China’s technology board may unleash speculative frenzy as it starts trading in two weeks

- Stocks are likely to soar much higher on debut than the industry average and the benchmark equity gauge

- The technology and innovation board opens on July 22 in Shanghai

China’s Nasdaq-styled board for home-grown technology companies risks turning into a hotbed for speculators when it kicks off trading in two weeks.

While the companies seeking to list on the board have priced their initial public offerings much higher than the industry average, the speculative mood could still send the stocks surging on debut, investors including Hengsheng Asset Management and Xunfunds Investment Management said. It underscores a key risk facing Chinese policymakers, who are relying on the capital market to shore up the hi-tech industry amid an intensifying trade war with the US.

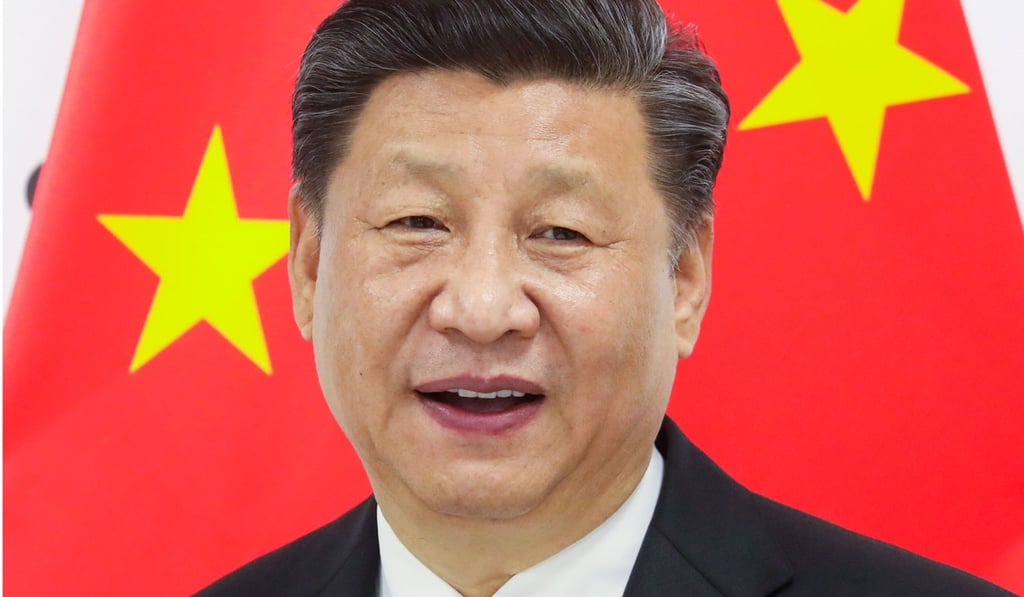

Twenty-five companies will start trading on the Science and Technology Innovation Board, also known as the Star market on July 22, the Shanghai Stock Exchange said on its website on Friday night – eight months after President Xi Jinping announced his vision for the board.

Five firms have unveiled offer prices ranging between 39.8 times and 79 times earnings. That compares with multiples of 11.4 times for the Shanghai Composite Index and 24.8 times for Shenzhen’s ChiNext board, another venue for China’s hi-tech companies that has higher listing standards.

“There’s a high chance that you will see speculative trading on the first few days after the technology board starts,” said Dai Ming, a fund manager at Hengsheng Asset in Shanghai. “Although the IPO shares are already priced at high-flying levels, there are always speculators who are willing to buy on the secondary market, sending the stocks much higher before selling them.”

Dips below offer prices seem unlikely as regulators want to make sure that the tech board has a successful start, which is also serving as a test bed for the registration-based system for IPOs. China’s main boards have not seen IPOs breach offer prices on debut for years, as new stocks are required to be universally priced at 23 times earnings to ensure there are no flops.