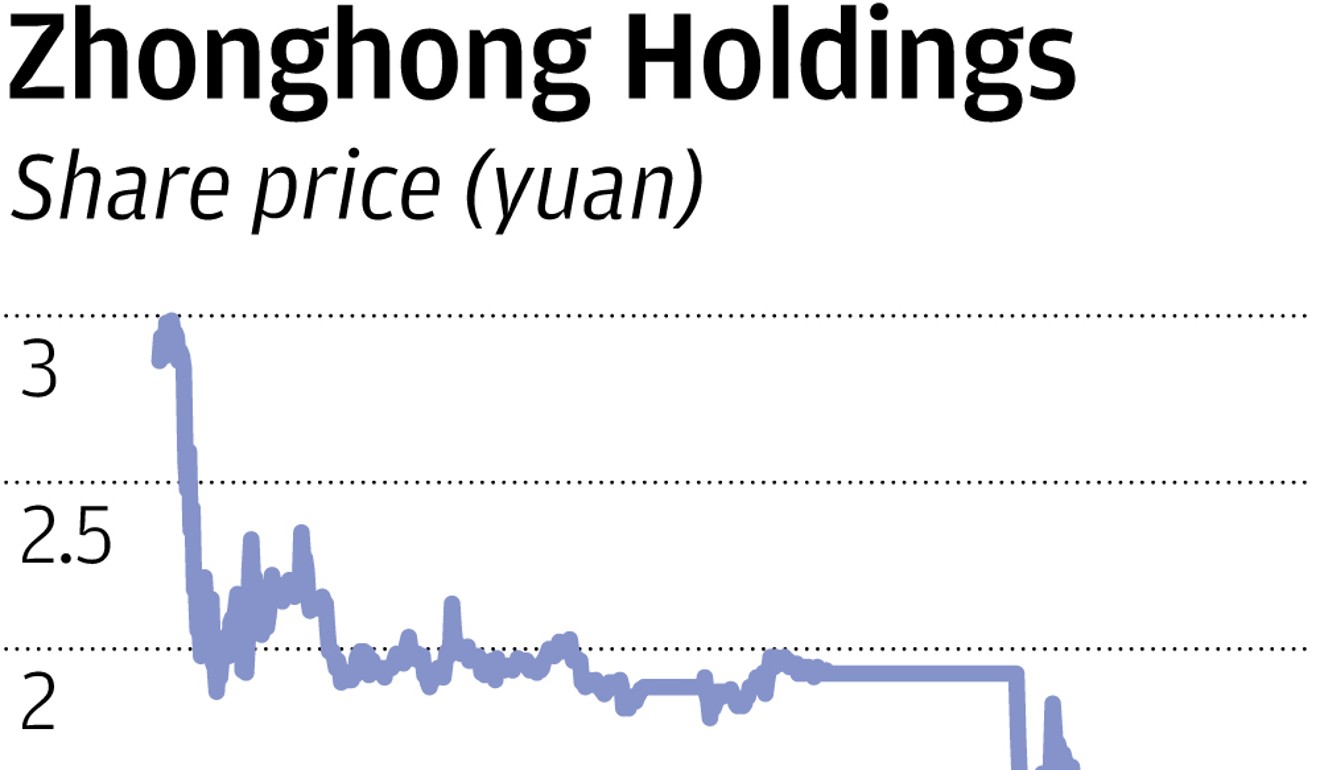

Property developer Zhonghong set to become first to be delisted for shares remaining below par value

- Shenzhen Stock Exchange will make a decision on whether to delist the stocks within the next three weeks, as shares closed below the par value of US14.5 cents for 20 consecutive days

Property developer Zhonghong Holdings Group could become the first stock to be delisted in China due to its long-term fall below par value, prompting fears more could fall prey to the rule as global stocks continue to drop.

The Shenzhen Stock Exchange will make a decision on whether to delist the stocks within the next three weeks, as the shares closed below the par value of 1 yuan (US14.5 cents) for 20 consecutive days, triggering one of the causes of a delisting, the bourse said in a statement on Thursday.

The stock was suspended from trading on Friday, before closing at 0.74 yuan the previous day.

A par value is the per-share amount appearing on stock certificates. It is also an amount that appears on bond certificates.

Of all the 97 companies to have been expelled from the Shanghai and Shenzhen exchanges so far since China started stock trading in 1990, none was because of low share prices. Most were deprived of their status after posting annual losses for three consecutive years.

Now, however, the worst share sell-off since a major crash in 2015 has exposed companies with poor share earnings to being delisted.

China’s market has lost US$2.6 trillion yuan in value this year, with the benchmark Shanghai Composite slumping 23 per cent, as the trade war with the US escalates.

Levels of borrowing against shares, or share pledging, has also increased risk.

Zhonghong’s situation has also now cast the spotlight on wind turbine maker Sinovel Wind Group and Kaidi Ecological and Environmental, as their share prices also closed below 1 yuan on Friday.

Sinovel finished 2 per cent lower at 0.97 yuan in Shanghai, the second day the stock has stayed under par value, while Kaidi slid 3.9 per cent to 0.98 yuan.

There are another 48 companies whose shares now trade between 1 and 2 yuan, according to Bloomberg data.

Zhonghong’s shares have crumbled 62 per cent in value this year, reflecting investor fears over its weakening profitability. The property developer forecast a loss of 2.1 billion yuan (US$302.9 million) for the first three quarters this year, citing decreased sales amid the government’s crackdown on rising home prices. It reported a full-year loss of 2.51 billion yuan in 2017.

Both its chairman and general manager resigned this week.

The Beijing-based developer floated its shares in 2000 and has 8.39 billion outstanding shares, valuing the company at 6.21 billion yuan. That is 16 per cent less than the average market capitalisation of the 2,161 companies on the Shenzhen exchange, according to Bloomberg data.

On Zhonghong’s last trading day on Thursday, the shares tumbled 9.8 per cent, as the daily trading volumes were less than half the average level over the past year, with 77.6 million shares changing hands.

Once the Shenzhen exchange had made its decision to delist the stock, Zhonghong’s shares will resume trading for 30 days before being officially being kicked off the bourse, the property developer said in a Thursday statement.