China’s offshore bonds watchdog promises easier funds transfer for developers to pay their debt after giving them a tongue lashing

- The NDRC said it would smooth the way to meet borrowers’ ‘reasonable needs’ in debt swaps, registering dollar bonds and remitting foreign currencies to pay their coupons and interests

- The NDRC also subjected the debtors to a tongue-lashing. Borrowers must ‘optimise their foreign debt structure,’ abide by ‘financial discipline and market regulations’ and ‘strictly use the funds raised in accordance with their stated purposes,’ the NDRC said

At the same time, the economic planning authority and watchdog agency of all foreign debt subjected the borrowers to a tongue-lashing. Borrowers must “optimise their foreign debt structure,” abide by “financial discipline and market regulations” and “strictly use the funds raised in accordance with their stated purposes,” the NDRC said.

Bloomberg’s Asia Ex-Japan USD Credit China High-yield Total Return Index lost 7.6 per cent so far this month as of Tuesday.

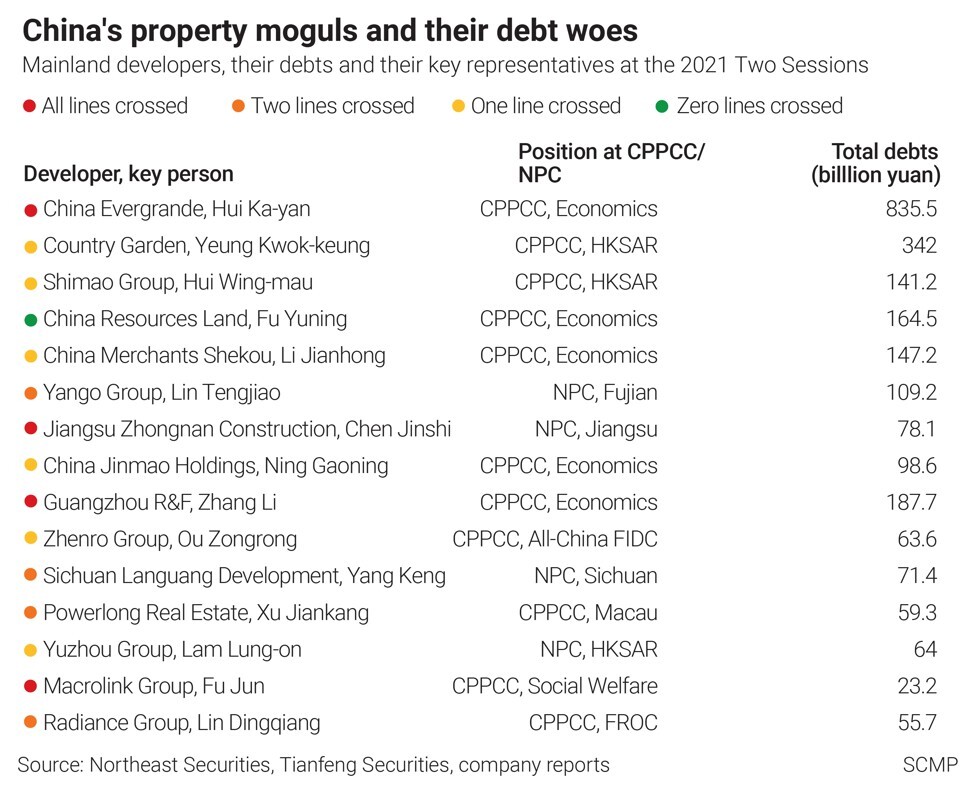

Participants called to the meeting were the among the top issuers of offshore bonds. Evergrande, with more than US$300 billion in total liabilities, was absent at the meeting, according to people familiar with the matter. Local authorities in Guangdong province and the company’s base in Shenzhen were aware and closely monitoring Evergrande’s debts and repayments, they said.

Kaisa Group and Central China Real Estate also took part in the meeting, according to sources who declined to be named. Kaisa Group’s share price fell 2.7 per cent, Central China Real Estate lost 3.1 per cent in Hong Kong after Fitch cut its rating to “B+” with a negative outlook.

Provincial authorities have responded to the NDRC’s promises, with the Fujian and Shanghai branches of the State Administration of Foreign Exchanges (SAFE) saying that they would speed up the process of approving cross-border currency remittances. A special “green channel” has been established for remittances, as long as the capital is used only for bond repurchases, according to a report by Caixin.

The refinancing risks of Asian high-yield market are still high, according to Moody’s Investor Service in a report released on Wednesday.

“Funding access will stay constrained for Chinese property developers, which account for 64 per cent of the bonds maturing over 2022 to 2026, amid tight lending regulations and weak investor sentiment on the back of defaults in the sector,” said Moody’s assistant vice-president Stephanie Cheong. “Outside the sector, still-rising spreads in the offshore market could challenge some companies’ refinancing plans until market sentiment normalises. Investors’ lower risk tolerance will continue to drive a shift toward shorter tenors, particularly for riskier credits over the next six to 12 months, keeping near-term refinancing risks elevated.”