Chinese tycoon in wrong nickel bets says business is sound with state support as debacle erases US$7.3 billion from related stocks

- Huayou Cobalt lost US$4.1 billion in market value over two days as investors reassess their business ties and collection risks

- Other related stocks in mainland China, Hong Kong and Sydney also tumbled amid concerns Tsingshan will be saddled with steep losses from soured nickel bets

Zhejiang Huayou Cobalt plunged by the daily 10 per cent limit for a second day on Wednesday in Shanghai, erasing 26 billion yuan (US$4.1 billion) of market capitalisation. The cobalt producer and Tsingshan have investments in a power project and a nickel-refining project in Indonesia, according to mainland media reports.

China Molybdenum slid 3.9 per cent in Shanghai and 9 per cent in Hong Kong, while CNGR Advanced Material and GEM declined by more than 2 per cent in Shenzhen. Nickel Mines tumbled as much as 23 per cent in Sydney before trading was halted. The slump wiped out US$3.2 billion in value from the four companies.

Tsingshan was said to have closed out part of its short positions on nickel contracts and was mulling whether to exit its bearish bets, Bloomberg reported late on Tuesday. The LME suspended trading on the contracts on Tuesday and cancelled some transactions after the price surged by as much as 250 per cent within 24 hours.

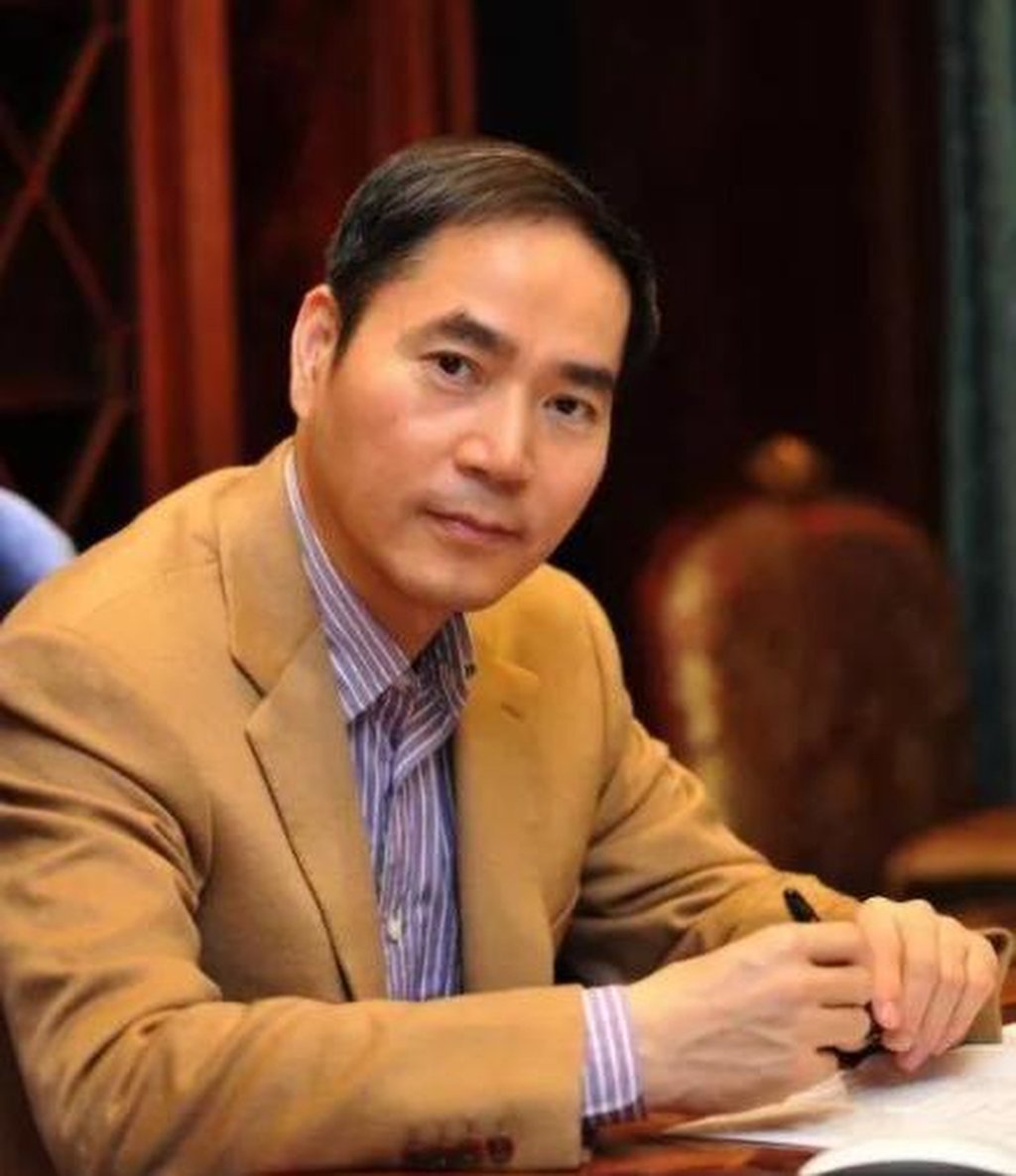

“Foreigners do have some actions and we are actively coordinating [with related parties],” China Business News cited Tsingshan chairman Xiang Guangda in an interview late on Tuesday. “I received many calls, and relevant state departments and leaders are very supportive of Tsingshan.”