Xiaomi should remind all investors in China of the vagaries of the nation’s reforms,” said Fraser Howie, co-author of Red Capitalism: The Fragile Financial Foundations of China’s Extraordinary Rise.