Evergrande slashes property prices by 30 per cent across China for one month, sounding clarion call on discount war

- Evergrande will offer 30 per cent across-the-board discounts for every property project sold in China starting on September 7

- The developer aims to sell 200 billion yuan (US$29 billion) of property during the month-long marketing campaign

The Shenzhen-based developer, founded and headed by China's third-richest businessman Hui Ka-yan, kicked off its month-long sales campaign on September 7. It aims to sell 200 billion yuan (US$29 billion) of property during the period, according to an Evergrande official who declined to be identified.

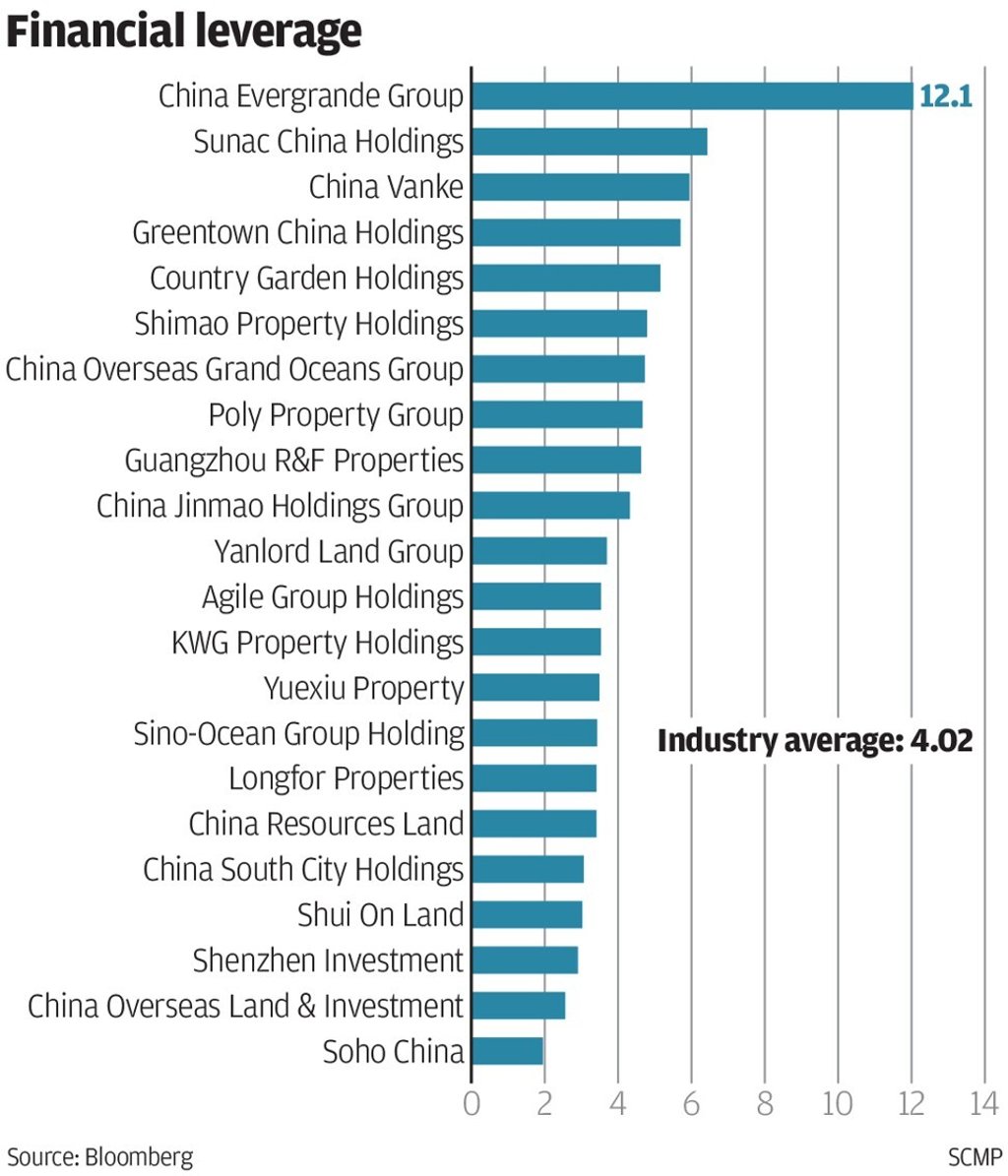

Across-the-board discounts are unusual for an industry that studiously avoids cutting prices for fear of upsetting owners in a nation faced with a dearth of investible options, where fixed assets are considered the safest sanctuary for retaining value. China’s developers, among the highest-leveraged borrowers in business, are under tremendous pressure to raise cash to repay the 360 billion yuan in aggregate bond payments due this year, according to data by Beike.

“Evergrande’s nationwide campaign signals the price war in China’s housing market this year has started,” said Yan Yuejin, director of Shanghai-based E-house China Research and Development Institute. “Developers are facing huge downward pressure, including piling up unsold homes due to the Covid-19 outbreak, local government’s various home sales tightening measures and most importantly central government’s recent call for deleveraging. They have an urgent need to sell homes and a price cut is clearly an effective way.”

Founded in 1996 by Hui, also known as Xu Jiayin on the mainland, Evergrande has 13 bonds totalling US$19 billion between 2021 and 2025, including various euro-dollar bonds, and a euro-non dollar instrument, according to Bloomberg’s data. The developer also has an HK$8 billion term loan due on November 30 this year.

Its sales goal for the month-long campaign overlaps with China’s National Day holiday on October 1, a typical peak season for retail sales and consumption. Evergrande, which sold 450.62 billion yuan of property in the first eight months, is behind schedule to meet its internal sales target of 800 billion yuan this year, as China’s consumption and retail sales has been hobbled by a coronavirus pandemic and dimmer outlook for jobs and exports amid a bruising US-China trade war.