China’s central bank declares Baoshang Bank bankrupt as it picks apart Xiao Jianhua’s financial empire

- Insolvent Baoshang Bank was unable to find new investors for recapitalisation before the government stepped in to set up a new lender to take over its assets, the central bank says

- Baoshang Bank will proceed to the bankruptcy procedure and the stakes held by Xiao’s Tomorrow Group will be liquidated, PBOC says

Baoshang Bank, the centrepiece of Chinese oligarch Xiao Jianhua’s Tomorrow Group, will be forced into bankruptcy as regulators step up the pace of cleaning up a sprawling financial empire with 3 trillion yuan (US$431 billion) in financial assets, according to the People’s Bank of China.

The bank extended as much as 156 billion yuan in loans to Tomorrow Group’s affiliates between 2005 and 2019, money that was never repaid. The group exploited the bank’s lax management and flawed governance and ran it into the ground, according to a publication by the Chinese central bank.

Financial regulators created a bank called Mengshang to take over all the assets from Baoshang Bank. Businesses at four of Baoshang’s branches outside Inner Mongolia were handed over to Huishang Bank. The central bank injected 23.5 billion yuan of capital into Baoshang Bank through a lending facility to ensure liquidity for its depositors.

To avoid a bank run, the regulators used the deposit insurance fund and money provided by the central bank to protect the interest of most creditors of Baoshang Bank, according to the quarterly monetary policy report by the People’s Bank of China. On the day of the government’s takeover, the lender had 4.7 million individual customers and over 60,000 corporate clients.

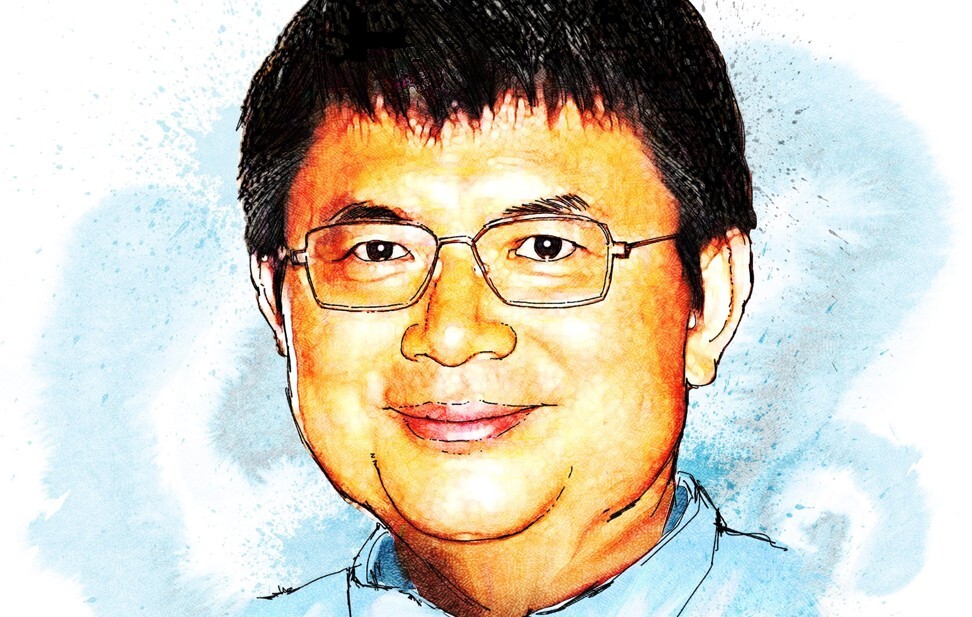

Xiao himself has not been seen in public since the eve of the Lunar New Year holiday, when he was persuaded to leave his hideout at the Four Seasons Residence in Hong Kong to return to mainland China for investigations. He is believed to be awaiting trial to face a litany of charges including bribery and manipulating stock prices.

Still, the initial plan of selling Baoshang Bank to strategic investors fell apart, as potential buyers were wary of the lender’s huge losses, the central bank said.

The next step of its clean-up involves forcing Baoshang Bank into bankruptcy, and the stake held by the shareholders before the government’s seizure will be liquidated, the People’s Bank of China said. The government is also pursuing the legal responsibility of related people, without elaborating.