Could Evergrande, which owed US$104.1 billion at the end of last year, collapse like HNA Group?

- Concerns mount after provincial government speaks to developer about diluting Evergrande’s controlling stake in regional bank

- Reports of banks rejecting IOUs issued by Evergrande to suppliers go viral on Chinese social media

“What worries us is the possibility that Evergrande has just reported the tip of the iceberg [as far as its mounting debt is concerned],” said Zhou Chuanyi, a credit analyst with Singapore-based Lucror Analytics. “At this moment, Evergrande will not be able to sell any new offshore bonds, and what’s worse is that if the biggest property firm crashes, investors might just lose confidence and interest in the entire sector,” she added.

Concerns about Evergrande have mounted of late after Chinese media outlet Caixin reported last week that the government of China’s northeastern Liaoning province had spoken to the developer about introducing state capital into a regional bank to dilute Evergrande’s controlling stake.

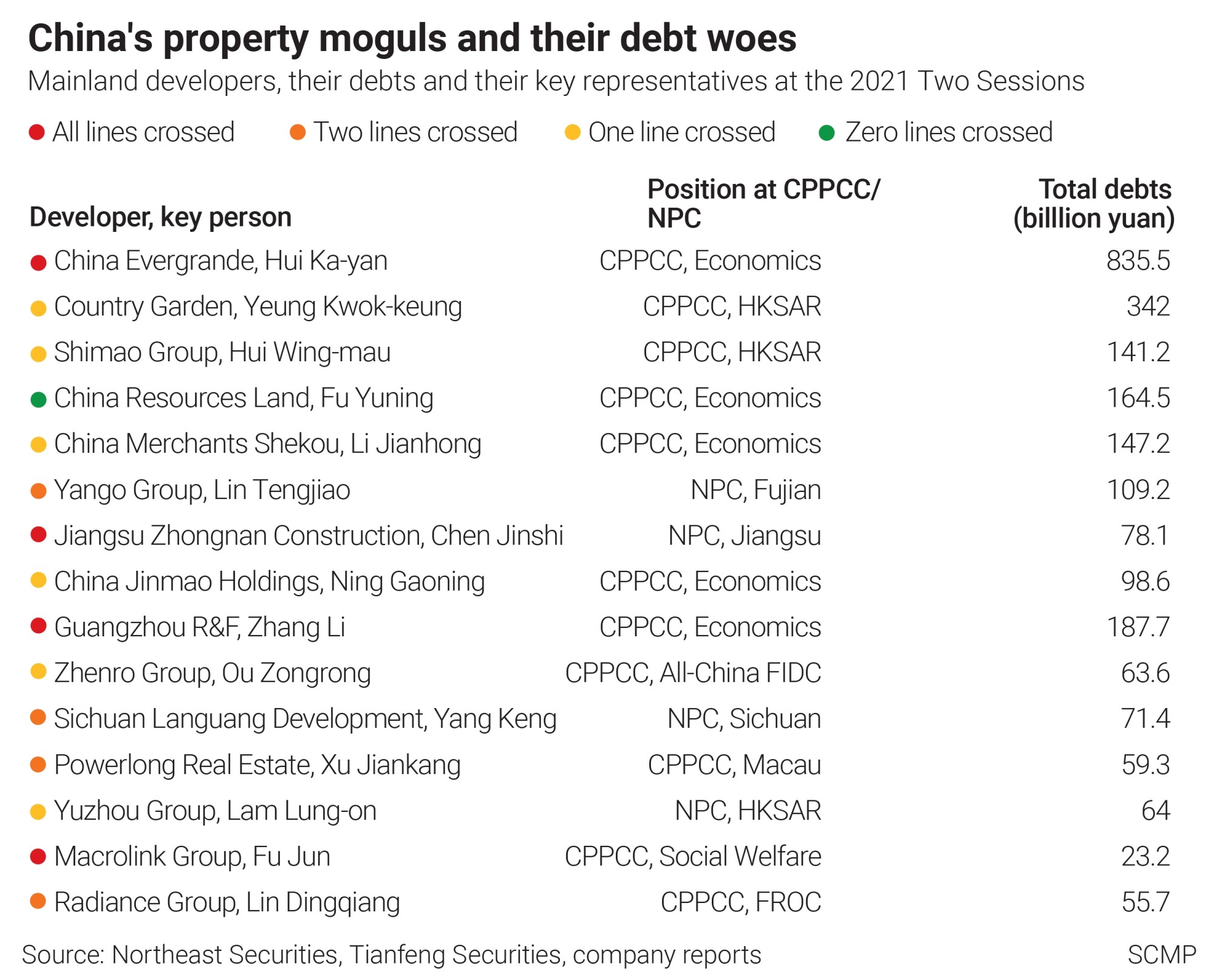

The three red lines, outlined last August, represent three different limits on borrowing – a liability-to-asset ratio excluding advanced receipts of 70 per cent, net debt-to-equity ratio of 100 per cent and cash to short-term debt ratio at one time. Evergrande is the only top-10 Chinese developer in breach of all three limits and is barred from adding any new debt.

