Shanghai’s index slump may have more to go as liquidity dries up in the world’s worst-performing stock market

The number of stocks trading below either the 200-day moving average or their book value is rising, pointing to more losses to come

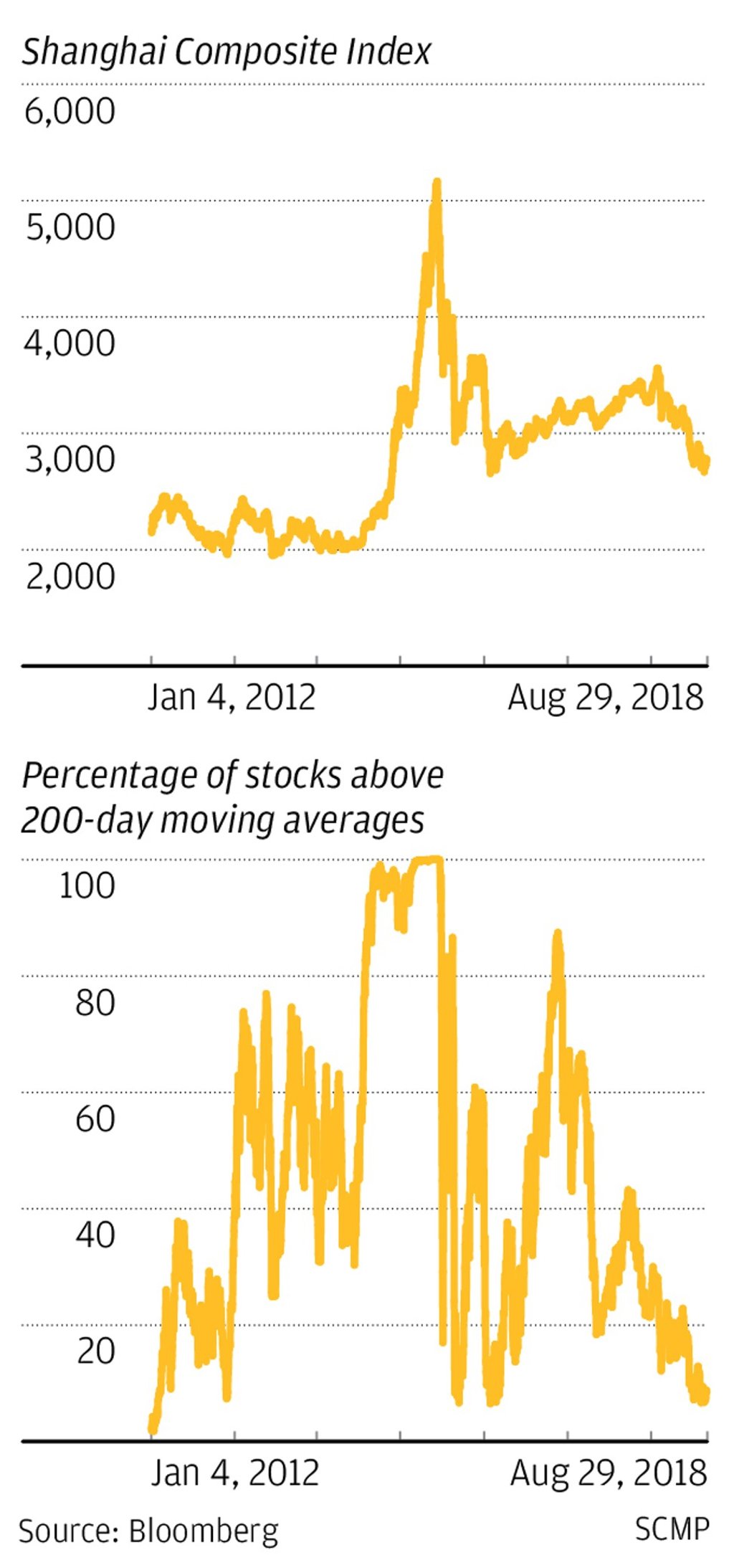

The world-beating slump on Chinese equity markets may have more room to run, if the number of companies with stock prices below either their 200-day moving averages or book values is anything to go by.

Of the 1,478 stocks on the benchmark Shanghai Composite Index, 93.3 per cent have fallen below their average prices for the past 200 days, according to Bloomberg data.

That is not far from the 98.2 per cent recorded in January 2012 at the bottom of a slump that did not turn around until 2014. The number hit 99.9 per cent at the peak of the 2008 global financial crisis.

At the same time, the number of stocks with prices below book values indicates that there is more gloom to come.

As of Thursday, 173 companies on the Shanghai Composite had fallen to such levels, the Bloomberg data showed, although the figure was still below the 200 companies seen in November 2008.

“The market isn’t likely to turn around any time soon,” said Ken Chen, a strategist at KGI Securities in Shanghai. “A turnaround of China’s markets usually needs improving fundamentals and loose liquidity, and up till now, we’ve seen neither.”