Hong Kong stocks extend losses as Ukraine war feeds recession risks while city lockdown, tech crackdown concerns linger

- Sell-off on Hong Kong stocks deepened as Tencent and NetEase slid after China’s political delegates proposed tightening control over the gaming industry

- Hang Seng Index members traded at the widest discount to book value in at least a decade; Alibaba bucked the sell-off with a rebound from record low

The Hang Seng Index lost 1.4 per cent to 20,765.87 at the close of Tuesday trading. The index slumped 3.9 per cent on Monday to the lowest since July 2016. The Tech Index weakened 3.2 per cent while the Shanghai Composite Index slid 2.4 per cent. Key markets in Asia-Pacific also retreated, following overnight losses in US equities.

Bucking the overall weakness, Alibaba Group Holding, the owner of this newspaper, recovered from its all-time low with a 0.9 per cent advance to HK$96.90.

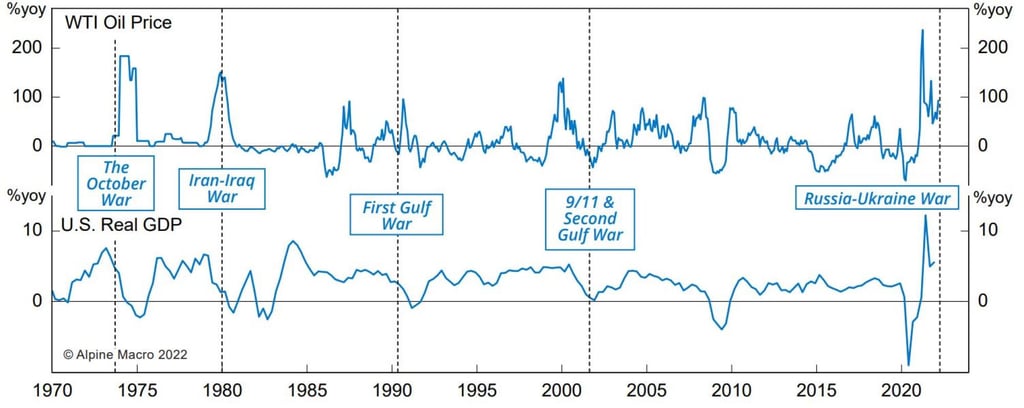

Investors are reassessing the risks of runaway inflation and recession as prices of commodities and grains from nickel to wheat hit record highs. Crude traded above US$120 a barrel, the highest since 2008, while Russia threatened to disrupt gas supply in Europe.

“The Russia-Ukraine conflict is unleashing a stagflationary impulse on the global economy,” Chen Zhao, chief global strategist at Montreal-based Alpine Macro said in a report. “This could be followed by a recession as oil prices soar and central banks tighten policy.”