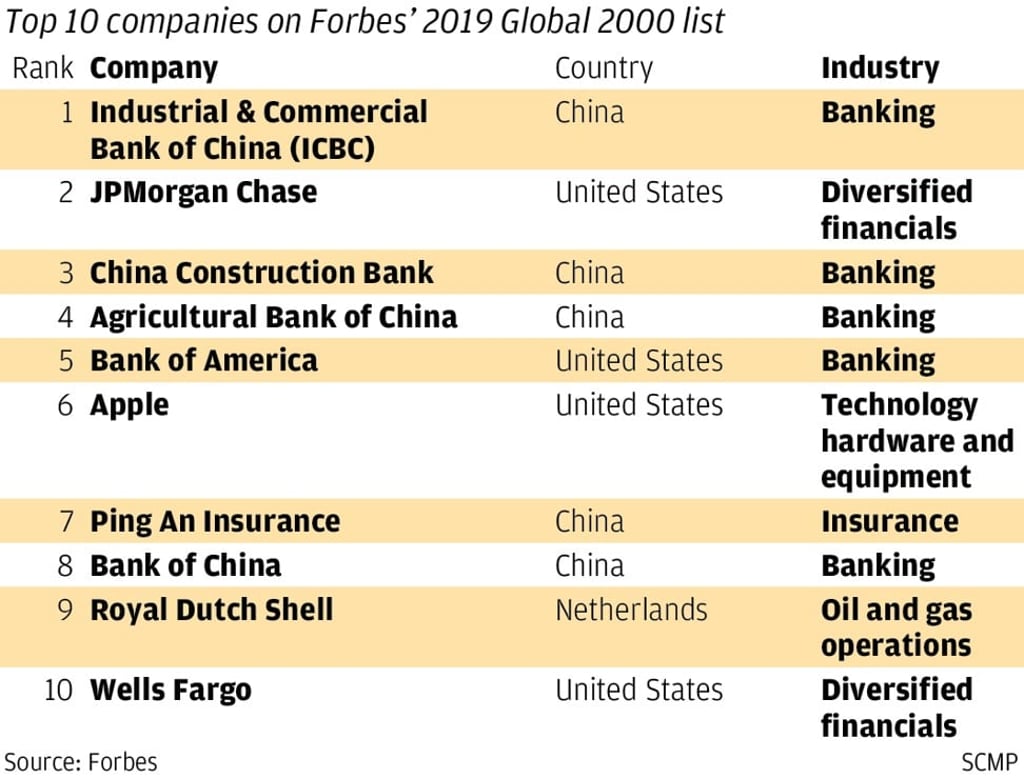

Industrial and Commercial Bank of China tops Forbes’ Global 2000 list for seventh year, while ‘Made in China 2025’ sectors languish

- China’s ‘Big Four’ banks as well as Ping An Insurance in top 10

- US continues to dominate ‘Made in China 2025’ sectors

China’s biggest banks have shrugged aside the gloom of its escalating trade war with the United States to dominate an annual list of the world’s biggest listed companies compiled by Forbes.

Industrial and Commercial Bank of China (ICBC), one of the country’s “Big Four” banks and the world’s largest lender by assets, has been ranked top for the seventh consecutive year by the Global 2000 list, itself in its 17th edition. The Big Four as well as Ping An Insurance are all in the top 10.

US bank JPMorgan Chase, which has benefited from tax cuts initiated by the Trump Administration, according to Forbes, is in the no. 2 spot. The list ranks companies by sales, profit, assets and market value.

ICBC has more than US$4 trillion in assets and employs nearly half a million people. It listed simultaneously in Hong Kong and Shanghai in 2006, in what was at the time the world’s largest initial public offering.

Its business as grown with the Chinese economy, bypassing other banks, said Gordon Tsui Luen-on, the managing director of investment company Hantec Pacific. “ICBC is also very aggressive with introducing new technology. Its Hong Kong arm, ICBC (Asia), along with Tencent Holdings has secured a virtual banking licence”, which will help it continue to develop, he said.