Advertisement

Buffett-backed BYD to use Baidu Apollo’s autonomous driving technology in its EVs as it raises its game against Tesla, domestic rivals

- Artificial intelligence giant Baidu will supply its Apollo Navigation Pilot smart driving services and products, according to two sources

- It marks an important step for Beijing-based Baidu as it strives to commercialise its Apollo self-driving technologies after nearly five year of development

Reading Time:2 minutes

Why you can trust SCMP

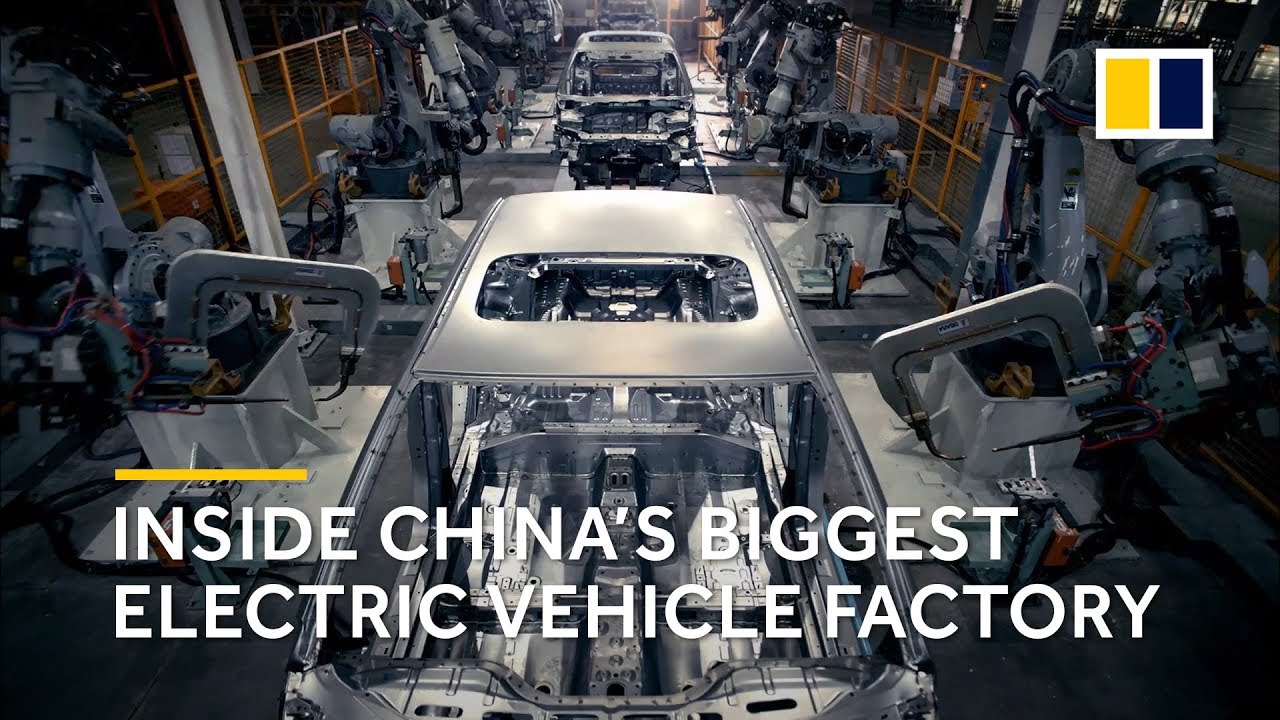

BYD, China’s biggest electric vehicle (EV) builder by sales, will enlist the help of Baidu’s autonomous driving technology to make its cars more intelligent as it raises its game against Tesla and domestic rivals.

The Shenzhen-based maker of batteries and cars, which is 7.9 per cent owned by Warren Buffett’s Berkshire Hathaway, has picked Baidu, China’s biggest search engine and artificial intelligence company, to supply its ANP (Apollo Navigation Pilot) smart driving services and products, according to two sources with knowledge of the matter.

The two companies, which already have a joint venture in the EV arena, are expected to announce the new partnership this week.

Advertisement

It will be an important step for Beijing-based Baidu too, as it strives to commercialise its Apollo self-driving technologies after nearly five year of development.

“BYD’s EVs have a good reputation for their batteries and battery management system, but they have to catch up with Tesla and domestic smart EV start-ups in autonomous driving and other digital technologies fitted in the next-generation of cars,” said Chen Jinzhu, CEO of Shanghai Mingliang Auto Service. “With advanced and sophisticated autonomous driving technologies, the vehicles can move up the value chain and be priced higher.”

Advertisement

Advertisement

Select Voice

Select Speed

1.00x