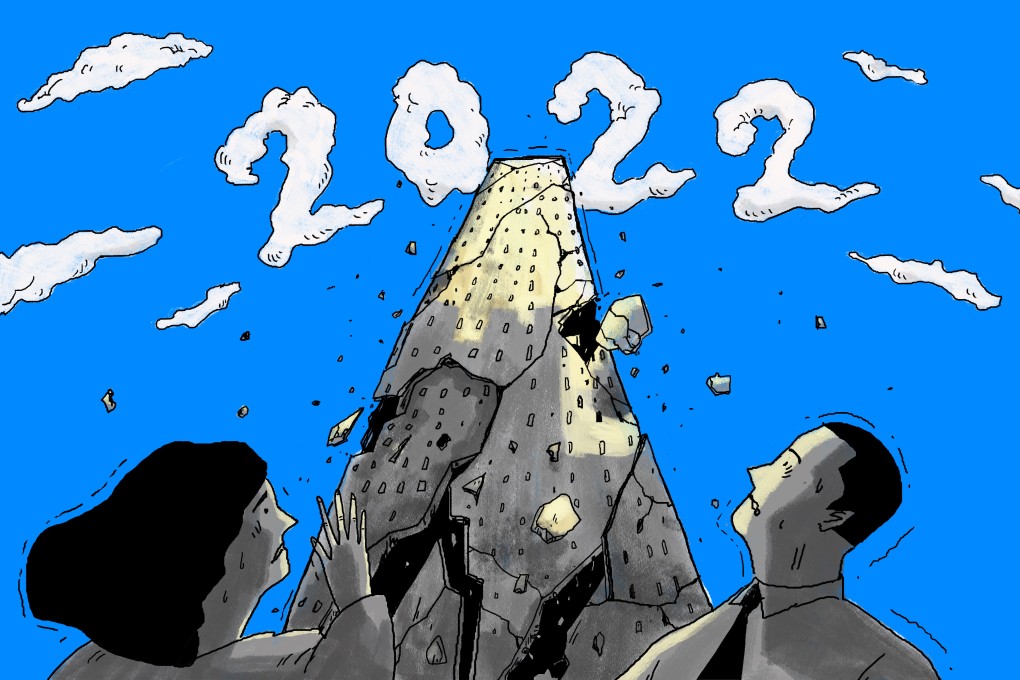

China property crisis: if last year was bad for the likes of Evergrande, Kaisa and Fantasia, just wait for 2022 as more pain predicted for investors

- The outlook for China’s developers appears bleak amid looming debt maturities, falling home sales and uncertainty over the proposed property tax

- Home sales are likely to drop between 5 and 10 per cent this year, according to forecasts by analysts, rating companies

Beijing’s “three red lines” policy, which set the debt thresholds for the real estate sector, limited highly leveraged developers’ access to new funds. It was widely cited as the reason for the situation they find themselves in currently.

“We do not expect a meaningful rebound [in their stock prices] until we see proof of significant policy easing, or a major turnaround in contracted sales,” JPMorgan Chase said in a research note recently. “The sector could stay range bound near term.”

Weaker housing market across the country, due to lengthy delays in mortgage approvals, has compounded the crisis. Contracted sales, or money collected from home presales, slumped by one-third last year through December 12, a trend that is likely to persist in the opening months of 2022.