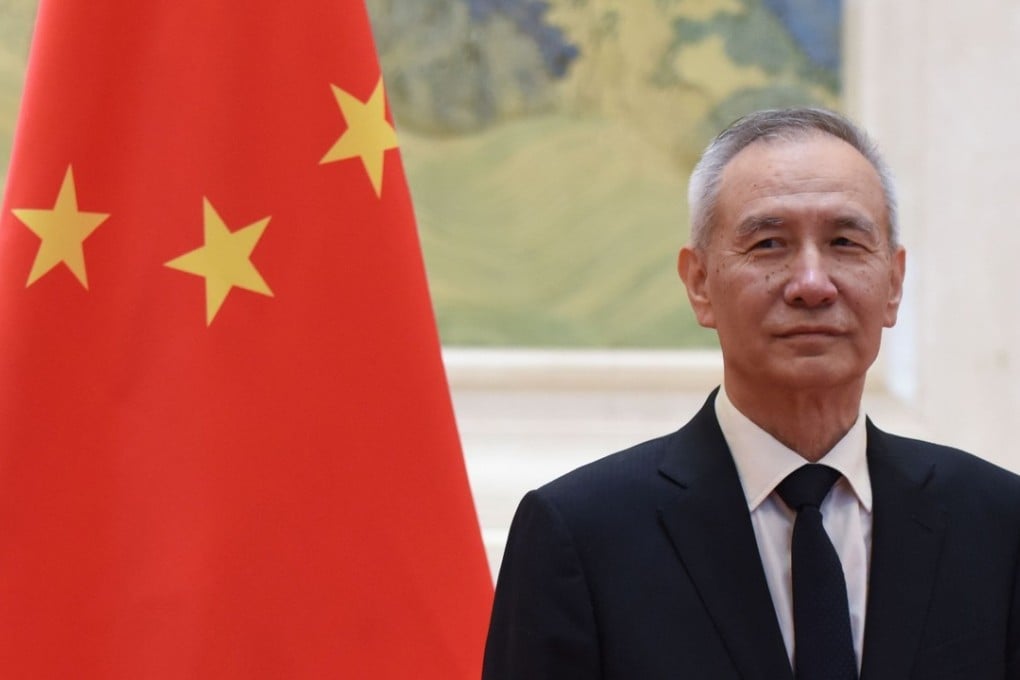

China economic tsar steps in to steady ship after slowest quarter in decade, says stocks have ‘high investment value’

Liu He joins financial and regulatory institutions in underlining economy’s resilience

Liu He, China’s financial tsar, led a coordinated effort with the country’s central bank and financial regulators on Friday to stem its worst stock market rout in three years, and extended a lifeline to businesses battered by a liquidity squeeze.

Chinese regulators have already sought measures to defuse risks related to shares used as collateral for loans, while the recent declines in the country’s stock market have created a good buying opportunity, the vice-premier said in an interview to the Communist Party’s mouthpiece, People’s Daily.

“In terms of global asset allocation, China’s stock market already has a pretty high investment value, with bubbles significantly contracting, the quality of listed companies improving and valuations at a historical low level,” said Liu. “I believe that investors will make a rational judgment.”

China’s economy sees lowest growth rate in 10 years as US trade war starts to bite

The coordinated effort had an immediate effect on the stock market – the benchmark Shanghai Composite Index rose by as much as 2.7 per cent on Friday, even as the economy posted its slowest quarterly growth in 10 years.

Earlier on Friday, the People’s Bank of China (PBOC), as well as the China Banking and Insurance Regulatory Commission (CBIRC) and the China Securities Regulatory Commission (CSRC) said they will ramp up support for private companies exposed to a liquidity squeeze caused by shares used as collateral for loans through easier lending.

Support from China’s top leadership comes after the Shanghai Composite Index fell to a four-year low this week, with sell-offs accelerating on mounting concerns that pledged shares will face forced sales and, thus, exacerbate declines. Shares worth 4.5 trillion yuan (US$648.6 billion) in market value have been used as collateral for loans – a way of accessing funds used particularly by smaller listed companies – according to Essence Securities data.

I believe that investors will make a rational judgment

This roughly equates to 13 per cent of the combined market capitalisation of stocks on the Shanghai and Shenzhen exchanges. Unless loans are repaid or more collateral is added, the stocks can be liquidated by debtors, further weighing on already weak sentiment.