Exclusive | The tenuous truce in the US-China trade war will decide whether Hong Kong’s best IPO party ever continues in the new year

- Hong Kong reclaimed the global crown in 2018 as the world’s most-preferred destination for initial public offerings (IPOs)

- A record 208 companies raised a combined HK$286.6 billion (US$36.6 billion) on the Main Board and the Growth Enterprises Market (GEM) in Hong Kong

On July 12, the Hong Kong stock exchange (HKEX) conducted an unprecedented ritual to start its trading day: four gigantic gongs were struck one after the other by executives of eight companies to commemorate the debut of their stocks.

The eight companies, including Chinese live-streaming application Inke, had to share the four cymbal-like instruments because the centre stage at the exchange was too narrow to accommodate a ceremonial gong for each representative.

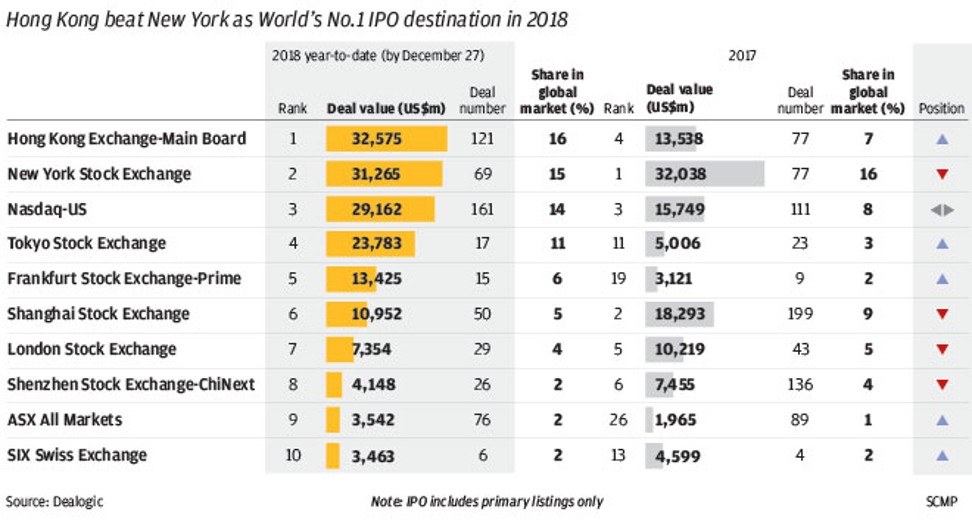

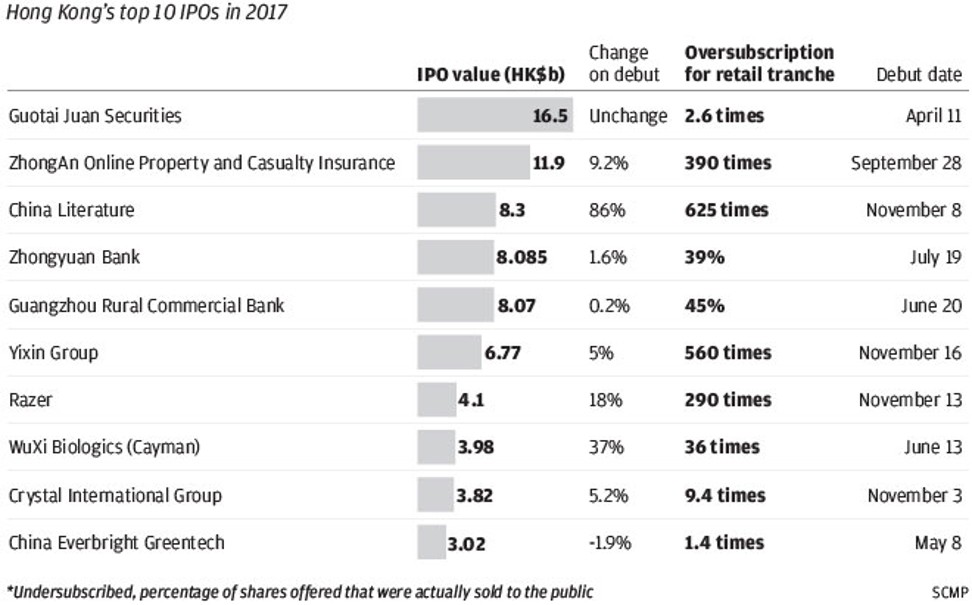

Eight trading debuts on a single day was the high-water mark in a blockbuster year for Asia’s third-largest equity market, which recaptured the much-coveted crown in the global race to raise the biggest amount of money from initial public offerings (IPOs) in 2018, besting New York, Shanghai and Shenzhen.

