Advertisement

Chinese VIE companies: what lawyers and analysts say about ‘existential risk’ to global stock investors

- China exercises great caution when opining on the validity of the VIE structure, given the scale and importance of such entities, law firm says

- Beijing is likely to keep allowing the use of the VIE structure in general, while potentially restricting its use in certain limited sectors, brokerage says

Reading Time:2 minutes

Why you can trust SCMP

1

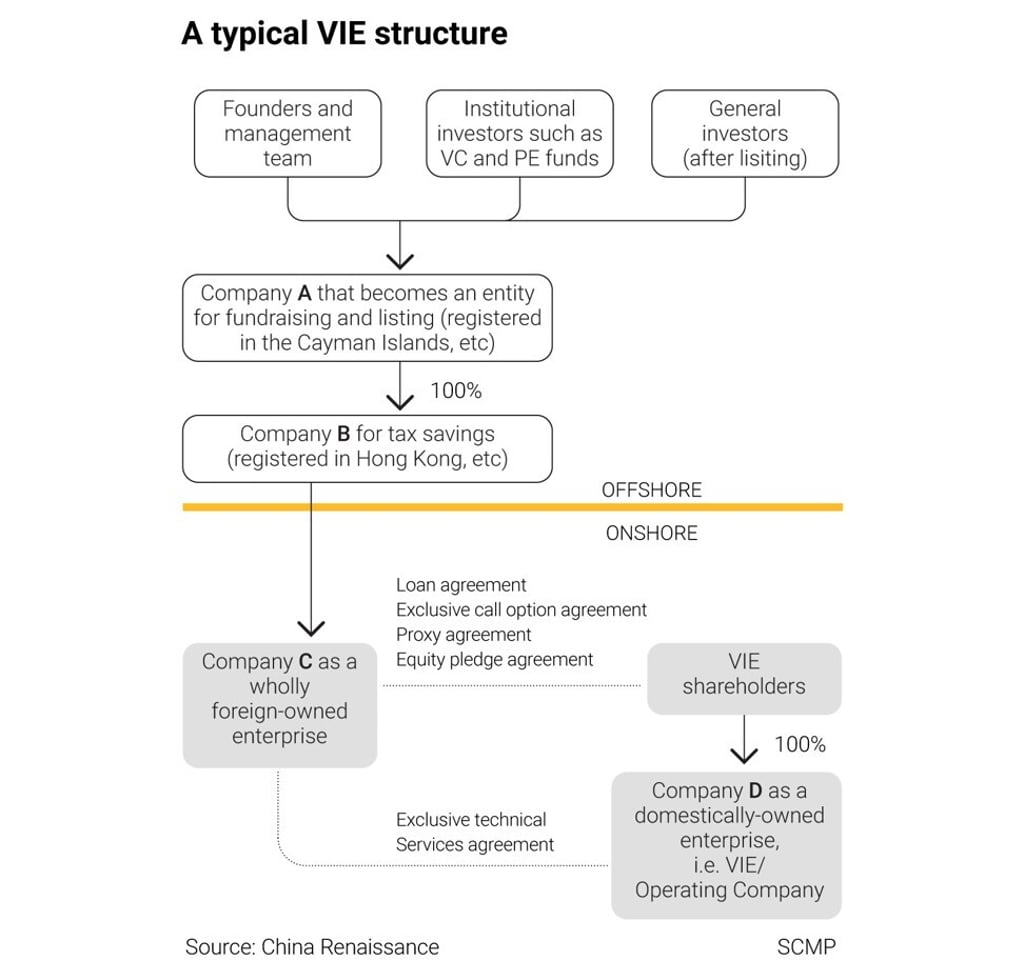

China is looking to provide more regulatory clarity for the operation of overseas-listed Chinese companies with a variable interest entity (VIE) structure even as its legality has yet to be tested, according to analysts and lawyers.

The State Administration of Market Regulation, the antitrust regulator, last week fined units of Alibaba Group Holding, Tencent Holdings and others for failing to seek approval for past acquisitions involving offshore VIE units. It also said VIE companies are not exempted from antitrust rules targeting online-platform operators.

It was a rare articulation on the legally ambiguous VIE structure, a special arrangement first invented by Chinese internet firms in the early 2000s to circumvent China’s foreign investment restrictions and to raise capital in offshore markets.

Advertisement

To optimists, the statement signalled Beijing’s tacit approval for the arrangement. After all, smart-scooter maker Ninebot became the first VIE-type company to win approval to list the first Chinese depositary receipts in Shanghai.

Advertisement

Yet, some legal experts have cautioned about its ambiguous legal standing. The latest Foreign Investment Law, which came into effect on January 1, skipped any mention of it altogether, keeping the “existential threat” alive and evolving to investors.

Advertisement

Select Voice

Select Speed

1.00x