Big Pharma must sacrifice upfront profits to get on China’s coveted list of medicines eligible for insurance reimbursements

- Drugs that make it to the list are eligible for up to 80 per cent of their prices paid for by insurance, shifting the cost burden from the patients to the public sector

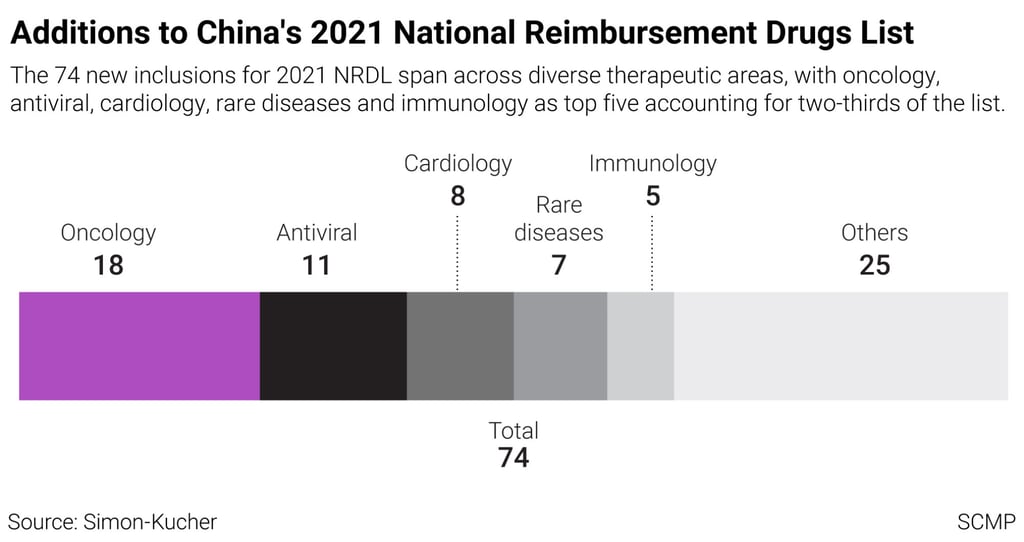

- On average, prices were reduced by 61.7 per cent before drugs could make it to the coveted 2021 list, which makes them eligible for reimbursements

On November 16, Du Jia, a 32-year-old mother in the Guangdong provincial city of Maoming, posted a video of her son, nicknamed Little Mili, on China’s Little Red Book social media platform.

In the video, Little Mili reached out to grab a toy, an instinctive gesture for most 19-month-old infants, but an impossible feat for someone afflicted with spinal muscular atrophy (SMA); were it not for a drug developed by a company based in Cambridge, Massachusetts.

“He was not able to move his hands and legs 14 months ago, before taking the injection” of Nusinersen, made by the Cambridge-based pharmaceutical giant Biogen, Du said in an interview with South China Morning Post.

But the cost for such improvement was gigantic.

Nusinersen, sold under the brand Sprinraza, is the world’s first therapy approved for treating SMA, a genetic disease afflicting an estimated 30,000 people in China, characterised by the loss of motor neurons in the spinal cord and lower brainstem that can result in severe, progressive muscle atrophy and weakness.

The drug, approved in more than 50 countries, used to cost 700,000 yuan (US$110,000) for each dose when it was launched in China in 2019, for a treatment course that lasts a lifetime. Most SMA victims like Du, a housewife, cannot afford the drug.