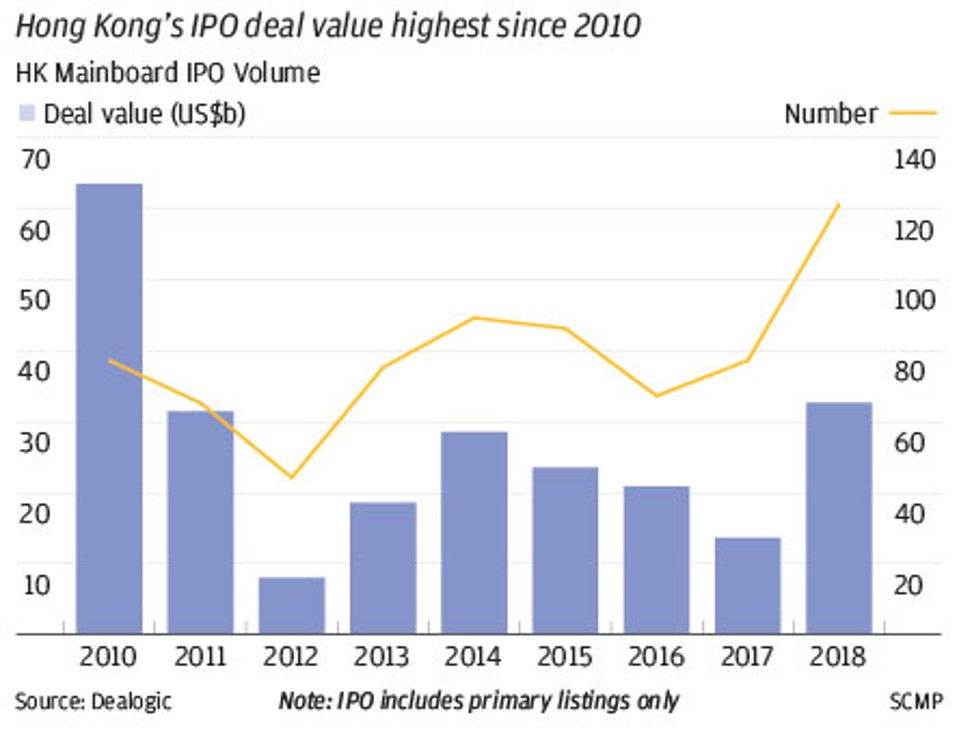

A record 208 companies listed this year on the HKEX’s Main Board and the Growth Enterprises Market (GEM), raising a combined HK$286.6 billion (US$36.6 billion). The Main Board alone hosted a record 121 primary listings, raising US$32.57 billion, according to data from Dealogic.

“The IPO pipeline is robust, and the momentum is strong,” said JPMorgan Chase & Co’s Asia-Pacific investment banking co-head John Hall, whose bank helped Ping An Healthcare & Technology raise HK$8.77 billion this year. “Instead of postponing their IPO agenda, most issuers want to be prepared to catch the right market window.”

The exchange owes its spectacular year to the biggest change in listing regulations in three decades, which cleared the way in April for pre-revenue biotech researchers and start-ups with multiple classes of shares to raise capital in the city for the first time.

It also offered mainland Chinese companies a quicker route to funds than in either Shanghai or Shenzhen, where the wait to get an IPO application through the approval process could take up to two years, subject to the Chinese regulator’s pacing.

After the reforms kicked in, 22 so-called new economy companies – tech start-ups and biotech firms – filed their IPOs in Hong Kong, adding two new growth segments to a market that has been dominated by real estate developers, banks and industrial companies.

