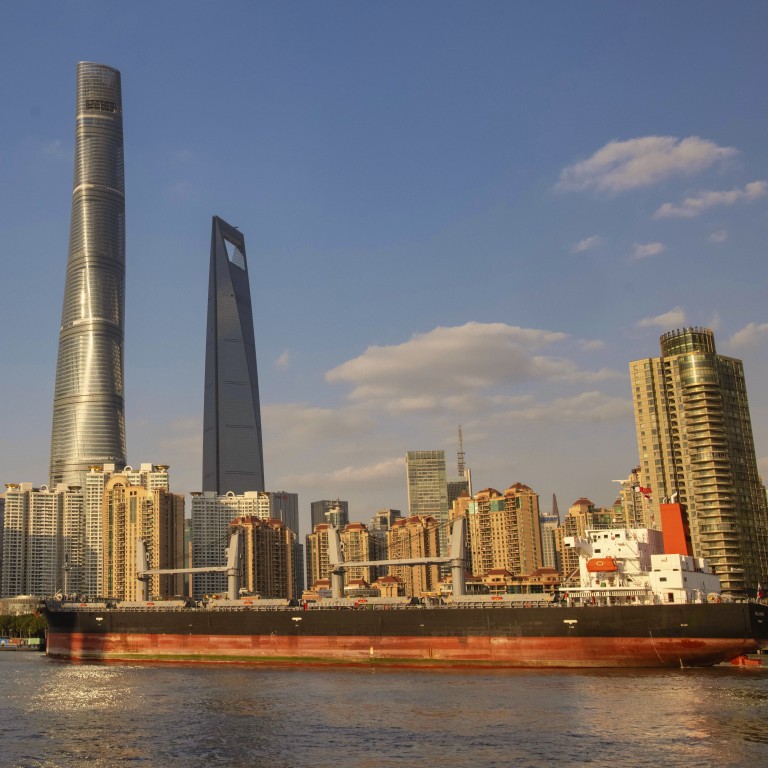

China’s largest private companies soar in value despite pandemic, worth half of second-largest economy’s GDP last year: Hurun report

- Internet, pharmaceutical and electric vehicle companies drive growth as pandemic recedes

- Tencent unseats Alibaba to become the most valuable company

China’s largest private companies mushroomed in value over the past year despite the Covid-19 pandemic, driven by fast growth in the internet, health care and electric vehicles sectors, according to a Hurun Research Institute report released on Wednesday.

The values on average of the country’s top 500 private companies surged by 55 per cent to a record 110 billion yuan (US$16.7 billion) from a year ago. They were worth a combined 56 trillion yuan, or about half of China’s gross domestic product last year, according to the report, which is based on data up to October this year.

“The main reasons for the rapid increase were the rise of the new economy, especially after the pandemic, a sharp rise in the stock markets and a flurry of new listings,” said Rupert Hoogewerf, chairman and chief researcher at Hurun.

Investors have piled into technology and pharmaceutical stocks globally, in search of growth and certainty, since the outbreak of the coronavirus. Central banks flooding the market with unprecedented liquidity has also helped push share prices higher.

The Nasdaq Composite has advanced 34 per cent since the beginning of this year, and the Shanghai Composite Index has gained 10 per cent. The Hang Seng Tech Index, which tracks the 30 largest technology companies listed in Hong Kong, added 15 per cent.

01:47

China GDP: economy grew by 4.9 per cent in third quarter of 2020

Telecommunications giant Huawei Technologies suffered a drop in ranking, falling to seventh from fourth last year, after it sold smartphone brand Honor to a state-led consortium to sidestep US sanctions that prevented it from buying key components.

Pharmaceutical companies led by Jiangsu Hengrui Medicine (US$74 billion) took up 93 of the 500 top spots, the most among all industries. Electric vehicle makers also sped up the ranks – BYD (US$67 billion) leapt 41 places to rank 17th in value, while New York-listed Nio (US$62 billion) made the list for the first time and ranked 19th.

Altogether, the 500 private companies employed 9.7 million workers, according to the report.