Evergrande crisis: CEO Xia Haijun sold all his dollar bonds before developer’s 2021 default on offshore debt, records show

- Vice-chairman and CEO Xia Haijun sold US$128 million face value in three dollar bonds in July and August last year, filings on Wednesday show

- Evergrande, which defaulted in December after failing to service the interest on two dollar bonds, has pledged to offer a debt workout plan in six months

China Evergrande’s top insider sold his holding of dollar-denominated bonds issued by the developer in a series of transactions in August last year, before its liquidity crisis worsened and led to a debt default.

The bonds were sold at prices between 35.9 cents and 52.4 cents on the dollar from July 27 to August 17, generating a total of US$56.5 million of proceeds. His purchase cost was not disclosed. He also did not explain why it took more than five months to report the changes. Prices have since slumped below 15 cents since Evengrande defaulted in December.

The developer, once China’s biggest by sales, is crumbling under 1.97 trillion yuan (US$310 billion) of liabilities as its cash crunch kept homebuyers at bay and Beijing’s “three red lines” policy shut the company and many of its indebted peers out of the loan market.

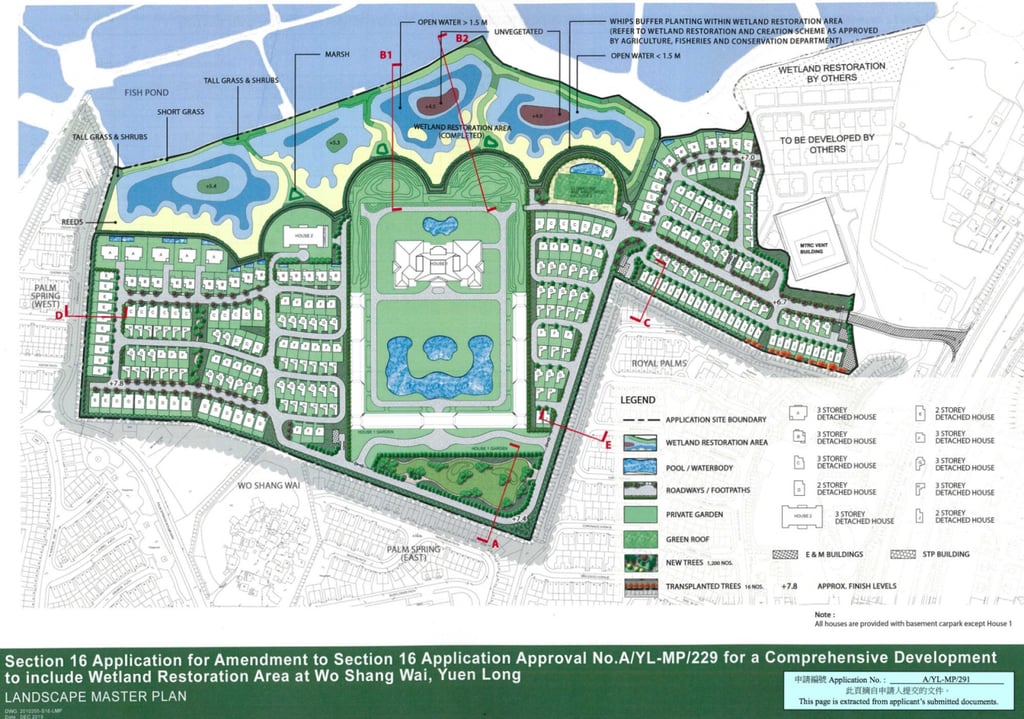

While Evergrande has pleaded for more time to restructure, some impatient creditors have turned hostile, including Oaktree Capital which seized its grandiose Versailles-like project in Yuen Long in New Territories, Hong Kong. The investors had loaned US$520 million to the developer, according earlier news reports.