Wuhan’s viral outbreak knocks the stock markets of China and Hong Kong off their paces, just as a rally is building momentum

- Hong Kong’s benchmark Hang Seng Index plunged by as much as 2.8 per cent on Tuesday, its biggest intraday decline since November 11

- In Shanghai, the A Share Index retraced 1.4 per cent, while a similar benchmark in Shenzhen dropped by as much as 1.3 per cent

The stock rally in mainland China and Hong Kong has lost its pace, after a pneumonia outbreak in the Hubei provincial capital of Wuhan claimed a fourth life.

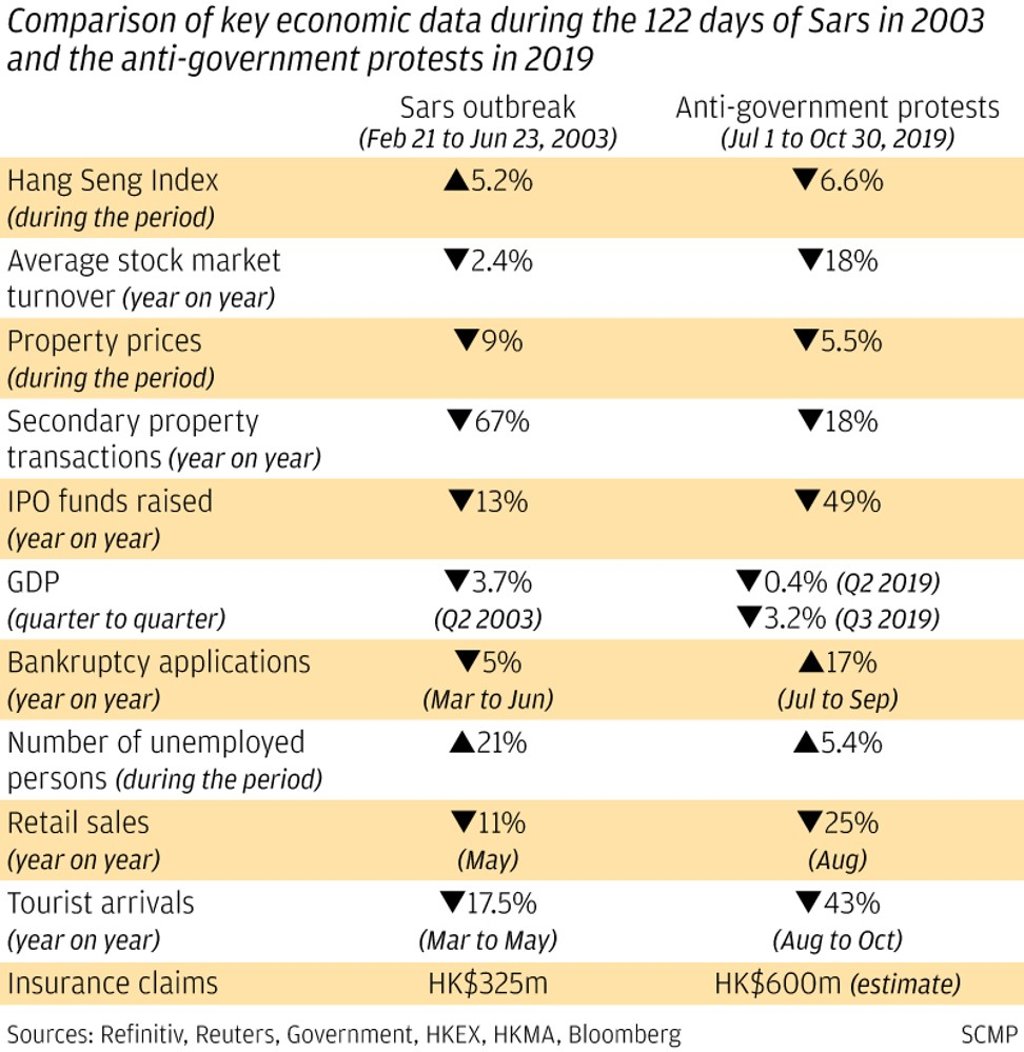

Stock traders began unwinding their positions on Monday, after a weekend report by the Chinese government of confirmed cases spiked to more than 100, from just a handful days earlier. The disease, attributed to a new coronavirus from the same family that caused the 2003 Sars pandemic, has spread to Shanghai, Shenzhen and Beijing, according to Chinese media.

Hong Kong’s benchmark stock index plunged by as much as 2.8 per cent on Tuesday, its biggest intraday decline since November 11. In Shanghai, the A Share Index retraced 1.4 per cent, while a similar benchmark in Shenzhen dropped by as much as 1.3 per cent.

Airlines, tour agencies, hotels, theme parks and restaurants led declines, amid concerns that another outbreak similar to the one 17 years earlier would deter people from congregating in public places, hurting their earnings.

“That’s a knee-jerk reaction that most affects investors psychologically,” said Wu Kan, an investment manager at Soochow Securities in Shanghai. “The epidemic will cause volatility on the market in the short term depending on how it plays out.”