With IPO rules reboot, Hong Kong is primed for 2018s big China technology listings

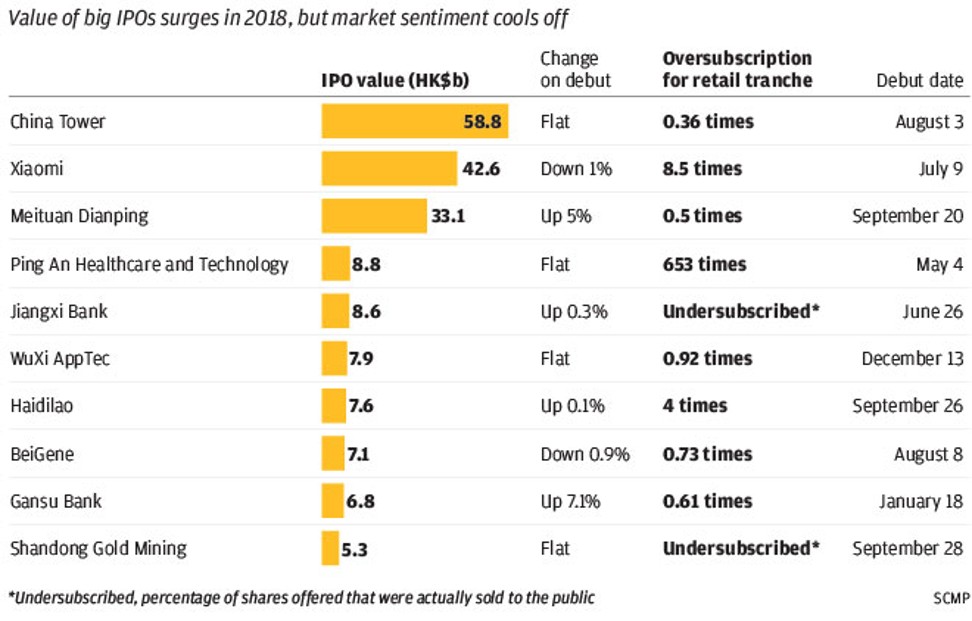

Chinese companies made up 95 per cent of the IPO values on the local bourse, Deloitte’s data showed. The four biggest internet and telecommunication IPOs – China Tower, Xiaomi, Meituan-Dianping and Pin An Healthcare – contributed to half the value raised this year in Hong Kong.

That opened “a whole new universe of opportunities for both issuers and investors,” HKEX chief executive Charles Li Xiaojia said during a December 17 party at the exchange to celebrate its victory over New York.

The surge in IPOs was also motivated by private equity and angel investors rushing for the exit before the overall market turns, analysts said.

The mainland’s PE market has cooled off in 2018 amid Beijing’s ongoing deleveraging campaign, weak domestic equity market, and an economic slowdown complicated by China’s ongoing trade war with the United States. Total fundraising value fell 30 per cent to 1.15 trillion yuan in the first 11 months, data from Zero2IPO Group showed.

As the industry cooled, PE and venture capital investors became harder to find. Thus major shareholders turn to the public equity market for financing.

“Some of the IPOs this year were driven by early investors,” said Wu. “They want to cash out given all the uncertainties, or at least have more exit options.”

China’s stock market needs to ditch its patchwork rules for a clean start at its watershed moment

But the best of times in the quantity of filings was also the worst, measured by post-IPO returns as Hong Kong’s benchmark Hang Seng Index slid 24 per cent since January, throwing the city into a bear market.

The stock prices of companies that raised more than US$100 million in the city fell 6.2 per cent on average within the first month of trading, while a staggering 77 per cent of every IPO this year fell below their offered prices, the worst performance since 2008, according to Bloomberg’s data.

New economy companies had not been spared the rout either. Xiaomi’s shares have fallen 23 per cent since its HK$42.7 billion IPO in July, while Meituan Dianping’s stock slumped 36 per cent since its HK$33.12 billion offer in September.

Where do blockbuster IPOs stand as the fizz goes out of Hong Kong’s stock trading debuts?

