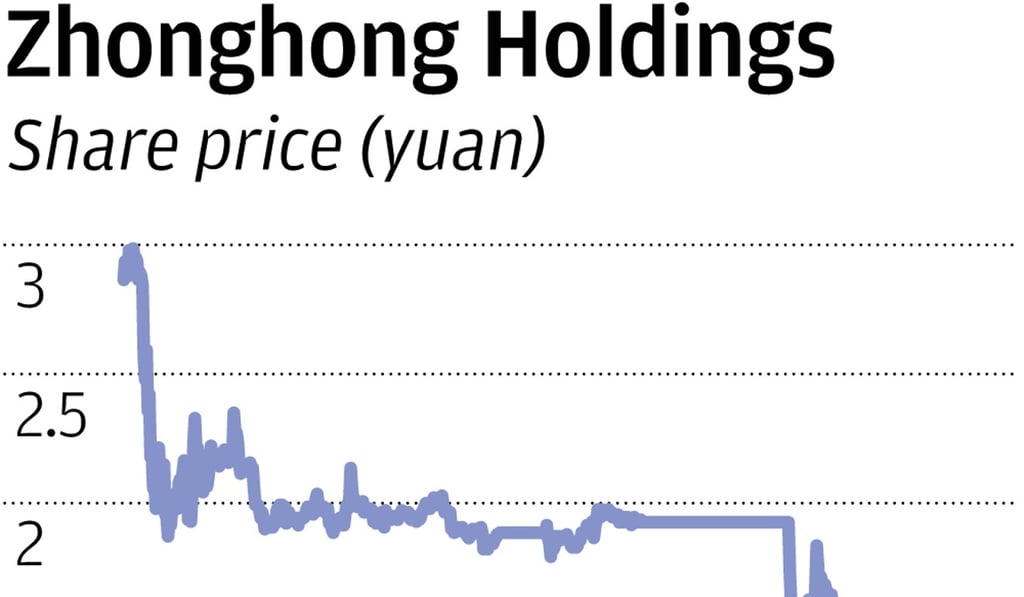

Property developer Zhonghong set to become first to be delisted for shares remaining below par value

- Shenzhen Stock Exchange will make a decision on whether to delist the stocks within the next three weeks, as shares closed below the par value of US14.5 cents for 20 consecutive days

Property developer Zhonghong Holdings Group could become the first stock to be delisted in China due to its long-term fall below par value, prompting fears more could fall prey to the rule as global stocks continue to drop.

The Shenzhen Stock Exchange will make a decision on whether to delist the stocks within the next three weeks, as the shares closed below the par value of 1 yuan (US14.5 cents) for 20 consecutive days, triggering one of the causes of a delisting, the bourse said in a statement on Thursday.

The stock was suspended from trading on Friday, before closing at 0.74 yuan the previous day.

A par value is the per-share amount appearing on stock certificates. It is also an amount that appears on bond certificates.

Of all the 97 companies to have been expelled from the Shanghai and Shenzhen exchanges so far since China started stock trading in 1990, none was because of low share prices. Most were deprived of their status after posting annual losses for three consecutive years.