“All our dealings with Shengjing Bank were in accordance with the law,” an Evergrande spokeswoman told the Post without giving any further details. “We have many ways to raise money … through our robust sales and spinning off our top-notch assets. We’ve sped up the preparation of listing the online home and car sales platform FCB Group, mineral water business Evergrande Spring and tourism unit Evergrande Fairyland,” she added.

The shares of Shenzhen-based Evergrande tumbled by about 10 per cent this week and have declined about 42 per cent from a peak this year. Meanwhile, a sell-off has sent its bonds crashing in recent weeks, with the yield on one bond due in January 2024 topping 23 per cent on Wednesday, according to Bondsupermarket, a bond information platform.

Investors might be overreacting, but confidence in Evergrande has been dwindling for a while now, Zhou said. The recent slump was not just the result of recent incidents, but was also down to the company’s weak financial position and soaring debt, she added.

Reports of banks rejecting commercial acceptance bills (CABs), or IOUs, issued by Evergrande to its suppliers since the beginning of June have gone viral on Chinese social media.

“We cannot get paid with Evergrande’s CABs and our company will die soon,” a user said in a social media post on June 2. An attached photo showed CABs worth 400,000 yuan, all expired in March.

The spokeswoman told the Post on Thursday that the above CABs had been settled.

However, another Evergrande contractor that the Post spoke to said that his dues were yet to be settled.

Lin, who only gave his family name, said that the company has not yet settled 1 million yuan of CABs while another 5 million yuan of CABs mature in July.

“I have to borrow money from banks to keep my company running now,” said Lin, who runs a small painting and heat insulation business in Nantong, southwestern Jiangsu province. “What I’m worried about is that the company is just not paying any more.”

He is currently working on six of Evergrande’s projects in the Yantze River Delta region, which account for half of his business.

“The payment delays have been happening for more than a year now,” he said. “Last year, the longest delay was 20 days, but now I’ve got some CABs that have not been cleared for two months.”

“I do not want to take Evergrande’s projects any more, but in the real estate sector it is just difficult to survive without work,” Lin said.

Evergrande admitted on June 7 that some of its CABs were overdue and that it would repay “a small amount of commercial paper that was overdue that it owed a few companies”.

CABs are not categorised as interest-bearing liabilities such as loans and bonds. “Defaulting on bonds and loans is far more sensitive. Failing to pay a few CABs affects a handful of small companies only, and while it’s a bad sign it doesn’t affect the financial system directly,” said Dinny McMahon, author of China’s Great Wall of Debt.

China Chengxin International Credit Rating put the company and nine of its onshore bonds on its credit watch list on June 7. It said the overdue CABs might possibly negatively impact further financing at Evergrande.

Major international rating agencies, however, have not made any adjustments so far. “We usually do not treat a developer’s CABs as debt. In the case of Evergrande, we still need to see if the reported delay has been negotiated between the company and the creditors, or not. It could be a way to save money to pay the banks and bondholders first. However, it would be negative to the company’s credit if there are signs that the company’s liquidity is under pressure,” said Kaven Tsang, senior vice-president at Moody’s Investors Service.

Hui Ka-yan, the high-profile real estate tycoon controlling Evergrande, said during an annual results briefing in March that the company would halve its debt over the next two years. Hui, who is also known as Xu Jiayin and is the company’s founder and chairman, said the company would pay down its debt to 350 billion yuan or less by June 2023, and has recently pledged to deleverage faster.

At an annual meeting in Shenzhen on June 3, Hui vowed to Evergrande’s suppliers and partners that the company would cut its debt to below 600 billion yuan by the end of the first half of this year. He also said the developer would meet at least one of the Chinese central government’s three red lines.

An employee of the company, who spoke to the Post on condition of anonymity, said Hui, a Chinese People’s Political Consultative Conference delegate, was very serious about toeing the official line. The three limits had put him in the hot seat, the employee added.

They said every department at Evergrande has only one task these days – bringing the company’s net gearing ratio below 100 per cent. The ratio was at 152.9 per cent at the end of 2020, according to Evergrande’s latest annual report. A deadline set for the end of this month by Hui for this task was approaching fast, they added. The company will announce it separately early next month, if it has met the target, rather than wait to disclose it in an interim report in August, the employee said.

“If the recent saga is just for massaging financial figures to look good, the situation won’t be that bad,” said Lucror’s Zhou. “The biggest worry is that the company is saving money for a hole that we cannot see.”

Some analysts, however, believe that Evergrande was in a better position when compared with China Huarong, for instance, as its assets were much more valuable.