Declining post-IPO prices pull down valuations for the next pending IPO in the pipeline, and creates a downward spiral. One in three IPOs this year managed to be priced over the halfway mark of their price range, an 8 percentage point deterioration from 2017, according to Deloitte’s data. Xiaomi had to cut its fundraising goal by almost half, pricing its IPO at the bottom of a price range, to get it across the finishing line.

"I don’t think it’s an issue," said China Renaissance Holdings’ Founder and Chief Executive Bao Fan in an interview when the company was listed in Hong Kong in late September. China Renaissance's shares have fallen 31 per cent as of Friday's close since the investment bank’s HK$2.7 billion IPO in September. "Volatility often occurs in the price discovery process, and in the end the market will reach a consensus about the valuation. The capital market always has cycles. It helps eliminate the inferior to let the fittest survive," he said in the earlier interview.

Hong Kong will remain one of the world’s top three destinations for fundraising in 2019, with 200 new IPOs raising between HK$180 billion and HK$230 billion, according to Deloitte.

That is not counting several large “unicorns” – pre-listing companies whose valuations surpass US$1 billion – that are still waiting to decide when, or where, they want to sell their shares.

Commentary: The only thing mythical about unicorns these days is their valuation

These unicorns include China’s dominant rise-sharing platform Didi Chuxing, valued at around US$52 billion; Bytedance, the US$75 billion parent of news aggregator Jinri Toutiao and TikTok; and video-sharing application Kuaishou, which is seeking a valuation of up to US$25 billion.

Ant Financial Holdings, the US$150 billion e-payment platform of this newspaper’s parent Alibaba Group Holding, has also been touted as a potential for a blockbuster listing.

Some IPO applicants have already turned to New York to take advantage of the 40 times price-earnings ratio on the Nasdaq, eschewing the 9.7 times on the Hang Seng Index.

The US will be a “strong opponent” to Hong Kong next year, as the US stock market has been more robust this year and new economy IPOs are performing better, said Deloitte China’s National Public Offering Group Co-leader Edward Au.

The S&P 500 has risen 7 per cent so far this year, while Hong Kong’s Hang Seng Index has slid 15 per cent, as the unprecedented trade war between Washington and Beijing has already dragged China’s growth to the slowest pace in 10 years.

But Hong Kong is still favoured by many Chinese companies due to its proximity to mainland China, and a cross-border investment channel called the Stock Connect that lets Chinese traders invest in Hong Kong-listed stocks, said Au.

“In the longer term, the demand for capital by Chinese new-economy companies will continue to grow,” he said. “If Hong Kong continues to work together with China, differentiate itself, and strengthens its market fundamentals, it will remain one of the most competitive.”

Whether the music will continue in Hong Kong next year depends on the tenuous truce in the trade war between the United States and China, said Au.

The global equity markets have already shown their volatility, with the Volatility Index rising to a year-high of 37.3 in February in Chicago. The Nasdaq swung between a 17 per cent gain and a 10 per cent slump in the past year, while the Hang Seng China Enterprises Index – where most mainland Chinese companies list their shares – swayed between rising 17 per cent and falling 14.6 per cent.

“The secondary market had been in decline since the second quarter, getting worse by the third and fourth quarters,” said Edmond Hui Yik-bun, chief executive of Bright Smart Securities in Hong Kong. “The US-China trade war weighed on sentiments, so much so that no one dared to invest in the markets.”

For now, Hong Kong’s brokers are looking north to the Greater Bay Area, comprising a combined population of 66 million people in 11 mainland Chinese cities, for growth. Spearheaded by the Chinese government, the zone foresees a greater metropolis where jobs, business opportunities, customs and immigration could be further integrated so that Hong Kong-based businesses can serve a market that is 10 times larger than the city’s own population, with a combined economy of US$1.5 trillion.

Bright Smart Securities increased its headcount by 20 per cent this year to cater to 270,000 customers in Hong Kong.

“It would be highly unlikely to repeat the spectacular market in 2019,” said Hui. “IPO issuers will only become even more cautious in the coming year.”

With additional reporting by Jane Zhang in Hong Kong

Illustration: Dennis Yip