Clean energy: US faces big challenges as it takes on China’s supply-chain dominance

- The US aims to become a global leader in clean energy manufacturing and innovation to compete with China

- Stronger government-led financial support is needed, and the US will still have to rely on China and other countries in the medium run, analysts said

The US Department of Energy (DOE) last month released America’s first comprehensive plan to increase its supply chain independence in the clean energy sector. It aims to establish the US as a global leader in clean energy manufacturing and innovation to compete with China.

“When it comes to clean energy, China has spent years cornering the market on many of the materials that power the technologies that we rely on. That’s why I committed us to build a clean-energy supply chain stamped ‘Made in America’,” said President Joe Biden on a virtual round table two days before the release of the DOE report.

“We can’t build a future that’s made in America if we ourselves are dependent on China for the materials that power the products of today and tomorrow.”

The Biden administration has ramped up the country’s ambitions to achieve a carbon-free society by 2050. The White House has also acknowledged that the US faces vulnerabilities in the clean-energy supply chain because of China’s dominance over the years.

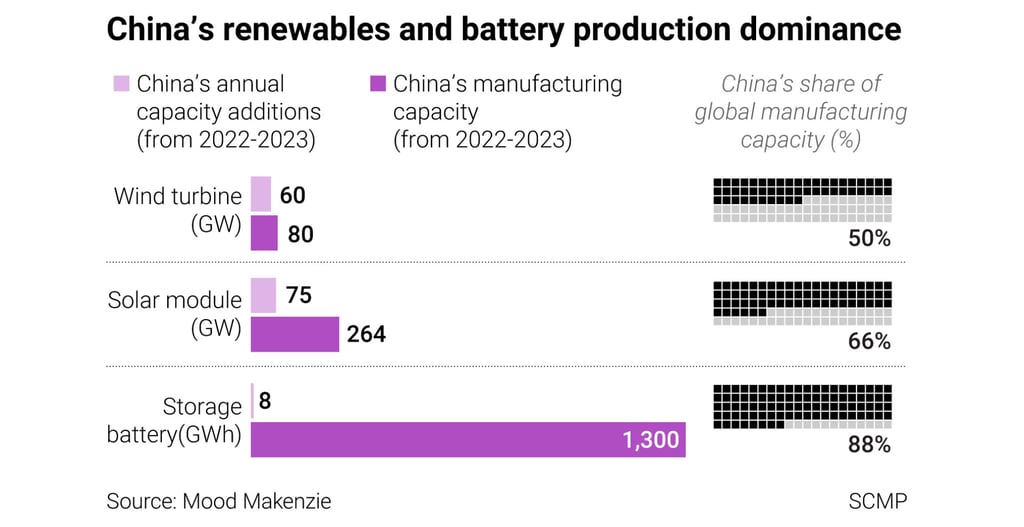

China is the world’s major supplier of solar modules, accounting for over 70 per cent of global production, according to energy research consultancy Wood Makenzie. For wind turbines, Chinese manufacturers have not made quite such significant inroads into overseas markets, but still account for half of global manufacturing.

China leads the world in lithium-ion battery manufacturing, accounting for 88 per cent of global battery storage production capacity. According to DOE data, China refines 60 per cent of the world’s lithium and 80 per cent of the world’s cobalt, two key inputs into high-capacity batteries.

There is another incentive for the US to reduce its clean-energy dependence on China. More than 40 per cent of global solar grade polysilicon comes from Xinjiang province, where the US has repeatedly accused China of human rights violation and applied sanctions to several local clean-energy companies.

Because of China’s growing ownership and production share in the supply chain, the risk of a slowdown in global decarbonisation is possible, and ensuring geographical diversity of import-dependent minerals is required.