China’s battered stocks have one more gauge to show they are bargains

Earnings yield increase on the benchmark index is indicator of subsequent gains for equities based on historical data

If lowered price earnings of mainland Chinese stocks are not appealing enough for investors, a reading of the yield on Shanghai’s benchmark index could change that.

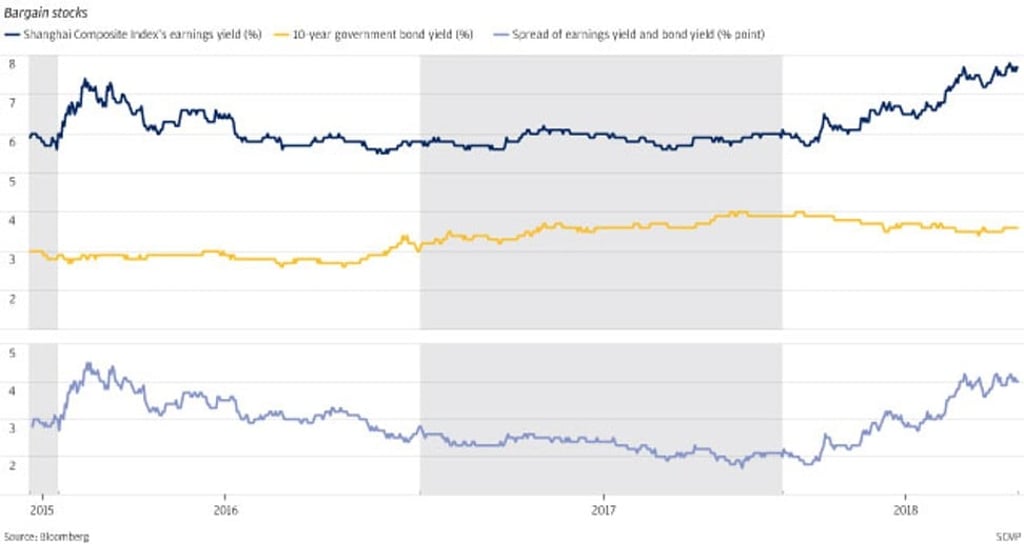

With the earnings yield on the Shanghai Composite Index’s rising 7.8 per cent this month, buying stocks would potentially generate the most decent returns since December 2014, according to Bloomberg data.

A decline of as much as 18 per cent since the start of the year has steadily pushed up the benchmark’s earnings yield, the reciprocal of the price-to-earnings ratio. The higher the earnings yield, the more undervalued stocks are, which means probable generous returns in the future.

China’s stocks are also at their most attractive level relative to the nation’s sovereign bonds in the past 29 months. The spread in August between the Shanghai Composite’s earnings yield and the 10-year bond yield has widened by the most since March 2016, Bloomberg data showed.

Still, the bulls and the bears have been locked in a debate over whether the world’s third-largest stock market will bottom out soon as the Shanghai Composite this month approached a low almost matching the level after the 2015 rout that erased US$5 trillion in value.

The bulls are buoyed by the beaten-down valuations, increased foreign buying and record share buy-backs by listed companies, while bearish investors cite the ongoing trade war with the US, the financial deleveraging and the waning interest among local investors as factors weighing on stocks.