US deal makers back away from deep-pocketed Chinese investors as Washington brands Beijing a national security threat

- Chinese buyers shunned as Trump administration accuses Beijing of gaining access to critical technologies and infrastructure through asset acquisitions

- Law expanding national security review process means there is ‘no point’ in trying to find a Chinese buyer

Just two months after the US moved to tighten controls on foreign investment, citing national security concerns, American deal makers are losing their appetite for selling assets to Chinese buyers – who had proven to be a gold mine because of their penchant for outbidding other suitors.

From Anbang’s US$1.95 billion acquisition of the iconic Waldorf Astoria hotel in New York to Tianjin Tianhai’s US$6 billion takeover of information technology company Ingram Micro, the Asian acquirers’ cheques kept getting bigger.

In 2016 alone, Chinese buyers invested US$51 billion in the US through 65 deals, according to data from Mergermarket.

On average, they paid at least 20 per cent more than their American counterparts were willing to bid, according to multiple people involved in the purchases, who asked not to be named because details about the bidding are not public.

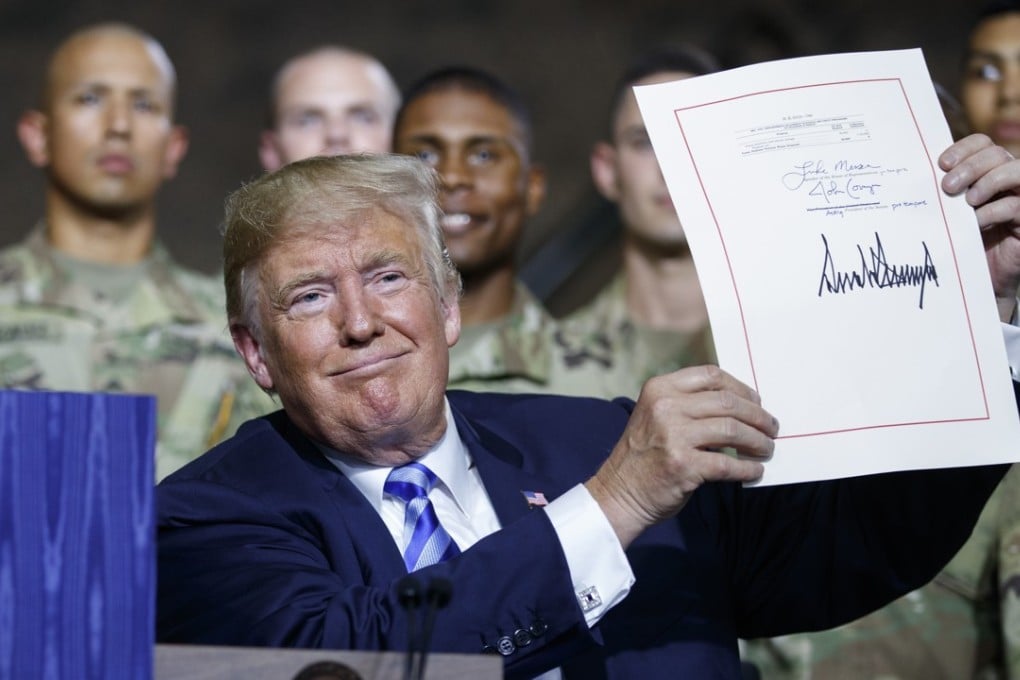

The heyday is over. Chinese buyers are being shunned as the country becomes the primary national security focus for the Trump administration, which accuses it of gaining access to critical technologies and infrastructure through asset acquisitions.

Watch: China’s company-buying spree fuels Asia mergers and acquisitions