Chinese biotech firm boosts funding, plans IPO next to catch European rivals in cancer therapy market

- EpimAb Biotherapeutics, a developer of bispecific antibody for cancer therapy, plans a public stock offering early next year

- The global market for bispecific antibodies is estimated at US$12 billion by 2026, according to a Kuick Research report

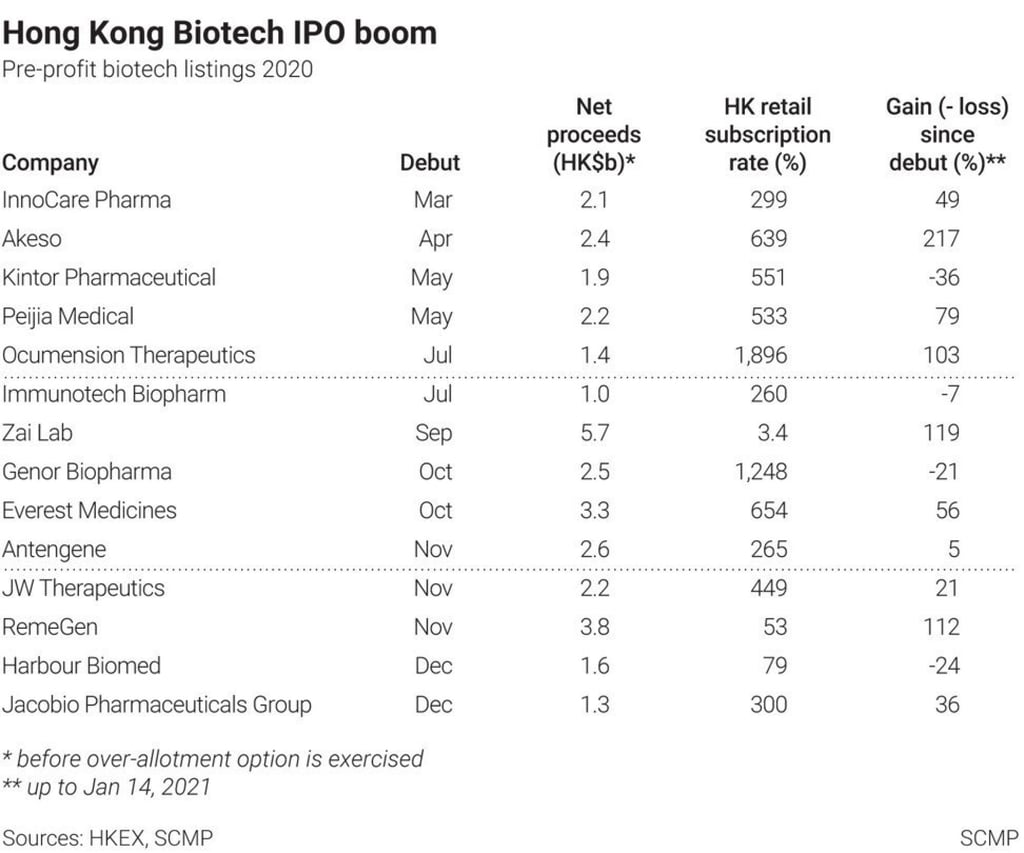

The fresh capital represents a precursor to the Shanghai-based firm’s public listing plan early next year to increase its financial firepower and compete with bigger rivals like Nasdaq-listed duo Merus and Affimed, as well as Hong Kong-listed mainland competitor RemeGen.

The six-year-old firm, backed by home investors and other venture capitalists, is likely to appoint investment banking advisers on its initial public offering (IPO) by midyear, said chief executive officer Wu Chengbin, who founded the firm in 2015.

“Our plan is to finish the pre-IPO by the end of this year and move to IPO early next year,” he added. In terms of listing venues, “we are actually keeping our options open in various markets. The US is one of the markets we are considering in addition to Hong Kong.”

EpimAb’s Series C financing round was co-led by China Merchants Bank International and Mirae Asset Financial Group of South Korea. Other backers included mainland private equity firm Hony Capital and Boston-based hedge fund Cormorant Asset Management. Adrian Cheng, who runs developer Hong Kong-listed New World Development, is also an investor.