Property magnate’s 26-year-old daughter buys Sing Tao, sends Hong Kong paper’s shares soaring by 54 per cent to five-month high

- 28 per cent stake acquired at premium of 65 per cent over stock’s last trading price

- Deal conducted in cash off the market while chairman Charles Ho will sell out all stakes after holding the newspaper company for 20 years

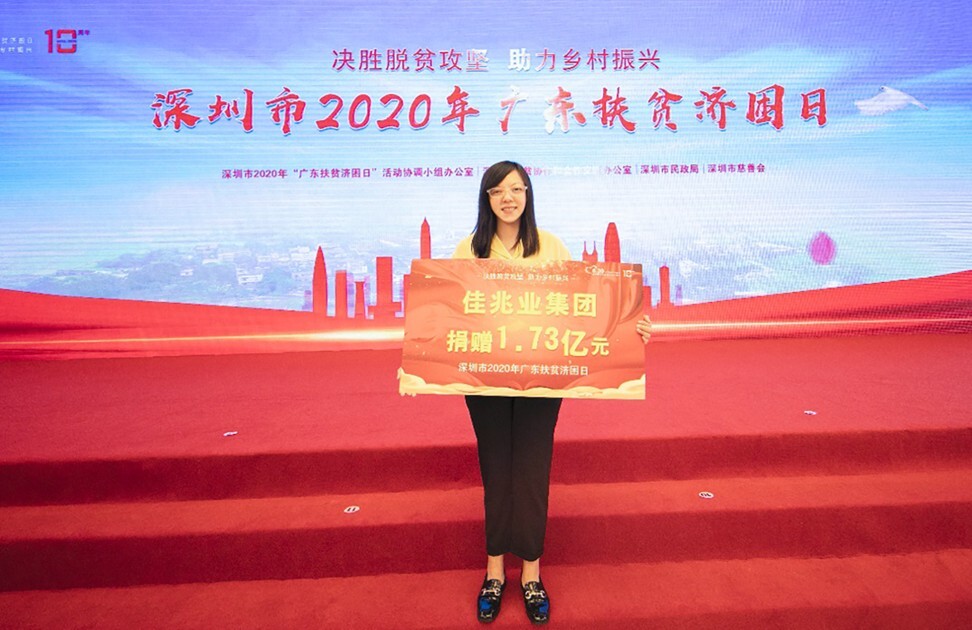

Kwok Hiu-ting, the 26-year-old daughter of Kaisa Groups founder, has bought control of the publisher of Hong Kong’s oldest Chinese-language newspaper, as the real estate developer makes its push into the city’s media business.

Kwok, who agreed to pay HK$369.8 million (US$47.7 million) last week to buy 28 per cent of Sing Tao News Corporation from the company’s chairman Charles Ho Tsu-kwok, said she wants the newspaper to invest more in mobile media, according to a statement.

“The acquisition of the stake in Sing Tao is my personal investment,” Kwok said. “I invest in the group mainly because of Sing Tao’s diversified media platform, strong brand, influence [in the community] and due to its high-quality news coverage.”

Sing Tao’s shares soared by as much as 54 per cent on the Hong Kong exchange when trading resumed after a three-day suspension for the acquisition announcement, in their biggest intraday percentage jump. Sing Tao shares rose to as much as HK$1.40, the highest intraday level since August 26, close to Kwok’s acquisition price for her stake.

Sing Tao would make better use of technology in future after being acquired by Kwok, invest more in mobile media to further diversify its business and keep the global Chinese-reading community promptly informed with the most comprehensive and in-depth news coverage, she said.

The deal will need the approval of the Committee on Foreign Investment in the United States (CFIUS) as the publisher operates businesses in the country. If no approval is obtained, Sing Tao will dispose of its US business and assets at a price without incurring any loss, according to the company’s statement.

Kwok’s acquisition also needs the approval by Hong Kong’s Securities and Futures Commission while Sing Tao maintains its listing status on the city’s stock exchange.

Kwok paid HK$1.5 per share for 246.55 million shares of Sing Tao, representing a premium of 65 per cent over the stock’s last trading price of 91 Hong Kong cents last Thursday. The stake held by the former chairman Ho in the company would fall to 3.37 per cent from 31.37 per cent after the transaction.

Ho will dispose the remaining 3.37 per cent to an independent third party unrelated to Kwok to avoid triggering a 30 per cent threshold that requires Kwok to make a general offer for Sing Tao, according to Hong Kong’s takeover code.

Sing Tao has been publishing the eponymous Sing Tao Daily broadsheet since 1938, making it Hong Kong’s oldest hometown Chinese-language newspaper. It also has two freely distributed papers in its portfolio: the Chinese-language Headline Daily and the English The Standard.

“The new largest shareholder maybe able to inject new capital into Sing Tao, which is good news for the company,” said Tom Chan Pak-lam, the chairman of industry body Institute of Securities Dealers of Hong Kong. “Since they have no experience in the media business, it is uncertain how [Kwok] will run the company.”

The shareholders’ notice to the exchange did not provide details about Kwok, but two sources said she was the daughter of Kwok Ying-shing, Kaisa Group’s chairman.

She was appointed vice-chairwoman of Kaisa Prosperity Holdings, the property management services arm of Kaisa Group, in November 2020, according to a stock exchange filing. She has degrees from Durham University and Columbia University.

He wanted to appoint himself and five others to Convoy’s board in September, but that was blocked by its current directors, who are supported by the family of Richard Tsai Ming-hsing of Taiwan’s Fubon Financial Holding. Fubon owns a 29.98 per cent stake in Convoy.