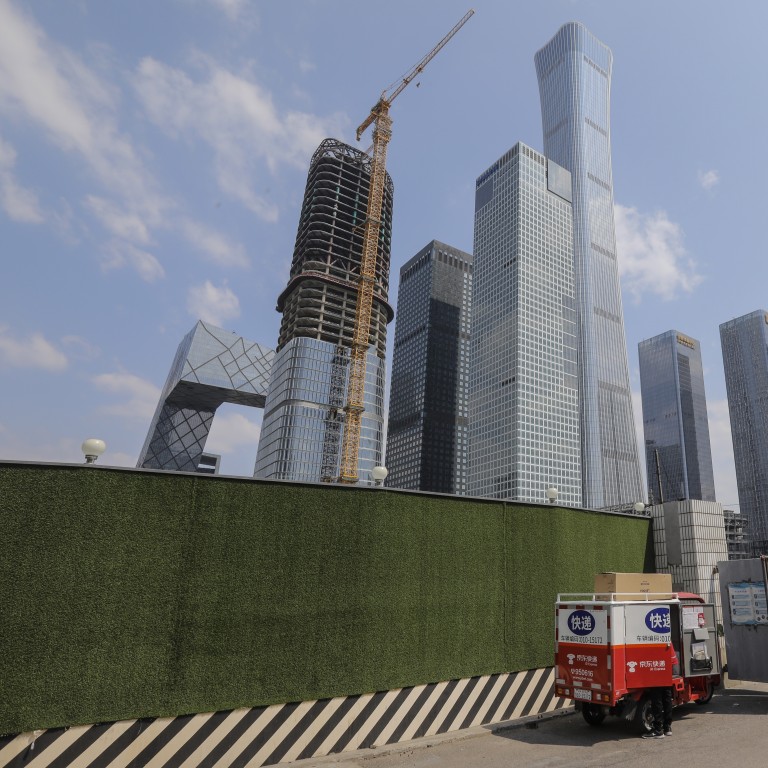

Chinese developers face potential price war in second half amid glut as state issues ‘red lines’ in deleveraging campaign

- China had 480 million square metres of completed but unsold homes at the end of July, the highest in eight months

- Framework caps debt-to-asset ratio at 70 per cent, net debt-to-equity at 100 per cent, and short-term borrowings at no more than cash reserves

Completed but unsold homes amounted to 480 million square metres (5.16 billion square feet) across 100 mainland cities at the end of July, according to data compiled by E-house China Research and Development Institute. That’s a 7 per cent increase from a year earlier, and the highest level of inventory since November 2019.

China’s economy shrank 6.8 per cent that quarter, its worst in decades, before rebounding 3.2 per cent in the second quarter. As a result, several top developers have either reported lower contracted sales in the first half, or sustained them at lower margins, to generate cash flows.

03:14

China's ‘terraced’ buildings maintain reputation for unorthodox architecture

Despite the hardship, Chinese regulators have continued to push on with their campaign to keep corporate debt levels in check to pre-empt any financial shock. The result is a so-called “red lines” on leverage guidelines for developers, the state-owned Economic Information Daily reported on Friday.

Twelve developers, including heavyweights China Evergrande, Country Garden, China Vanke and Sunac China, were asked to submit a report on their deleveraging solutions by the end of September, the daily said, citing a framework issued by the central bank and the housing ministry during a symposium in Beijing on August 20.

The framework caps debt-to-asset ratio for developers at 70 per cent, net debt-to-equity at 100 per cent, and short-term borrowings at no more than cash reserves. Failing to meet those “red lines” may result in them being cut off from access to new loans from banks, it said.

The next few months may see the overall external financing environment for real estate developers tighten, in contrast to the relatively loose conditions seen in the first half of 2020, according to Liu Xiaoliang and Wang jin, analysts at rating agency S&P Global Ratings.

“Policy on real estate financing may expand to cover banking and non-banking loans, equity financing and domestic and overseas bond financing,” they wrote in a report last month. “This may squeeze developers that previously moved between different financing channels.”

The framework will be a big challenge for some developers, which this year have found it hard going in selling their homes amid a slowdown in the economy and weaker purchasing power from job losses or pay cuts.

Country Garden, the second biggest developer by sales, reported a 5 per cent decline in contracted sales in the first half this year. China Vanke, the third-largest, saw a 4 per cent drop, while fourth-ranked Sunac China recorded a 9 per cent fall.

“Most home sellers have seen their first-half sales slackened due to a nearly-two month halt by the Covid-19 outbreak,” said Yan of E-House. “It has signalled an increasing pressure of new home supplies.”