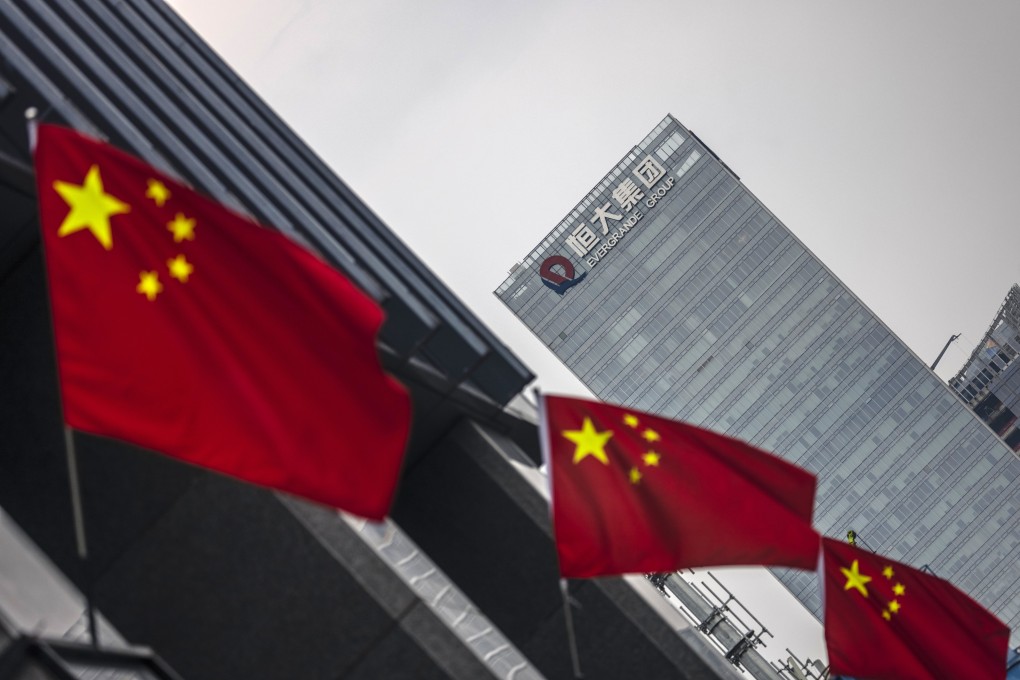

Evergrande crisis: China auditing assets of distressed property developer and chairman Hui Ka-yan, sources say

- A thorough assessment of Evergrande’s assets will help the authorities to decide whether a bailout involving state-owned entities is necessary, sources said

- Beijing has repeatedly sought to reassure investors, but it has not yet indicated how it plans to stabilise Evergrande and the broader property market

The audit, previously unreported, highlights how Beijing is taking charge at Evergrande after the real estate giant missed payments on two overseas bonds, triggering a restructuring to address more than US$300 billion of liabilities in the group.

Assessing the value of the assets, and determining if there are any hidden ones, will also allow the authorities to decide whether a bailout involving state-owned entities is necessary, the sources said.

The fate of Evergrande and other indebted Chinese property companies has gripped financial markets in recent months amid fears of knock-on effects around the world.

Beijing has repeatedly sought to reassure investors, but it has not yet indicated how it plans to stabilise Evergrande in particular, which last week was deemed to be in “restricted default” by Fitch Ratings after it missed coupon payments worth US$82.5 million.

Representatives from state-owned entities are now steering a newly set-up risk management committee at Evergrande and the authorities’ previous findings show Evergrande’s liquidity crunch is more complicated than expected, one of the sources said.