China’s innovative companies should be zooming ahead. But unfavourable lending system holds them back, report says

- China’s lending system favours state-owned enterprises, leading companies to put less in R&D to cover short-term loans

- US companies are far more profitable than Chinese counterparts as a result

Chinese companies are not nearly as profitable as their US peers because many take on too much short-term debt in a lending system that favours state-owned enterprises, leaving them with less money to invest in research and development, according to a research report.

These Chinese companies have to keep excessive cash or short-term investments to pay for bank or other loans that must be repaid in as little as a year, the report by China Galaxy Securities points out.

That makes it harder for them to generate profits to excite investors, helping explain why the Shanghai Composite Index remains almost unchanged from the level it was at a decade ago, while the Dow Jones Industrial Average returned 163 per cent in the same period, marking the country’s longest bull run.

It also means that companies that should be huge engines of growth in China, where the economy is slowing, are being held back.

“In China, only the financial companies and property developers are more profitable than the American firms, which is very unhealthy,” said China Galaxy Securities’ chief economist Liu Feng, who co-authored the report.

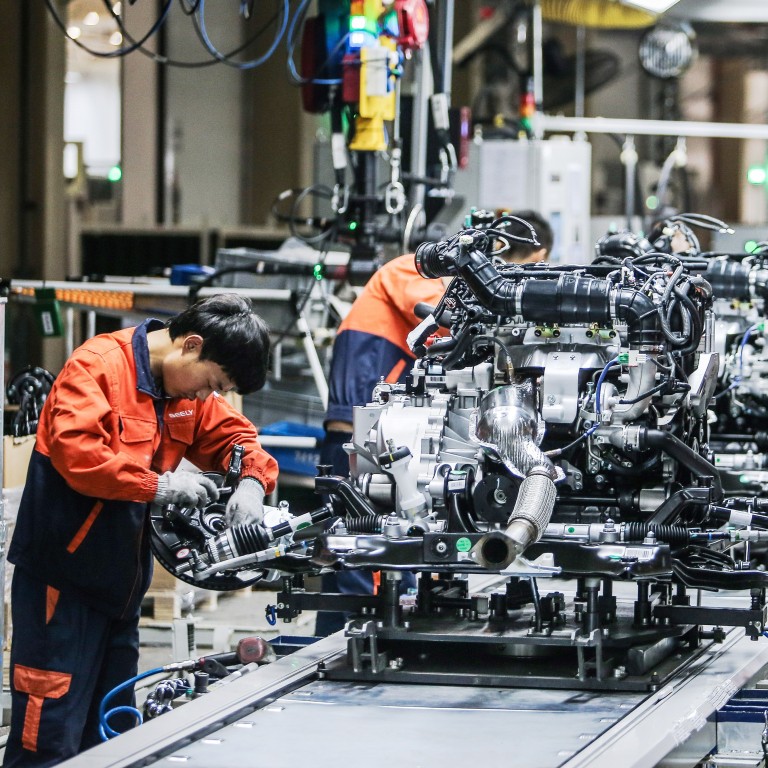

“This means the market is not supporting those new industries with great development potential, such as advanced manufacturing,” he added.

The report looks at a key measurement – the return-on-equity (ROE) ratio – that shows how well a company uses investments to generate profits.

The ratio for China-listed companies deteriorated to 4.4 per cent on average by the middle of this year from 4.7 per cent in 2018, Liu and strategist Fu Yanping wrote in the report dated October 29.

That is lower than the 7.1 per cent return-on-equity ratio among American’s public companies.

In sectors such as industrials, consumer discretionary – goods and services deemed non-essential – and information technology, Chinese companies’ average ROE ratio was not even half of that among their US peers, according to the report.

Investors have long criticised China’s stock market for failing to generate value for the public.

In 2018, China’s listed companies turned in the worst annual results on record, with 452 out of 3,602 public companies incurring annual losses.

The so-called quick ratio – a yardstick measuring a company’s ability to meet its short-term obligations with its most liquid assets – is less than 80 per cent for non-financial Chinese companies, compared with the much better 98 per cent figure for American firms, the report shows.

The root of the problem is that China’s capital markets have failed to provide enough direct funding support to small, private and innovative companies, Liu said. That includes when companies first sell their stocks and bonds through initial public offerings as well as in the secondary markets.

Capital market financing – critical to innovative, smaller companies – accounts for less than 20 per cent of China’s total social financing, which is the broadest measure of overall credit and liquidity to the real economy. In the US, it is more than 50 per cent, he added.

“China’s economic breakthrough over the past 40 years depended on the banking system, but banks always prefer companies with credit and state-owned companies,” Liu said.