Top venture capitalists and bankers land key role in deciding China’s tech board IPOs

- Candidates for the consultative panel include Neil Shen Nanpeng, founder and managing partner of Sequoia Capital China

- Hillhouse Capital CEO Zhang Lei and China Renaissance CEO Bao Fan also are on the list

Some of China’s best-known venture capitalists and bankers could play a key advisory role in picking companies on the upcoming Nasdaq-style technology board in Shanghai.

The Shanghai Stock Exchange published on Wednesday night two separate lists with names of candidates for the “listing and consultative committees” for the tech board.

The two committees consist of 48 candidates each.

Neil Shen Nanpeng, the founder and managing partner of Sequoia Capital China; Zhang Lei, CEO of Hillhouse Capital, and Bao Fan, CEO of China Renaissance, are among the candidates for the consultative committee.

Shen, who backed Alibaba Group, Meituan Dianping and ByteDance, is one of China’s most influential start-up investors.

Hillhouse Capital, founded by Zhang in 2005, is known for its early investments in Tencent Holdings, Baidu, Didi Chuxing and Meituan Dianping.

China Renaissance, an investment bank set up by Bao in 2004, has made its name by advising on and investing in a number of high-profile tech start-up deals, including the mergers between Meituan and Dazhong Dianping, and between Didi and Kuaidi, as well as the acquisition of Mobike by Meituan Dianping.

Other candidates for the consultative committee are executives from biotech companies and big state-owned enterprises such as Shanghai-listed pharmaceutical companies Wuxi AppTec and Hengrui Medicine, state-owned car giant SAIC Motor, China Electronics Corporation and China Aerospace Science and Technology Corporation.

Yin Zhiyao, CEO of Chinese chip equipment maker Amec, is also on the same committee list.

Amec is planning an IPO on the tech board and has hired Haitong Securities and Changjiang Securities as deal sponsors.

The listing committee, mainly comprising members from accounting firms and securities regulators, will mainly act as the administrative decision maker on the IPO applications.

The consultative committee, consisting of industry professionals and academics, will mainly act as the key advisory body for the tech board.

The two lists are open to public consultation until March 27.

If there are no objections, the list of candidates on the consultative committee will considered as final, while that of the listing committee will be narrowed down to between 30 to 40 people, the exchange said.

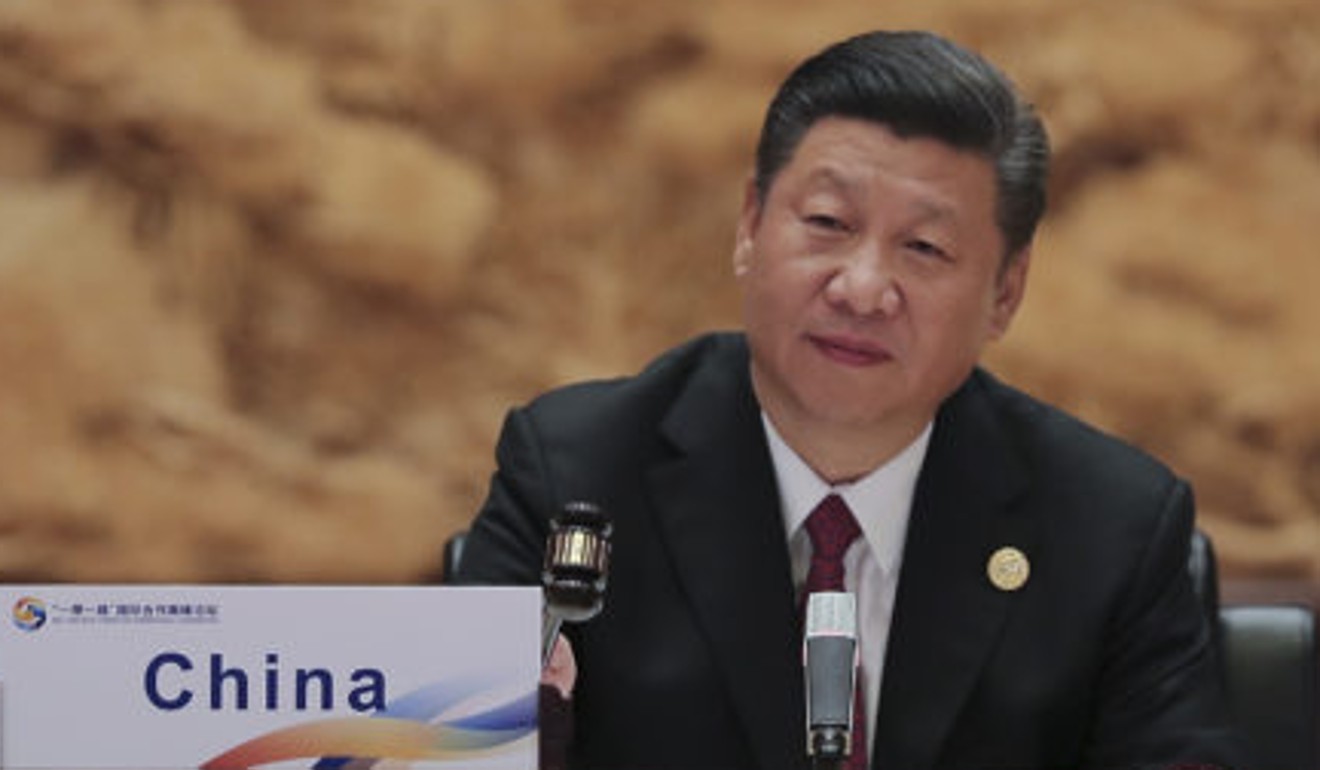

The tech board was first announced by Chinese President Xi Jinping in November and will pilot a registration-based system for initial public offerings, which has less stringent listing rules.

This is a key initiative by China to provide domestic funding support to its hi-tech, innovative start-ups, allowing them to compete on a global level in key areas like microchips, automation and self-driving cars.

The CSRC unveiled regulations for the tech board on March 1, which will focus on sectors with “strategic significance” to China, such as hi-tech equipment manufacturing, biotechnology, big data, new materials, and some sensitive technologies like network information technology.

The board will also allow pre-profit firms and companies with weighted voting rights to list.