Explainer | Surpassing Hong Kong and Singapore was easy. Shenzhen’s next economic miracle rests on Tencent, Huawei and its top companies

- Shenzhen’s success is underlined by the fact that its gross domestic product surpassed that of Hong Kong in 2018

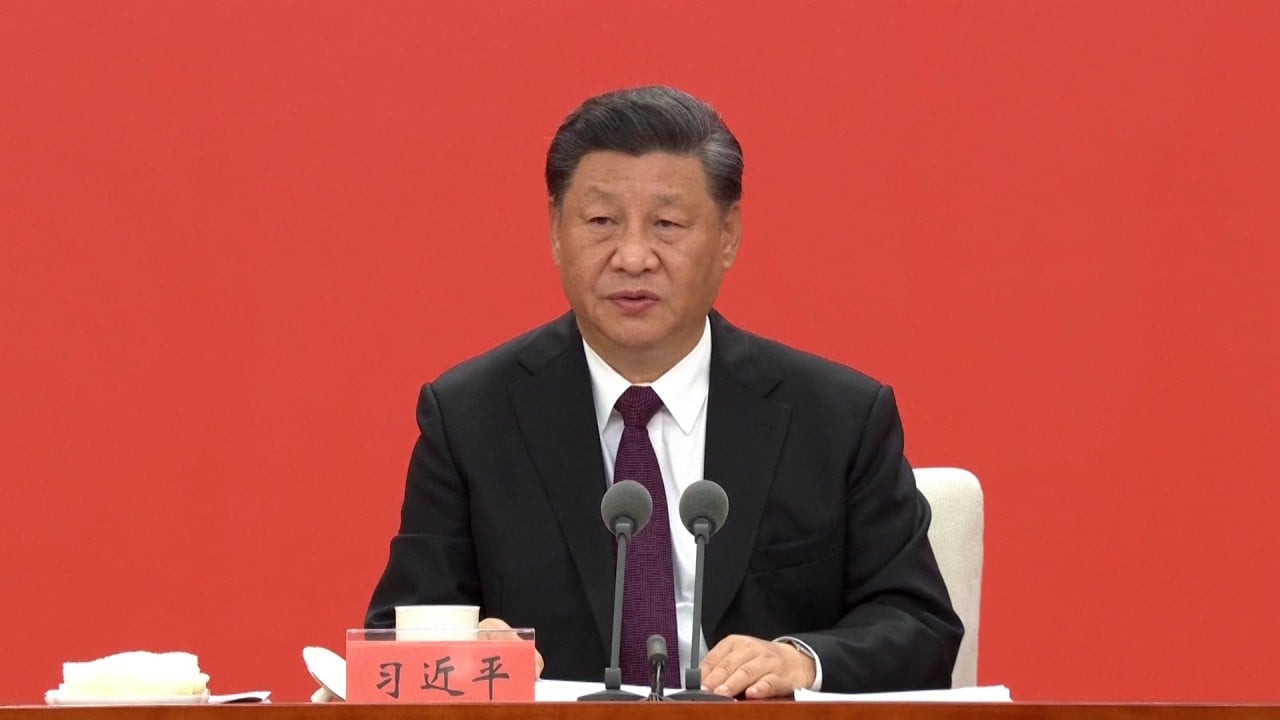

- Xi promised more autonomy for Shenzhen to create another economic miracle; climate change projects will be big over the next five years, analyst says

“The outlook for Shenzhen is still promising and it will continue to be a leading city in China,” said Liu Guohong, the director of Shenzhen-based China Development Institute’s Finance & Modern Industry Department. Part of its success is down to contributions by leading players in different sectors, Liu said.

“If you look at leading companies in major industries across the country, many of them are based in Shenzhen,” said Liu. “You can name China Vanke and Poly Group as leaders in the property sector. Tencent is a leader in information technology and Ping An leads the insurance industry. In manufacturing, the leaders are Huawei and BYD.”

Shenzhen had the third-highest concentration of members in China’s 500 most valuable private companies in 2020, according to Hurun Report. Three Shenzhen-based companies were in the top 10, while 59 firms made it top 100, based on valuations published in October last year.

While more than 60 per cent of Shenzhen’s companies are engaged in sectors such as IT, property and finance, projects concerning climate change and sustainable developments will also report big growth over the next five years, Liu added.

Tencent Holdings

The internet giant, with a market cap of about HK$6 trillion yuan as of Friday, overtook Alibaba Group Holding, which owns the South China Morning Post, as China’s most valuable private company in 2020, according to Hurun.

Tencent, which operates the WeChat messaging app and owns stakes in a number of gaming firms, including the developer of League of Legends, was ranked 197th in the Fortune Global 500 List as well. Tencent Music, its music streaming subsidiary, was listed on the New York Stock Exchange in December 2018.

Pony Ma Huateng, 49, Tencent’s owner, had a net worth of US$60.4 billion as of Wednesday, according to Forbes data. He surpassed Alibaba founder Jack Ma as China’s richest person in June last year, thanks to strong demand for mobile games during coronavirus lockdowns in the country.

Ping An Insurance

Ping An, whose name literally means “safe and well” in Chinese, provides insurance, banking and financial services. The company, which is China’s largest insurer, has a market cap of HK$1.65 trillion and is ranked 21st in the Fortune Global 500 List.

The pandemic kept its agents from meeting clients because due to the Social distancing measures, the insurer saw 598 million customers, an increase of 16 per cent, use its online platforms to buy insurance, wealth management and health care products last year.

Huawei Technologies

Founded by Ren Zhengfei in 1987, Huawei has emerged as the leading manufacturer of telecommunications equipment and smartphones globally.

Shenzhen Mindray

The Shenzhen-based company is China’s biggest provider of medical devices and solutions. Thanks to the coronavirus pandemic, during which it reported growing demand for patient monitoring systems and ventilators, its market cap had risen to 493 billion yuan as of Friday.

Patient monitoring and life support devices made up 50.5 per cent of the sales at the company in the first half of last year, up from 38.3 per cent in 2019. It reported an increase in sales overseas too, and China’s dominance in its sales declined from 58 per cent to about 50 per cent last year.

BYD

The carmaker has been backed by US billionaire Warren Buffett since 2008. It started out as a battery maker in 1995 and had cornered 12.9 per cent of China’s new electric vehicles market as of last year. As of Friday, it had a market cap of HK$548 billion.

Amid the pandemic last year, it reported a 162 per cent jump in net profit to 4.23 billion yuan. The carmaker has also been producing face masks and revealed in May last year that it was making 50 million masks a day.