Alibaba’s 40 price downgrades, US$1.2 trillion tech wipeout show no one knows the bottom as China’s regulatory tentacles snare all

- More than 15 brokerages have trimmed Alibaba’s ADR price targets since November, with the securities trading at 28 per cent below consensus

- No way to predict and quantify where the market bottom is, says Hong Hao of Bocom International

Analysts from at least 15 brokerages – from UBS Group and Goldman Sachs to Citigroup, Oppenheimer and CLSA – have slashed their price targets for Alibaba by at least 40 times since early November, when Chinese authorities abruptly foiled Ant Group’s blockbuster stock offering and slapped a record US$2.8 billion antitrust fine on the e-commerce giant.

Alibaba’s American depositary shares (ADSs) recently traded at about US$196 in New York, or 15 per cent below their 12-month target of US$230 from the least bullish of 53 analysts with a buy recommendation, according to data compiled by Bloomberg. It is also 28 per cent below the market consensus.

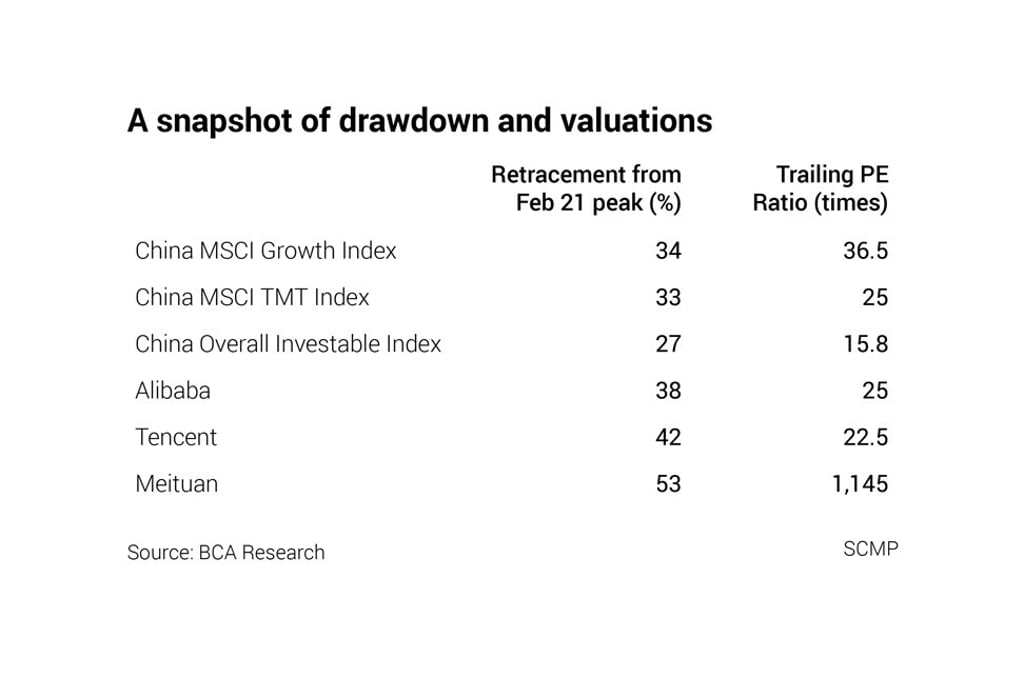

The picture is the same for Tencent, which together with Alibaba, the owner of this newspaper, and Meituan make up the triumvirate coveted by global money managers as recently as a year ago. These stocks are now probably labelled “buy at your own peril”, after investors lost a fortune with China’s regulatory tentacles reaching every nook and cranny of key industries, snaring giants and minnows alike.

“No way [to predict where the market bottom is],” said Hong Hao, managing director with Bocom International Holdings in Hong Kong. “There is no way to quantify. Policies are subjective.”