Exclusive | The tenuous truce in the US-China trade war will decide whether Hong Kong’s best IPO party ever continues in the new year

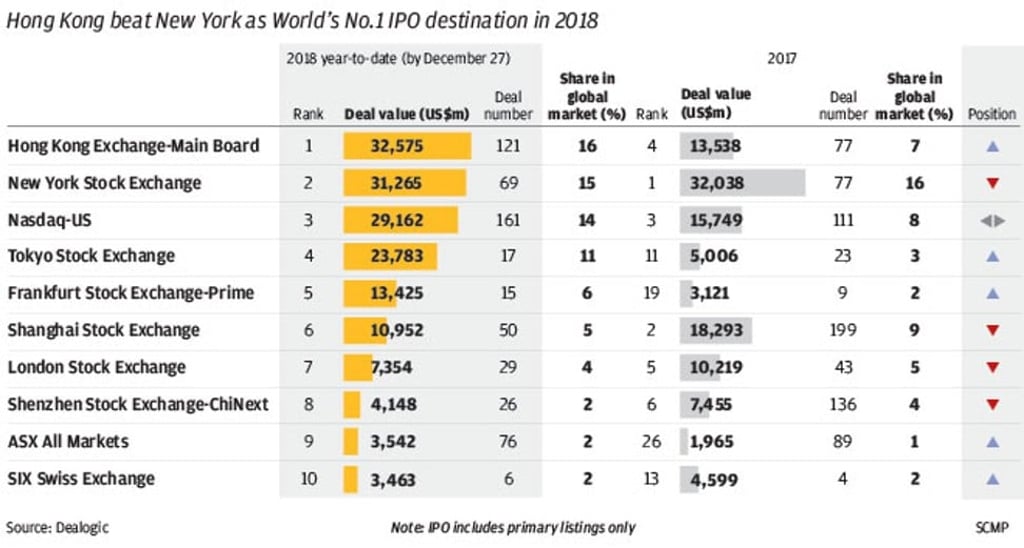

- Hong Kong reclaimed the global crown in 2018 as the world’s most-preferred destination for initial public offerings (IPOs)

- A record 208 companies raised a combined HK$286.6 billion (US$36.6 billion) on the Main Board and the Growth Enterprises Market (GEM) in Hong Kong

On July 12, the Hong Kong stock exchange (HKEX) conducted an unprecedented ritual to start its trading day: four gigantic gongs were struck one after the other by executives of eight companies to commemorate the debut of their stocks.

The eight companies, including Chinese live-streaming application Inke, had to share the four cymbal-like instruments because the centre stage at the exchange was too narrow to accommodate a ceremonial gong for each representative.

Eight trading debuts on a single day was the high-water mark in a blockbuster year for Asia’s third-largest equity market, which recaptured the much-coveted crown in the global race to raise the biggest amount of money from initial public offerings (IPOs) in 2018, besting New York, Shanghai and Shenzhen.

A record 208 companies listed this year on the HKEX’s Main Board and the Growth Enterprises Market (GEM), raising a combined HK$286.6 billion (US$36.6 billion). The Main Board alone hosted a record 121 primary listings, raising US$32.57 billion, according to data from Dealogic.

“The IPO pipeline is robust, and the momentum is strong,” said JPMorgan Chase & Co’s Asia-Pacific investment banking co-head John Hall, whose bank helped Ping An Healthcare & Technology raise HK$8.77 billion this year. “Instead of postponing their IPO agenda, most issuers want to be prepared to catch the right market window.”

The exchange owes its spectacular year to the biggest change in listing regulations in three decades, which cleared the way in April for pre-revenue biotech researchers and start-ups with multiple classes of shares to raise capital in the city for the first time.